Term Life Insurance vs Income Protection in Australia: Don’t Get Caught Out!

G’day, you mob! Let’s clear up some confusion about Term Life Insurance and Income Protection here in Australia. You’ve probably heard both terms, especially when sorting out your finances. The dinkum truth is, understanding what each does is crucial for protecting your loved ones and your own financial stability. This guide will help you properly wrap your head around Term Life vs Income Protection AU.

You see, while life in the land of Oz is often bloody brilliant, it’s also famous for throwing a few curly ones our way, isn’t it? What happens if you’re suddenly out of the picture, or if you can’t actually work because you’ve copped an injury or come down with something nasty? That’s exactly where Term Life vs Income Protection AU policies jump in, offering a vital safety net. While they both give you a bit of financial comfort, they’re built for chalk-and-cheese situations. So, let’s crack on and clear up the confusion, hey?

Table of Contents

Term Life Insurance: Protecting Your Mates and Family

First up, let’s chew the fat about Term Life Insurance. In a nutshell, this policy chucks out a lump sum of cash to your nominated beneficiaries (usually your family or closest mates, anyone you reckon needs a hand) if you pass away or get diagnosed with a terminal illness during the policy’s term. Think of it as a financial safety blanket for your nearest and dearest when you’ve snuffed it. It’s a common and dead sensible part of many Australians’ financial plans, especially when you’re comparing Term Life vs Income Protection AU. https://primelifecover.com/ai-life-insurance-australia-2025/

Here’s why it’s an absolute ripper of a thing for many Aussies:

- Clearing Debts: Got a whopping mortgage on your dream home? Car loans? Or maybe some other big debts knocking around? That lump sum from Term Life Insurance can help pay ’em all off. This means your family won’t be lumbered with your bills when they’re already doing it tough.

- Income Replacement for the Long Haul: If you’re the main breadwinner, or even chip in a decent slice to the household income, your passing would leave a gaping hole. This payout can keep your family going for years, letting them maintain their lifestyle, cover daily expenses, and plan for their future without you. It’s about keeping things ticking along nicely.

- Covering Future Costs: Just think about those future costs for your kids – school fees, uni, even just giving them a leg up when they’re older, setting them up. A Term Life Insurance payout can ensure these big-ticket items are covered, giving your kids the best possible start.

- Funeral and Other Final Expenses: Let’s face it, funerals can cost an arm and a leg, can’t they? The lump sum can cover these immediate costs, taking some of the financial sting out for your family during an already emotional time.

- Good Value: Generally, Term Life Insurance is pretty decent value for money, especially when you’re younger and healthier. You cough up premiums for a set period (the “term”), and you get a substantial payout. It’s a straightforward way to get solid cover without breaking the bank.

So, if your main worry is making sure your family is properly sorted financially if you’re no longer around, Term Life Insurance is your best bet, no worries. This is a key distinction when you’re sizing up Term Life vs Income Protection AU

Income Protection Insurance: Protecting Your Pay Packet

Now, let’s pivot a bit and talk about Income Protection Insurance. This type of policy is a bit different, mind you. It pays you a regular, ongoing income (usually up to 70-75% of your regular salary) if you’re unable to work because you’re crook or injured. It’s designed to keep your bills paid and tucker on the table when you can’t bring in the dough. When you’re weighing upTerm Life vs Income Protection AU, this is your cover for when you’re still breathing but can’t earn a crust.

Why is this an absolute pearler for Aussies?

- Replacing Lost Income: This is its main gig. If you get sick or injured and can’t rock up to work, Income Protection makes sure you still get a regular payment. This means you can keep paying the mortgage, putting food on the table, and generally keeping your life on track without draining your savings or racking up debt.

- Covering Daily Living Costs: Think about all your regular bills – electricity, internet, phone, groceries. Income Protection makes sure you can keep covering these, even when you’re off work.

- Maintaining Your Lifestyle: Without your income, keeping your current lifestyle can be a real uphill battle. Income Protection helps you keep things as normal as possible while you’re on the mend.

- Rehabilitation Support: Some policies might even throw in benefits for rehab or retraining, helping you get back on your feet and back into the workforce quicker.

- Tax-Deductible Premiums: Here’s a top little tip for Australians: in most cases, the premiums you pay for Income Protection outside of super are tax-deductible. That’s a nice little bonus that makes it even more appealing, eh?

So, if your biggest concern is what happens if you can’t work and bring home the bacon, Income Protection is your champion. It’s all about protecting your earning power, a crucial aspect when thinking about Term Life vs Income Protection AU.

Term Life vs Income Protection AU: The Big Differences

Alright, let’s cut to the chase and lay out the core differences between these two vital forms of cover. This table should make the comparison of Term Life vs Income Protection AU crystal clear, no mucking about.

| Feature | Term Life Insurance | Income Protection Insurance |

| What it Covers | Death or Terminal Illness (where death is likely within 24 months) | Inability to work due to illness or injury (temporary or long-term) |

| Payout Type | One big lump sum | Regular monthly income (usually 70-75% of your pre-tax income) |

| When it Pays | Upon death or terminal illness diagnosis | After a waiting period (e.g., 30, 60, 90 days) when you can’t work |

| Who it Pays To | Your nominated beneficiaries (family, loved ones) | You, the policyholder |

| Premium Tax | Generally NOT tax-deductible (outside super) | Generally TAX-DEDUCTIBLE (outside super) |

| Primary Goal | Protect your family’s financial future after you’re gone | Protect your income and lifestyle while you’re alive but unable to work |

| Cover Period | For a specified “term” (e.g., 10, 20, 30 years) | For a specified “benefit period” (e.g., 2 years, 5 years, to age 65) |

As you can see, while both are about financial protection, they protect against completely different risks. It’s not really a case of one being better; it’s about what specific risk you’re trying to cover. This distinction is vital when you’re trying to get a handle on Term Life vs Income Protection AU.

Why You Might Need Both: The Aussie Double Whammy

Here’s the real kicker: for many Australians, it’s not a choice between Term Life Insurance and Income Protection. It’s often recommended to have both to cover all your bases. Why? Because life can throw two very different kinds of spanners in the works, you know?

- Term Life Insurance steps up when you’re no longer kicking on, making sure your family can carry on without the added stress of financial hardship.

- Income Protection looks after you while you’re still here, but unable to earn a buck. It’s about keeping the wolf from the door and maintaining your lifestyle during a bit of a rough trot.

Imagine having Term Life but no Income Protection: you get sick, can’t work for months, and suddenly your savings are gone, and you’re struggling to pay the bills. Conversely, having Income Protection but no Term Life means that if you pass away, your family is left with nothing. See? It’s about a complete picture of protection. A thoughtful combination of Term Life vs Income Protection AU gives you broad coverage.

Considerations for Australians: Getting Your Head Around the Choices

When you’re looking into Term Life vs Income Protection AU, there are a few uniquely Australian things to keep in mind, ’cause it’s a bit different here:

- Superannuation (Super): Did you know you might already have some basic Death (Term Life) and Income Protection cover tucked away in your super fund? It’s often default cover, so the levels might be a bit low, but it’s a starting point. It’s always worth having a stickybeak at your super statement or giving your fund a buzz to see what you’ve got. While getting cover through super can be cheaper, payouts for Income Protection can sometimes be more complex due to super rules, so keep that in mind.

- Stepped vs. Level Premiums: This is a fair dinkum important point, so pay attention!

- Stepped Premiums: These start lower but generally climb each year as you get older.

- Level Premiums: These start higher but generally stay more stable over time, meaning they could be cheaper in the long run if you hold the policy for ages. Have a good long think about your long-term financial goals and cash flow when making this choice.

- Waiting Periods & Benefit Periods (for Income Protection):

- Waiting Period: This is how long you have to be out of action (unable to work due to illness or injury) before your Income Protection payments start. Common waiting periods are 30, 60, or 90 days. A longer waiting period usually means lower premiums, but you’ll need enough savings to tide you over during that time.

- Benefit Period: This is how long the payments will keep coming (e.g., 2 years, 5 years, or right up to age 65).

- Own Occupation vs. Any Occupation (for Income Protection): This is absolutely massive, don’t miss this! It’s a key detail for Term Life vs Income Protection AU.

- Own Occupation: This beauty pays out if you can’t perform the duties of your specific job.

- Any Occupation: This one only pays if you can’t perform the duties of any job for which you are reasonably qualified, even if it’s not what you’re used to. “Own occupation” is generally better (and more expensive) as it gives you much broader cover. Don’t skate over this when you’re having a squiz at Term Life vs Income Protection AU details. asic.gov.au

Frequently Asked Questions About Term Life vs Income Protection AU

We get it, insurance can be a bit of a curly one, can’t it? Here are some common questions Aussies often have about Term Life vs Income Protection AU:

Q1: Can I get both Term Life Insurance and Income Protection?

A1: Bloody oath, you can! In fact, for comprehensive financial protection, it’s often the go-to move to have both. They cover different risks and complement each other, giving you broader peace of mind.

Q2: Are premiums for Term Life vs Income Protection AU tax-deductible?

A2: Generally, Income Protection premiums are tax-deductible if held outside super. Term Life Insurance premiums are typically not tax-deductible (outside super). Always double-check with a financial advisor or the ATO for your specific situation, just to be sure.

Q3: How much cover do I need for each?

A3: For Term Life, think about your total debts (mortgage, loans), how much income your dependents would need (e.g., 10-15 times your income), and future expenses like kids’ education. For Income Protection, you can typically cover up to 70-75% of your pre-tax income. A financial advisor can help you do the sums and figure out what’s right for you.

Q4: Can I get these policies through my superannuation fund?

A4: Yes, often you can. Many super funds offer basic Death (Term Life) and Income Protection as default cover. While it can be more affordable and convenient, the level of cover might be basic, and actually getting the benefits from super can sometimes be more restricted. It’s crucial to compare cover inside and outside of super.

Q5: What’s a “waiting period” for Income Protection?

A5: The waiting period is the time you have to be out of action (unable to work due to illness or injury) before your Income Protection payments start. Common waiting periods are 30, 60, or 90 days. Choosing a longer waiting period usually means lower premiums, but you need to have enough savings to see you through that time.

The Bottom Line: Don’t Procrastinate on Term Life vs Income Protection AU

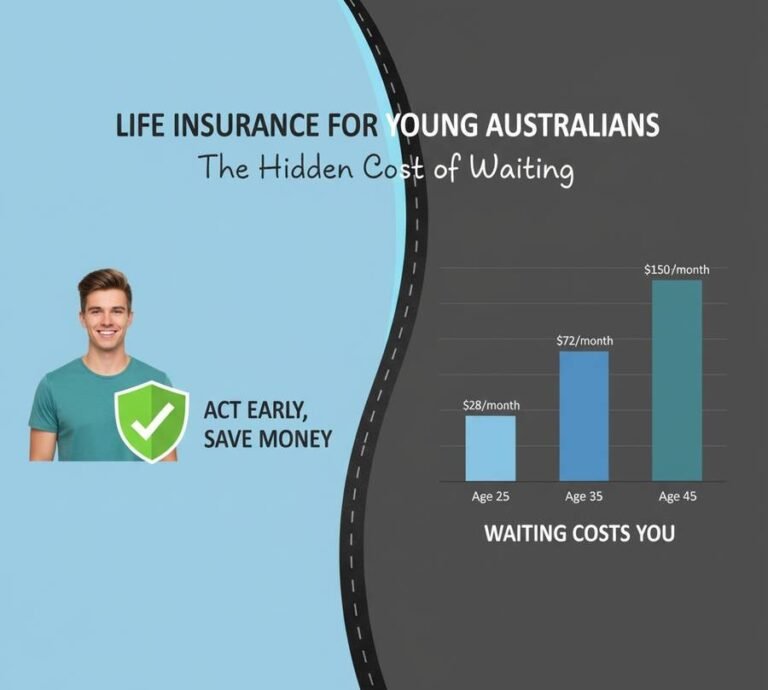

In 2025, being an Aussie means being smart, adaptable, and planning for whatever life chucks at ya. Putting off sorting out your Term Life vs Income Protection AU is like leaving a gaping hole in your financial safety net. These policies are affordable, essential safeguards that protect both your family’s future and your ability to earn a living if things go belly up.

Don’t wait until it’s too late or premiums go through the roof. Take control of your financial future today. Do your research, compare options, and get your Term Life vs Income Protection AU sorted. It’s one of the smartest moves you can make for your family’s security and your own peace of mind. Your future self, and more importantly, your loved ones, will give you a big high-five for it. Too right!

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

Written by the Primelifecover Editorial Team

The Primelifecover Editorial Team consists of experienced insurance researchers and writers dedicated to providing reliable, easy-to-understand guidance on life insurance and financial protection across the USA, UK, Canada, and Australia. Our team ensures every article meets the highest editorial standards, with accurate, regularly updated information to help you make informed choices.

Contact us: https://primelifecover.com/contact-us-page/

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook