Whole Life Insurance 2025 USA — Higher Rates, Bigger Dividends & Better Deals

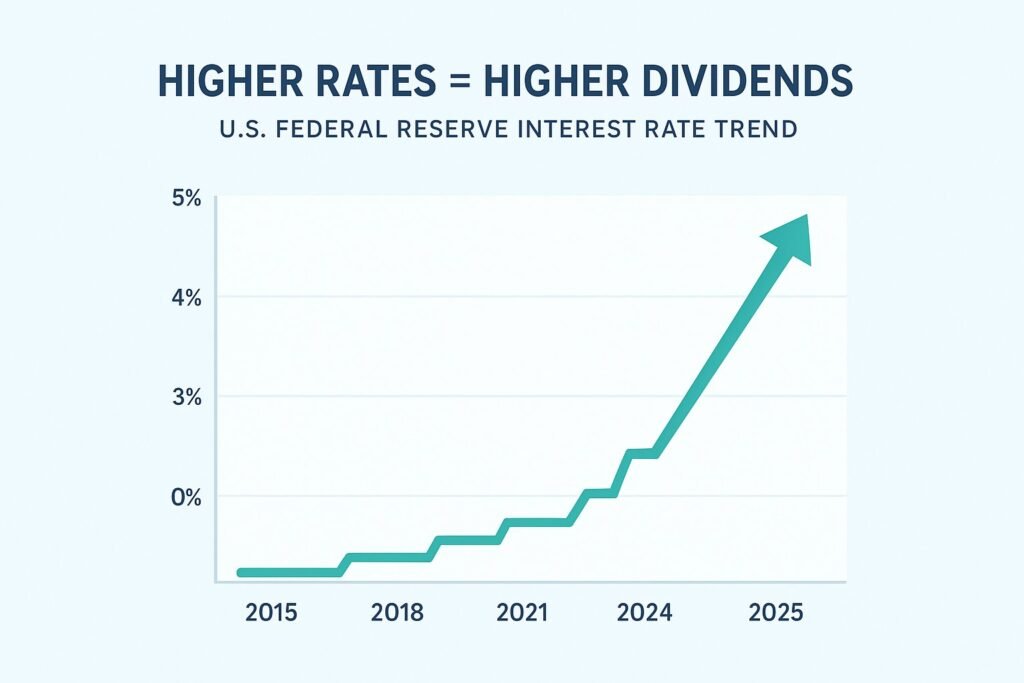

In 2025, many U.S. consumers are spotting an unusual alignment of economic and industry trends that make whole life insurance USA 2025 worth a second look. With the Federal Reserve holding the federal funds rate in a higher range, dividend scales rising at some mutual life insurers, and new hybrid products and underwriting technologies changing the value proposition of cash-value policies, this year offers buyers potential advantages not seen in recent low-rate years. Federal ReserveFRED

Table of Contents

What Is Whole Life Insurance USA and How It Works in 2025

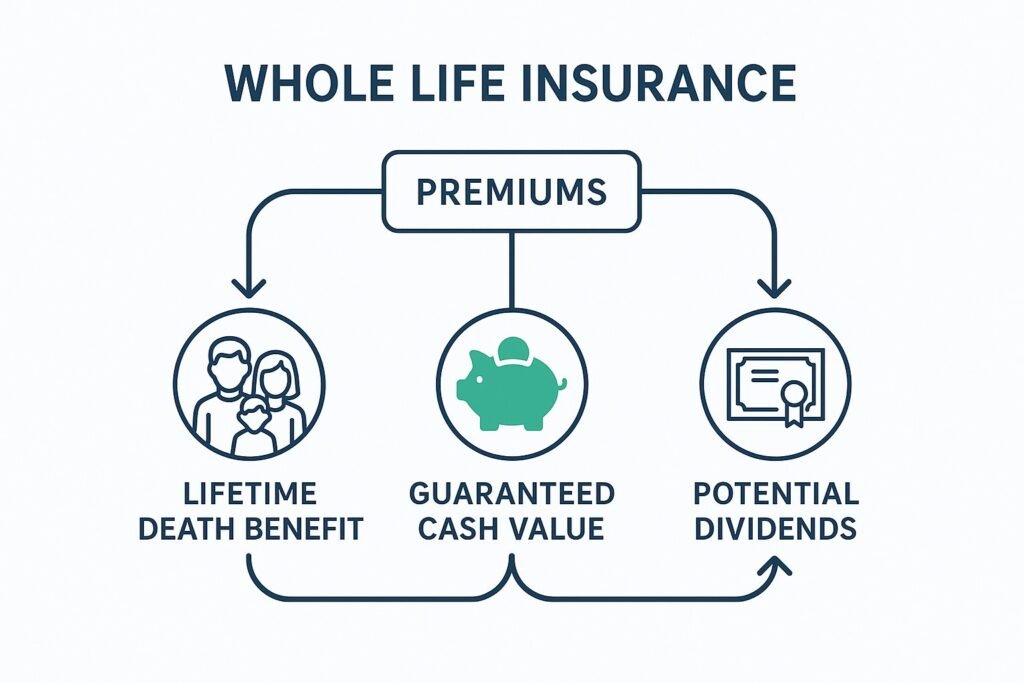

Whole life insurance usa is a permanent life insurance policy that provides lifelong death benefit protection, fixed premiums, and a cash value component that grows on a guaranteed schedule and often receives non-guaranteed dividends from the issuing company. Policyholders can borrow against cash value, withdraw it (subject to policy rules), or use it to pay premiums later in life. This combination of protection, forced savings, and potential dividends is what differentiates whole life insurance usa from term and many universal life products.

Why 2025 Could Be the Best Year to Buy Whole Life Insurance USA

Two practical levers make timing important for whole life insurance buyers:

- Interest rates and dividend environment — Higher interest rates typically improve the investment returns insurers can earn on their general account assets, which can raise dividend scales and credited interest used in cash-value calculations. Buying when interest-crediting and dividend outlooks are favorable can accelerate cash-value accumulation.

- Market product design and competition — When insurers compete for buyers during particular market cycles, they may launch more consumer-friendly illustrated scales, promotional credits, or improved rider pricing. In 2025, product innovation (hybrids, improved IUL/VUL features) is reshaping buyer options.

Top 5 Reasons to Act on Whole Life Insurance 2025

1. Higher Interest Rates Boost Policy Performance

The Fed’s target range has been maintained in mid-2025 at about 4.25%–4.50%, a level much higher than the near-zero environment of the 2010s. That higher-rate environment means insurers earn better returns on bonds and other fixed-income assets that back whole life insurance usa guarantees — and some companies are passing those gains to policyholders via improved dividend scales or stronger credited interest. Federal ReserveFRED

2. Dividend Scales Are on the Rise at Mutual Insurers

Several mutual life companies (which pay dividends) have updated illustrations and scales for 2025 that are higher than recent years, reflecting improved investment spreads and company performance. That can translate into faster cash-value growth, larger year-over-year improvements in non-guaranteed components, and potentially better long-term illustrated performance for whole life insurance policyholders. (Example: major mutual insurers have publicly shared improved 2025 dividend scales.)

3. Hybrid policies and long-term care riders are more attractive now

Hybrid life + long-term care options — where the policy pays long-term care benefits if care is needed and pays a death benefit if not — look more compelling because higher rates reduce the implied cost of funding these riders. These hybrids effectively let buyers hedge the risk of needing care without paying late-life premiums for standalone LTC policies that have become costly or thinly available.

4. Cash-value alternatives (IUL/VUL) are growing, but whole life insurance remains uniquely predictable

Indexed and variable universal life (IUL) products have seen outsized growth (VUL new premium surged year-over-year), but those products carry market risk and less guarantee than whole life. For Americans seeking lifetime guarantees plus potential dividends and predictable premiums, whole life continues to be the conservative, predictable option — and in 2025 the predictable side looks stronger thanks to interest-rate tailwinds. LimraBankrate

5. Smarter underwriting (and better pricing for healthier lives)

AI, big data, and alternative risk signals (including wearables and digital health records) are enabling faster, more precise underwriting. For many healthy buyers, this can mean lower premiums or better risk classes, making the effective cost of whole life policies more favorable for qualifying applicants in 2025. However, it raises privacy and fairness questions — to clarify how your data will be used.

Who benefits most from buying whole life insurance USA 2025?

- Young professionals (late 20s to 40s) who want a forever policy with guaranteed death benefit and long-term cash value accumulation.

- Parents and guardians who want a guaranteed death benefit to replace future earnings and to build a tax-advantaged cash buffer for children’s future needs.

- Business owners who need key-person protection or a funded buy-sell agreement; whole life insurance usa provides a guaranteed death benefit and predictable funding vehicle.

- Pre-retirees and estate planners who want to lock in lifetime coverage for estate liquidity, legacy planning, and potential tax-advantaged transfers. Whole life insurance usa can be particularly useful when interest rates make cash-value growth stronger.

- People seeking conservative cash-value accumulation as part of a diversified financial plan (not a substitute for retirement accounts but a complement for specific goals).

Real-Life Example: How Higher Rates Impact Cash Value Growth

Imagine two identical applicants, both age 35, seeking a permanent policy. In a low-interest illustration (pre-2022 style), the projected cash value at age 65 might have been materially lower because of lower dividend/crediting assumptions. In a 2025 illustration that uses improved dividend scales and higher interest-crediting assumptions, the same premium can project greater cash accumulation, better loan collateral, and improved internal rates of return on the policy’s cash component. (Remember: illustrations are company-specific and non-guaranteed; always compare guaranteed vs. illustrated numbers.)

Risks and Drawbacks of Whole Life Insurance USA

- Higher upfront cost than term life. Whole life insurance usa premiums are significantly higher than term for similar face amounts. If your immediate need is pure income replacement on a budget, term may still make sense.

- Non-guaranteed components. Dividends are not guaranteed. Although many mutual insurers have long dividend histories, future dividends depend on company performance, interest rates, mortality, and expenses. Compare guaranteed cash values vs. illustrated ones.

- Surrender charges and loan interest. Withdrawing or surrendering early can trigger losses. Policy loans accrue interest and reduce death benefits if unpaid. Understand the policy’s loan rate and surrender schedule.

- Complexity and illustrations. Carriers show different illustrated outcomes. Don’t buy based only on a single attractive illustration — compare multiple carriers and ask for guaranteed schedules.

- Regulatory and market shifts. Interest rates can change; the Fed held rates at 4.25%–4.50% in mid-2025 but signaled that it will reassess as data come in. That could push rates lower in later 2025 or 2026, changing outlooks.

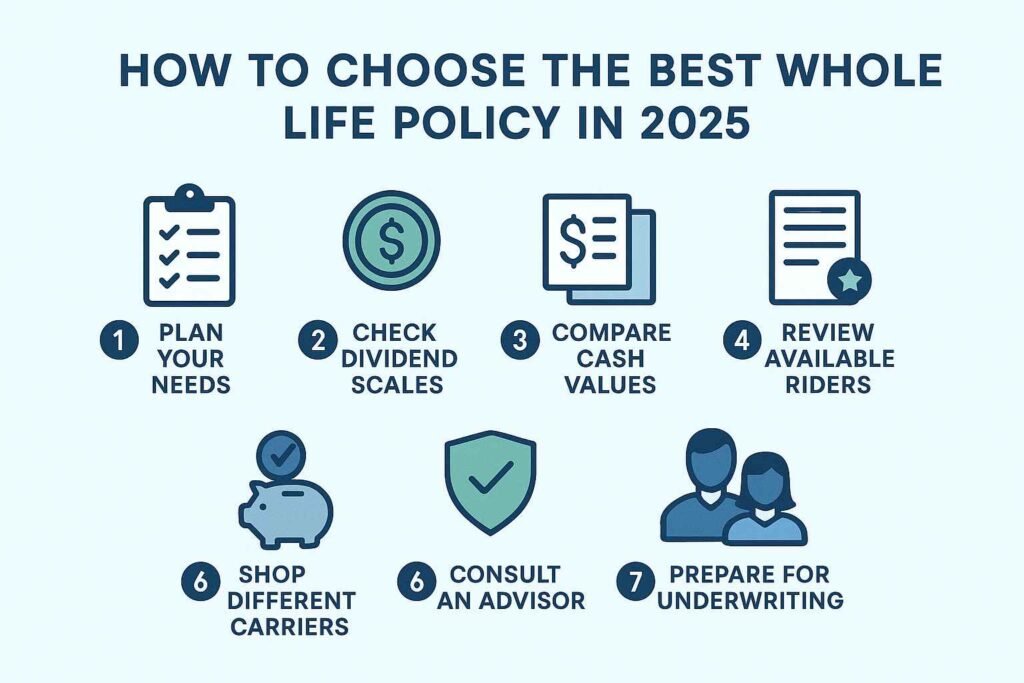

How to choose the best whole life policy in 2025 — step-by-step

- Start with a clear objective. Are you buying for estate planning, cash-value accumulation, business uses, or lifetime protection? The objective guides the face amount and funding pattern.

- Request in-force and current dividend scales. Ask the agent/carrier for the current dividend scale and the company’s dividend history (10–20 years if available). Companies with stable, rising scales are easier to trust for long-term plans.

- Compare guaranteed vs. illustrated values. Look at both guaranteed cash values (conservative) and illustrated dividend projections (optimistic). Make decisions with the guaranteed values in mind.

- Check riders and flexibility. Does the policy include or allow affordable LTC riders, accelerated death benefit riders, or paid-up additions? In 2025, paid-up additions (PUA) remain a powerful way to turbocharge cash value. Compare Long Term Care

- Shop multiple mutual carriers. Mutual companies typically pay dividends; compare at least three top-rated mutual insurers to see differences in scale and illustration.

- Work with a fiduciary or fee-only financial professional (not just a commission-only salesperson) if your situation is complex. Ask for net-cost comparisons (after commissions) and insist on transparent projected outcomes.

- Underwriting prep. If you’re healthy, ask about accelerated underwriting, and consider sharing wellness data only after understanding privacy implications. Smarter underwriting in 2025 can lock in better risk classes for low-risk buyers.

Things to ask the insurer or agent right now (quick checklist)

- What is your current dividend scale for whole life insurance usa in 2025? (Ask for the percentage and the history.)

- Provide a side-by-side of guaranteed values vs. illustrated (with current dividend/crediting assumptions).

- Are there flexible paid-up additions (PUA) to accelerate cash value? How are they priced?

- What is your policy loan interest rate today, and how is it tied to market rates?

- If I add a long-term care or chronic illness rider, how does it affect the death benefit and premiums? Compare Long Term Care

Short FAQ (Answering common search queries)

Q1. Is whole life insurance usa worth it in 2025?

It can be, for buyers who value lifetime guarantees, predictable premiums, and tax-advantaged cash-value growth — and who accept higher upfront cost. In 2025 the higher interest-rate environment and improved dividend scales make whole life more competitive than in recent low-rate years.

Q2. Will interest rates stay high?

As of mid-2025 the Fed held rates at roughly 4.25%–4.50% but signaled data-dependence; markets expect potential cuts later depending on inflation and labor data. Because rates can change, locking certain guarantees now may benefit buyers who want to secure favorable illustrated outcomes today. Federal ReserveFRED

Q3. Whole life vs. IUL vs. VUL — which to choose in 2025?

Whole life: predictability and guaranteed values (plus dividends at mutuals). IUL: upside tied to an index (with caps and floors); better for buyers comfortable with more complexity. VUL: equity exposure and higher potential returns, but also market risk. In 2025, VUL and IUL sales have surged, but whole life still leads for conservative, guarantee-seeking buyers.

Final thoughts — should you act this year?

If you value lifetime guarantees, want a conservative cash-value vehicle, are comfortable paying higher premiums now, and prefer the certainty of a mutual insurer’s dividend history, whole life insurance USA 2025 presents a compelling buying window. Higher interest rates and improved dividend scales have tilted the math in favor of cash-value accumulation and policy guarantees. However, because life insurance is long-term and company-specific, do not buy solely on a single attractive illustration — compare carriers, understand guarantees, and consult a trusted advisor.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook