Life Insurance Tax Deduction UK: Complete Guide to Save More in 2025

Introduction

Paying tax is something no one in the UK can avoid, but most of us want to make sure we are not paying more than we should. At the same time, many families take out life insurance to make sure their loved ones are financially safe if anything happens to them. What often gets missed is the link between the two. With the right set-up, there are times when life cover and tax savings can go hand in hand.

This guide takes a clear look at Life Insurance Tax Deduction UK rules and explains how they may work for different people in 2025. No jargon, no confusion – just straight answers that show you what is and isn’t possible.

Table of Contents

What Do We Mean by Life Insurance Tax Deduction in the UK?

A tax deduction is simply a way of lowering the income HMRC looks at when it works out your tax bill. The less income that counts, the less tax you pay. Pensions are a common example – money put into a pension often qualifies for tax relief.

But where does life insurance sit? For most people, premiums are paid from your take-home pay, meaning after tax has already been taken. In that situation, the cover itself is valuable, but there’s no direct tax saving.

The picture changes if you are a company director or if your employer offers certain types of life cover. Under those circumstances, the premiums may be treated as a business cost rather than a personal one. That is when Life Insurance Tax Deduction UK rules can come into play, creating a genuine saving.

How Do Premiums and Tax Fit Together?

Let’s take a simple example. You earn £2,500 each month after tax and set up a personal life insurance policy costing £50. That £50 comes from your bank account just like rent, food or any other bill. No tax benefit is attached to it.

Now, imagine the same person runs a small limited company. If the company sets up a relevant life insurance plan, the business can usually pay the premium as an expense. This reduces the company’s taxable profit. In effect, the premium is paid before tax, not after, which makes it cheaper overall.

The tax office is fine with this kind of set-up, so there’s nothing shady about it. The aim isn’t to duck tax, but to use the rules in a fair way. That’s why knowing how Life Insurance Tax Deduction UK works can be handy, especially in 2025 when plenty of families and small businesses are already stretched.

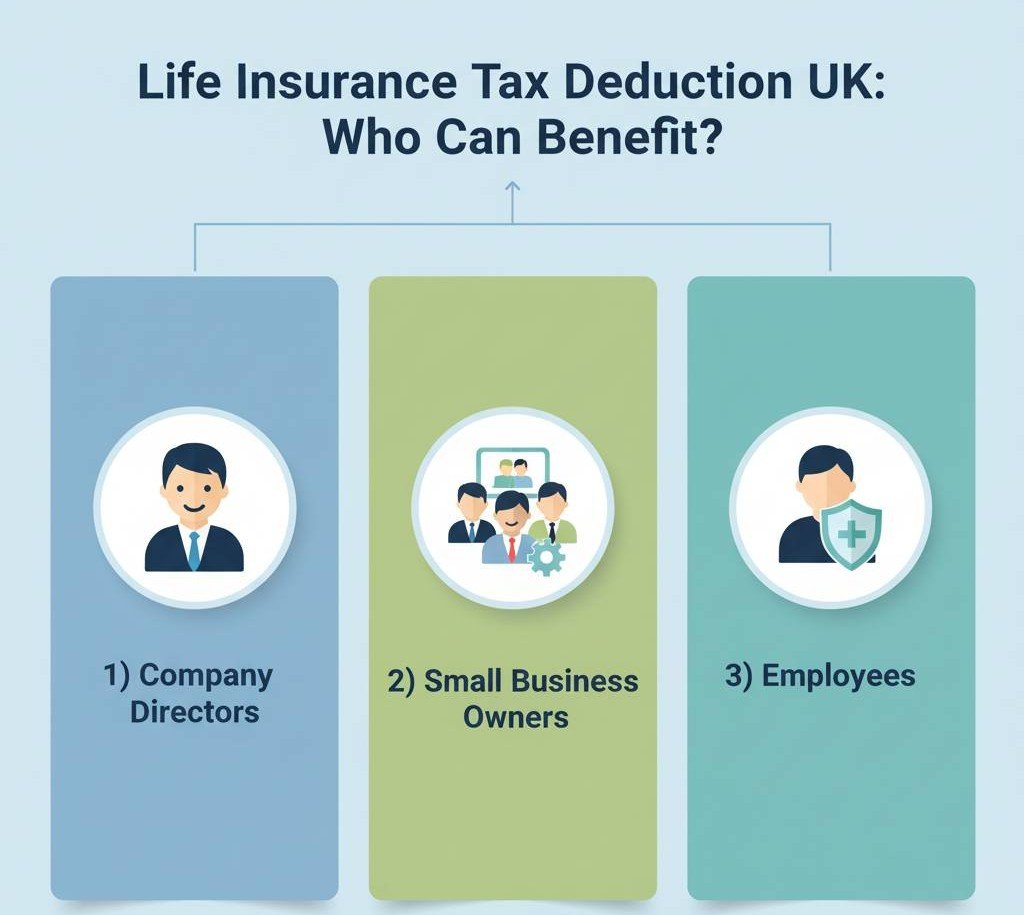

Who Can Claim Life Insurance Tax Deduction UK?

Not everyone in Britain can claim tax relief on life insurance. For most people with a standard policy in their own name, premiums are paid from money that’s already been taxed, so there’s no direct saving. But in certain cases, the rules do work in your favour.

1. Company Directors

If you run your own limited company, you may be able to take out what’s called a “Relevant Life Policy”. Instead of paying the premiums personally, the business pays them on your behalf. Because the policy is set up under specific rules, the cost is usually treated as a business expense. This means the company’s profits are reduced, and less corporation tax is due.

In simple terms, the business pays, it claims tax relief, and the cover still protects your family. This is one of the clearest examples of Life Insurance Tax Deduction UK in action.

2. Small Business Owners with Staff

Relevant Life cover isn’t just for directors. If you employ staff, you can provide policies for them as well. Your company pays the premiums, they don’t count as a taxable benefit for the employee, and your business still gets the deduction. For smaller firms, this can be a very tax-efficient way to reward employees and give them valuable protection without the cost of a full group scheme.

3. Employees with Workplace Benefits

Some larger employers set up life insurance as part of their benefits package. In most cases, the employee doesn’t pay tax on the value of this benefit, which means there’s no extra burden on their wages. While this isn’t always described as a “deduction”, it’s still a way the system makes cover more affordable.

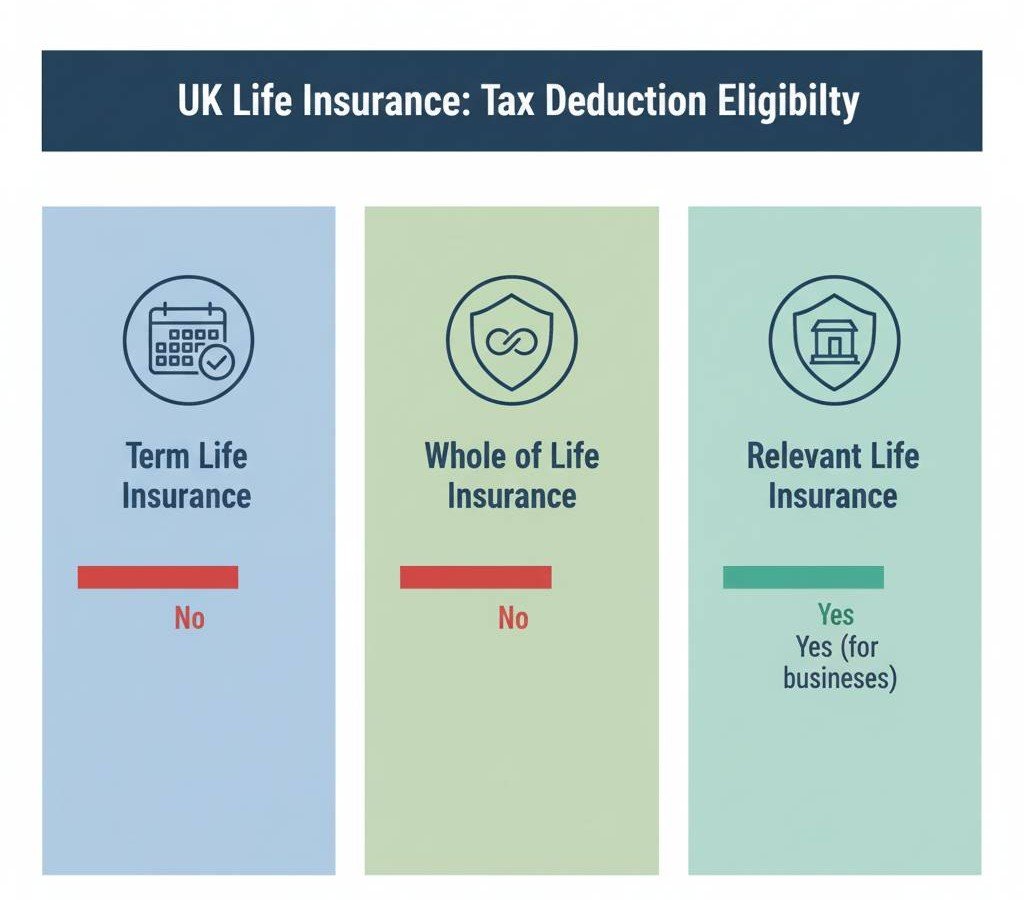

Types of Life Insurance and How Tax Rules Apply

Different types of cover can lead to very different tax outcomes. It’s important to know the difference before assuming you’ll save.

Term Life Insurance

This is the most common type, where you pay for cover over a fixed period. Personal term life plans are usually paid from after-tax income, so no deduction is available. But if arranged through a company as a Relevant Life Policy, the premiums can be treated as a business cost, giving that all-important Life Insurance Tax Deduction UK.

Whole of Life Insurance

These policies run for your entire lifetime and often include a savings element. Because of that, they can have different tax treatment when it comes to payouts. However, premiums are generally not deductible unless they are set up under the same Relevant Life structure through a company.

Relevant Life Insurance

This is the star of the show when it comes to tax efficiency. Designed specifically for employers and directors, it allows the business to pay the premiums while gaining corporation tax relief. The person covered doesn’t get hit with extra income tax or National Insurance, so the saving feels a lot bigger in real terms. If you’re serious about using Life Insurance Tax Deduction UK, this type of cover is worth exploring.

Employer and Workplace Schemes

In addition to Relevant Life cover, some firms run group schemes. These policies are paid by the employer, cover multiple staff members, and are usually set up to give a tax-efficient benefit. Employees don’t pay income tax on the cover, and the employer can often claim the premiums as a deductible expense.

For businesses, this makes sense as part of a wider staff benefits package. For employees, it means free or subsidised protection without any tax headache. It’s another example of how Life Insurance Tax Deduction UK works in practice, even if people don’t realise it.

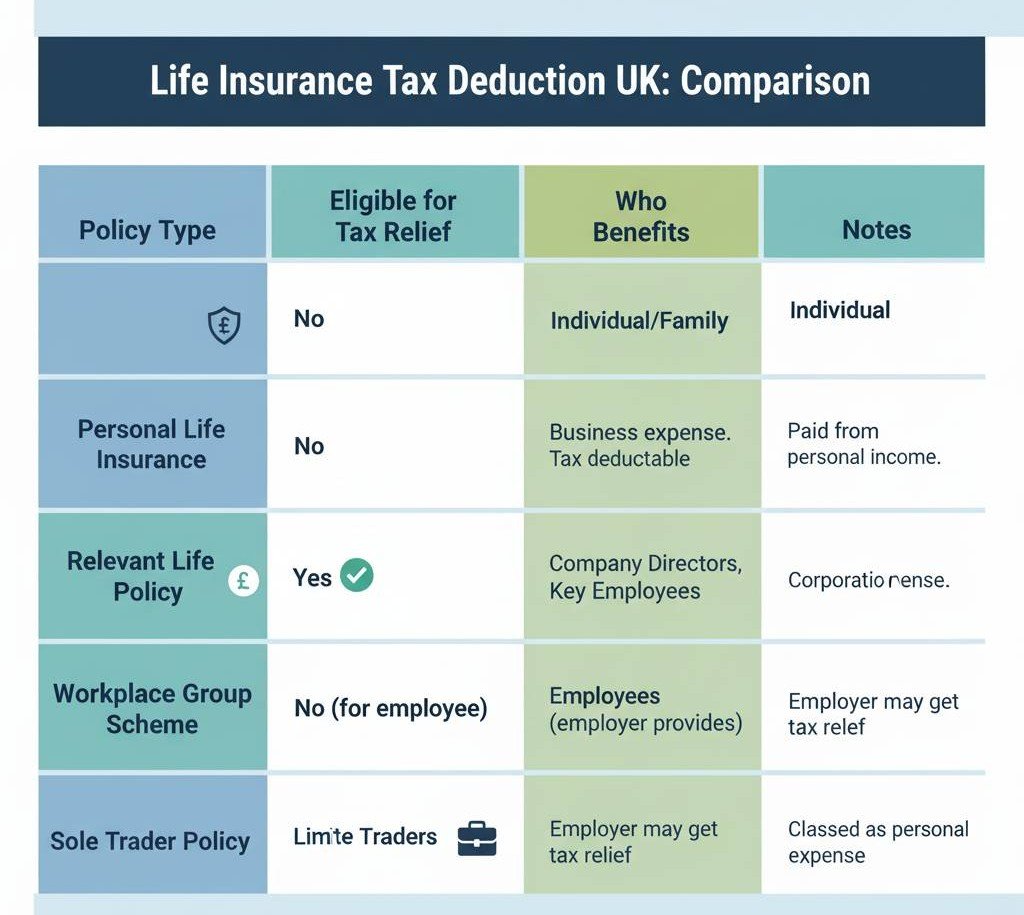

Life Insurance Tax Deduction UK: Quick Comparison

| Policy Type | Eligible for Tax Relief? | Who Benefits | Notes |

| Personal Life Insurance | No | Individual / Family | Premiums paid from after-tax income |

| Relevant Life Policy | Yes | Company Directors / Employees | Business pays premiums as an expense |

| Workplace Group Scheme | Yes (usually) | Employees | Often part of staff benefits package |

| Sole Trader Policy | No | Sole Trader | Not separate from personal income |

Myths About Life Insurance and Tax

Plenty of ideas fly around about tax and cover, but not all of them are true. Here are some of the most common ones:

Myth 1: “All life insurance is tax deductible.”

Not the case. Personal policies that you pay from your wages don’t count. The Life Insurance Tax Deduction UK only works in certain cases like Relevant Life.

Myth 2: “Tax relief means HMRC pays you back in cash.”

That’s a misunderstanding. A deduction lowers the income or profit that tax is worked out on. You save because your taxable amount is smaller, not because you get a cheque in the post.

Myth 3: “Only big firms benefit from this.”

No. Even a single director with a small company can set up Relevant Life cover and get the tax break. In fact, for many small business owners, the saving is bigger compared with paying personally.

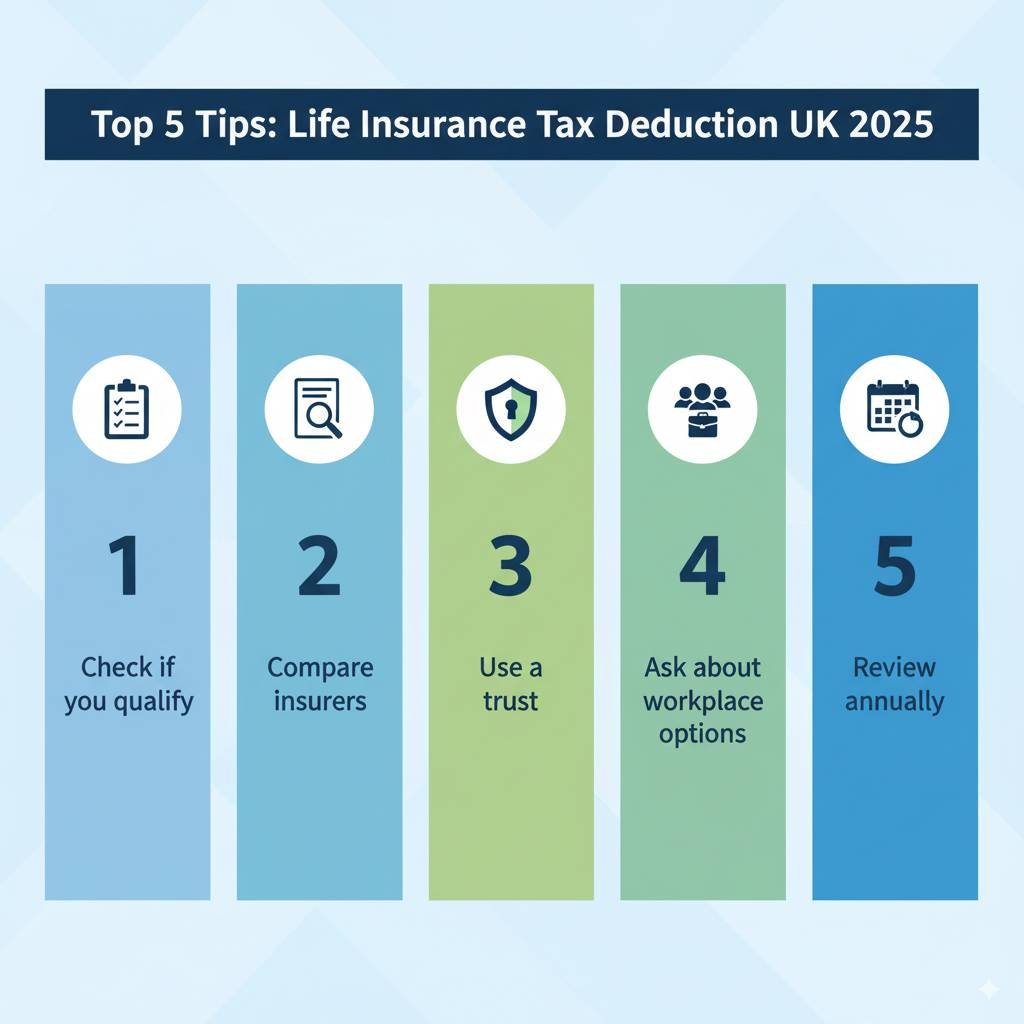

Tips to Make the Most of It in 2025

Knowing the rules is one thing, but using them properly makes the difference. Here are some easy steps:

- Check if you qualify – If you’re a company director, ask your accountant if Relevant Life could help.

- Check a few insurers- before you sign up. Each one sets their own rules and prices, so it pays to look around first.

- Use a trust – Without this, the tax side may not stand up.

- Ask about workplace options – If your job offers life cover, learn how it’s taxed. Sometimes it’s worth more than a pay rise.

- Have a quick look– at your policy every year or so. Tax rules don’t shift that often, but it’s better to be sure.

Right now, with bills piling up and pay packets feeling tight, using Life Insurance Tax Deduction UK can help you stretch your money a bit further. It’s not just about looking after your family – it can also make everyday money stuff a little simpler.

Real-Life Examples

Sometimes it’s easier to understand with a few simple examples.

Example 1: Small Company Director

Sam runs a design studio and pays himself a salary. Instead of buying life insurance from his own wages, he sets up a Relevant Life Policy through the company. The firm pays the premiums, claims them as a business expense, and Sam’s family is still protected. The policy costs the same on paper, but in practice Sam saves money thanks to the Life Insurance Tax Deduction UK rules.

Example 2: Family with Standard Cover

Emma is a teacher and buys a personal life insurance plan. She pays £30 a month from her bank account. Because it’s a personal policy, there’s no tax saving, but it still gives peace of mind. This shows that not all policies qualify – and why it’s important to know the difference.

Example 3: Employer Scheme

David works for a tech firm that offers life cover as part of its staff benefits. He doesn’t pay anything towards it, and there’s no extra tax taken from his wages. For him, it feels like a free bonus. It’s another way the Life Insurance Tax Deduction UK framework helps, even if employees don’t always notice it.

Frequently Asked Questions

1. Is every life insurance premium tax deductible in the UK?

No. Standard personal policies don’t count. The Life Insurance Tax Deduction UK mostly applies to Relevant Life cover set up through a business.

2. Do I need a trust for tax relief to work?

Yes. Without a trust, HMRC may treat the policy differently, and the saving could be lost.

3. What happens to the payout – is it taxable?

In most cases, if the policy is written under trust, the payout is not part of the estate for inheritance tax. That’s one of the main advantages.

4. Can self-employed people benefit?

If you’re a sole trader, the rules don’t work the same way because you and the business are the same legal person. A limited company set-up is usually needed for the Life Insurance Tax Deduction UK to apply.

5. Does this count as tax avoidance?

No. HMRC allows it when the policy meets the right conditions. It’s about using the system fairly, not bending the rules.

Final Word

Life insurance is mainly about looking after your loved ones, but in some cases it can also ease the tax bill. Once you understand when the Life Insurance Tax Deduction UK works for you, it’s easier to pick cover that protects your family and helps you keep more money in your pocket.

For company directors and small business owners, Relevant Life cover is often the best route. For employees, workplace schemes can be a hidden benefit worth far more than many people realise.

As costs rise in 2025, every saving helps. Getting life insurance right won’t just secure your family’s future – it can also put more money back in your pocket today.

Disclaimer

This blog is written for general information only and is not financial or tax advice. Rules may change, and everyone’s situation is different. Before making any decisions about life insurance or tax planning, speak with a qualified adviser or accountant in the UK.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook