Whole and Universal Life Insurance in Canada 2025: This Isn’t Just for the Rich Guys Anymore

You know, the other day, I was grabbing a double-double at Timmies, and the guy in front of me was chatting on his phone. He was talking about “legacy planning” and “tax-sheltered growth,” and I’ll be honest, my eyes started to glaze over. It sounded so complicated, so far out of my league. And for a long time, I think that’s how most of us felt about life insurance beyond the basic term policy.

It was just one of those things you get when you’re young, maybe when you buy your first house or have a kid. It’s a good-for-now kind of thing. But it’s got a countdown timer on it. What happens when that timer runs out? What happens when you’ve built a life and want to make sure it stands forever? Learn more about Term Life Insurance Canada 2025

That’s a question a lot of us are asking in Canada right now. And it’s why something incredible is happening. People are realizing that Whole and Universal Life Insurance Canada 2025 isn’t just a fancy tool for the wealthy anymore. It’s for you. It’s for me. It’s for anyone who wants to build something that lasts. I’m not talking about boring finance talk; I’m talking about taking care of your family in a way that’s smart, solid, and a little bit brilliant.

Let me break it down for you, no fancy lingo. Just me, sharing what I’ve learned, so you can see if this might be the right fit for your family.

Table of Contents

Why Everyone’s Buzzing About This in 2025

When we were kids, many of us had a secret spot to hide our piggy bank. We felt safe knowing our money was tucked away where no one else could reach it.

That’s a lot like how Whole Life Insurance and Universal Life Insurance Canada (2025) work.

Each time you pay your premium, part of it goes toward the insurance coverage—the promise that your family will receive money if something happens to you.

The other part is set aside in a built-in savings account within the policy. This is what’s called the cash value.

And here’s the most important part: that money grows, and the government can’t touch it. It’s tax-deferred. That means the money can grow and grow, year after year, without you having to pay a single dollar in taxes on its growth. Think about that for a second. Your money gets to compound for decades without being chipped away by taxes. It’s a huge, huge deal.

This is the big reason why these policies are so popular now. We’ve all seen how the economy can be, a little rocky sometimes. Having a safe, growing asset that’s separate from the stock market and your RRSP gives you a feeling of security that’s tough to beat. It’s a way to build a financial fortress for your family.

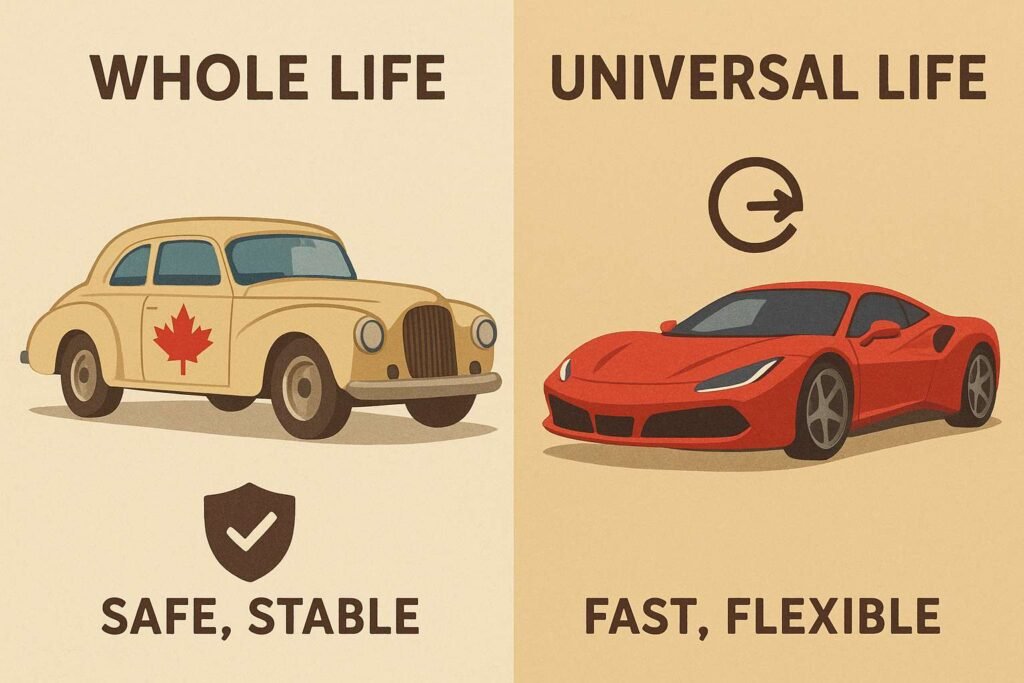

The Car Analogy: Two Ways to Drive Through Life

Okay, let’s skip the garden talk. That’s a bit too… flowery. Instead, let’s think about this like buying a car. You want a car that’s going to get you and your family where you need to go for the rest of your lives.

The Whole Life Car 🚗

Whole life insurance is like owning a classic Canadian car—strong and dependable. Think of an old Chevy that keeps running year after year.

- Your payments work the same way. They never change, so it’s easy to plan ahead and know exactly what you’ll pay for life.

- Guaranteed Performance: The car is guaranteed to drive a certain distance and get you to your destination. The savings part of your policy (the cash value) is guaranteed to grow at a specific rate. You know exactly what you’ll have in the tank.

- Bonus Fuel: Every now and then, the insurance company may give you something extra. It’s not promised, but often they pay out dividends. You can use these dividends to buy more coverage, reduce your payments, or simply take the cash.

Why it’s a great choice:

- It’s a no-brainer: You just pay and drive. No complicated decisions.

- It’s safe: You don’t have to worry about the car breaking down. It’s built to last.

- It’s predictable: You know exactly what you’re getting and can plan your whole life around it.

The downside:

- It’s more expensive: This kind of reliable, vintage car costs more to buy upfront.

- No upgrades: You can’t put a new engine in it or change the tires. It’s a “take it as it is” kind of deal.

The Universal Life Car 🏎️

Now, choosing universal life insurance is like buying a high-performance sports car. It’s fast, flexible, and you get to customize it.

- Flexible Payments: You can pay as little as you need to just keep the car running, or you can pour a lot of extra money into it to make it go faster. This is great if your income changes.

- You Pick the Engine: You get to choose how the money in the “gas tank” (your cash value) is invested. You can pick a safe engine that doesn’t go very fast, or you can pick a high-octane engine that could go super fast, but could also blow a gasket!

- You’re the mechanic: You have to keep an eye on the car’s performance. If your investments aren’t doing well, you might need to add more money to the tank to keep the car from stalling out.

Why it’s a great choice:

- It’s flexible: You can adjust your payments and investment choices.

- Huge potential: If you make smart choices, your car can go much, much faster than the whole life car.

- More control: You are the one in charge of the car’s performance.

The downside:

- It’s a bit scary: If your investments do poorly, you could lose money.

- It’s a lot of work: You have to actively manage your car to make sure it keeps running well.

Picking Your Dream Team in Canada

You wouldn’t trust a mechanic you found on the side of the road to fix your car, right? The same goes for your life insurance company. Here’s a simple table I put together with some of the best and most trustworthy companies in Canada for Whole and Universal Life Insurance Canada 2025.

| Company | Who They’re Great For | The Best Thing About Their Whole Life | The Best Thing About Their Universal Life | My “Trust Factor” |

| Manulife | People who are into health and wellness. They have a program that rewards you for living healthy. | They’ve been around forever and have a great history of giving out good bonus money (dividends). | Their Vitality Plus™ program can actually lower your payments if you get active and healthy. It’s a game-changer. | Solid as a rock. |

| Sun Life | People who like things to be simple and easy to use on their phone or computer. | They’re a rock-solid company with a name everyone trusts, a true Canadian institution. | They have a lot of different investment options so you can choose what works for you. | Top-tier. |

| Canada Life | People who want to leave a big legacy. They’re known for helping with huge family estates. | Great for big-picture planning and paying solid dividends. | Their Freedom UL policy gives you a lot of freedom to control your money. | Old school reliable. |

| Desjardins | People who want a company that feels like a family. It’s owned by its members. | Known for being very competitive and caring about its customers. | They have unique products and a great reputation for helping people. | Like a good neighbor. |

| iA Financial Group | People who want a lot of options and a plan that is made just for them. | They offer a lot of flexibility within their whole life products. | Their Genesis UL is one of the most customizable policies out there. | The “build your own” option. |

(My “Trust Factor” is my personal way of telling you which companies are known to be strong and reliable, based on their long history and financial ratings. It’s like a good review from your neighbour.)

The Big Secret: How This Works with Taxes

This is the part that gets people really excited.

Picture having a wallet that always has something saved inside.When you pass away, everything in that wallet goes straight to your family, and the government can’t take any of it. That’s how the death benefit from Whole and Universal Life Insurance Canada 2025 works. It’s completely tax-free for your loved ones. This is a powerful way to leave money for your family to pay off the house, send the kids to school, or just to give them a fresh start. It’s a huge relief.

And that special savings account inside your policy? The money grows in there, year after year, without you having to pay any taxes on it. This is a huge, huge advantage. Over 20 or 30 years, that tax-deferred growth can add up to a lot more money than in a regular bank account.

This is a smart way for Canadians to build wealth for the future, whether it’s for retirement or to simply leave a beautiful gift to their family.

My Personal Advice for You

So, how do you choose the right plan for you? It’s not about finding the “best” policy out there. It’s about finding the best policy for you.

I always tell people to ask themselves these three simple questions:

- What’s your personality? Are you a person who loves safety and guarantees, or do you get excited about the chance for bigger growth, even with a little risk?

- How do you want to manage your money? Do you want a plan that you can just pay and forget about? Or do you enjoy checking on your investments and making choices?

- What are you saving for? Are you just looking for a secure way to leave money for your family? Or are you also hoping to use some of that cash value for a big future event, like a down payment on a cottage or to help pay for your retirement?

Taking a moment to answer these questions will make your choice much easier.

The Most Important Step

The surge in Whole and Universal Life Insurance Canada 2025 is not just about numbers; it’s about a change in mindset. It’s about Canadians realizing that they can be proactive about their future. It’s about moving from being a passenger to being the pilot of their financial journey.

Don’t wait until you’re older and have more to worry about. The best time to start thinking about life insurance was yesterday. The second-best time is right now.

Finding the right policy and the right advisor can feel a little intimidating, but it doesn’t have to be. We are here to help you get the protection and peace of mind you and your family deserve.

To start exploring your options and to connect with a trusted advisor who can help you, please visit the links on our website today. It’s the first step on a journey that will change your family’s future.

“Even if you’re new to Canada, there are tailored options available. Check out our Life Insurance for Canadian Newcomers guide.”

Answers to Your Questions (FAQs)

Q: What’s the main difference between whole and universal life in a simple way?

A: Whole life is like a fixed savings plan with a promise. Universal life is like a flexible savings plan where you have some control over how your money grows.

Q: Does my family have to pay taxes on the money they get from my policy?

A: No, the money your family gets is completely tax-free. It’s a special benefit of life insurance in Canada.

Q: Can I use the money in my policy before I pass away?

A: Yes! You can access the cash value through a loan or a withdrawal. Some people just use this money for family stuff—like helping with a son or daughter’s wedding. Others keep it aside so they have a little extra when they stop working.

Q: Why do young people pay less for this type of insurance?

A: Insurance companies see younger, healthier people as a lower risk. Because of this, the monthly cost (premium) is much cheaper. This makes it a great time to start a policy.

Q: What if I miss a payment?

A: With whole life, the money you’ve saved inside the policy can sometimes cover a missed payment or two. With universal life, you need to watch more closely—if the savings run out and you stop paying, the policy could end.

Disclaimer

This blog is just for basic info. It’s not advice. If you need help, talk to an insurance advisor who can check your own situation. The points here are about Whole and Universal Life Insurance in Canada 2025, but rules can change anytime.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook