5 Life Insurance Myths Canadians Swear By—Busted! (2025 Guide)

Let me tell you something funny—life insurance myths Canadians believe are probably the last thing anyone wants to talk about over coffee. I’ve seen friends roll their eyes the second the topic comes up. Someone always says, “Too expensive, not for me,” or “I’m young, I don’t need it.”

Here’s the thing: those lines sound logical, but they’re myths. And myths have consequences. I know one couple in Mississauga who delayed getting coverage because “money was tight.” Then, when one of them faced a sudden health scare, the premiums doubled overnight. That’s when reality hit.

A recent survey even showed that 53% of Canadians don’t have enough life insurance, and the biggest excuse? “It costs too much.” Truth bomb: most people guess the cost at two to three times higher than it really is.

So in this blog, we’ll bust the 5 biggest life insurance myths Canadians believe—with real numbers, local examples, and some straight talk you won’t hear from your uncle at the BBQ.

Table of Contents

Myth #1: Life Insurance in Canada Is Too Expensive

Why People Think This

Honestly, I get it. If you’re already watching grocery bills creep up, rent in Vancouver skyrocket, and gas prices sting every time you fill the tank—it feels like life insurance is another big-ticket item you can’t afford.

But here’s the catch: most Canadians are way off when they picture the actual premium.

Reality: It’s Cheaper Than You Think

Think of it like this: the cost of life insurance can be less than your weekly Tim Hortons habit.

- A 28-year-old non-smoker in Toronto can snag $250,000 in coverage for about $18 a month.

- Wait until you’re 45 years old, and the same coverage jumps to around $60 a month.

That’s less than what many of us spend on Netflix, Disney+, and a couple of Uber Eats orders every month.

Real-Life Example: Sarah & Daniel

Meet Sarah and Daniel, a young couple in Toronto. They’re late 20s, newly married, still paying off their condo mortgage.

At first, Sarah shrugged off life insurance: “We’re fine, it’s too pricey anyway.” But when they finally checked, they realized they could each get $500,000 in coverage for under $25/month.

That’s $50 total—less than their Friday sushi night.

Sarah later told me, “We honestly thought it would be $150 each. If we knew sooner, we’d have signed up years ago.”

Quick Comparison: Perception vs. Reality

| Age (Healthy Non-Smoker) | Coverage | What People Guess | Actual Monthly Premium |

| 28 | $250,000 | $60–$70 | ~$18 |

| 35 | $500,000 | $100+ | ~$30–$35 |

| 45 | $250,000 | $150 | ~$60 |

👉 See the gap? The myth is louder than the math.

Myth #2: I Don’t Need Life Insurance Because I’m Young

The Young-and-Invincible Mindset

If you’re in your 20s or 30s, chances are you’ve thought: “Why bother? I’m healthy, no kids, no rush.”

I’ve heard this from friends in their late 20s. The problem? Waiting usually means paying way more later.

The Truth About Buying Young

Insurance companies love young, healthy clients. Why? Lower risk = lower premiums. And here’s the kicker: once you lock in a term policy, your rate doesn’t go up.

Think of it like buying hockey tickets. If you buy them early, you pay the lowest price. Show up on game day? You either pay double—or you don’t get in.

Real-Life Example: James in Vancouver

Take James, a 25-year-old software engineer in Vancouver. He bought a $500,000, 20-year term life insurance policy for just $28/month.

If James had waited until he was 40, that same policy would cost him over $70/month. That’s more than $10,000 extra over the term, just for waiting.

Why Young Canadians Shouldn’t Wait

- Rates are dirt cheap now. They only climb with age.

- Future-proofing. Even if you don’t have kids today, you may tomorrow—and you’ll already be covered.

- Debt doesn’t vanish. Student loans, credit cards, car payments—they’ll still need paying if something happens.

Bottom line: Being young isn’t a reason to skip life insurance—it’s the smartest time to lock it in.

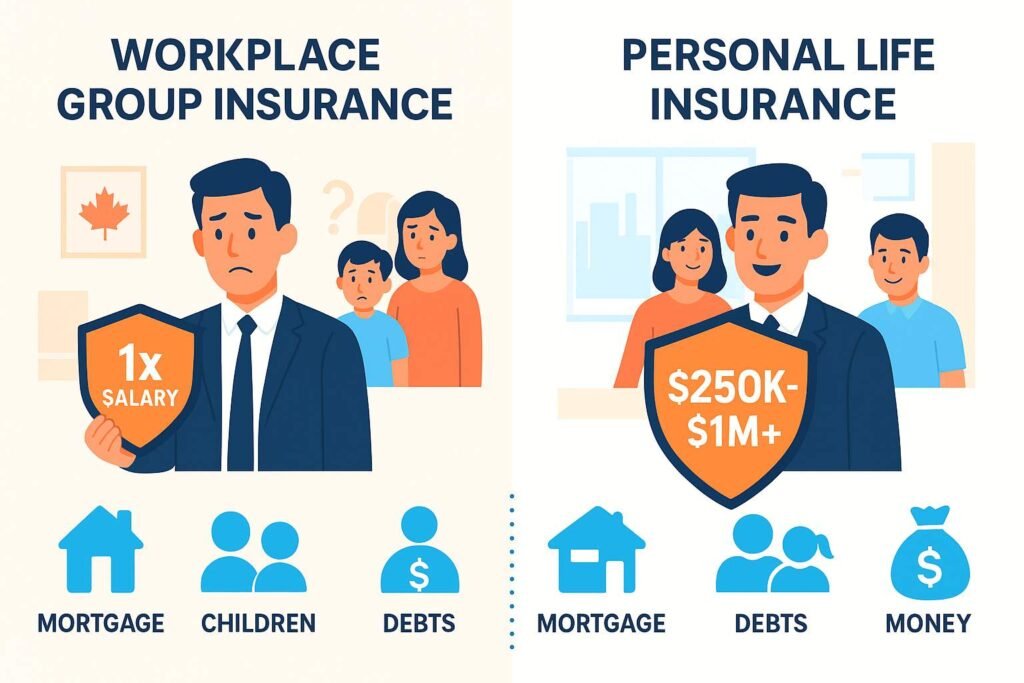

Myth #3: I Have Group Life Insurance Through Work—That’s Enough

Why People Believe This

A lot of Canadians feel safe because their job offers “free” or low-cost life insurance. Sounds great, right? It’s like your employer is saying, “Don’t worry, we’ve got you covered.”

But here’s what most folks don’t realize: workplace coverage usually isn’t nearly enough.

The Reality Check

Group plans often give you 1x or 2x your annual salary. If you’re earning $60,000, that’s maybe $60k–$120k in coverage.

Now ask yourself: would that cover your mortgage, debts, kids’ schooling, and day-to-day expenses for your family if you weren’t around? For most, the answer is a hard no.

And the bigger kicker: if you switch jobs, retire, or get laid off—poof, that coverage is gone.

Real-Life Example: Priya in Calgary

Priya, a 34-year-old nurse in Calgary, thought her hospital’s group plan was enough. She earned around $75,000 a year, and the plan gave her $75k in life insurance.

When she sat down with an advisor, they calculated that her family actually needed $600,000+ in coverage to cover their mortgage, childcare, and future expenses.

That gap—half a million dollars—was the wake-up call. Priya later said, “I thought my work plan had me covered. Turns out, it was barely a safety net.”

Quick Comparison: Group vs. Personal Coverage

| Coverage Type | Average Coverage | Stays if You Change Jobs? | Enough for Mortgage + Kids? |

| Group Plan | 1x–2x salary | ❌ No | ❌ Rarely |

| Personal Plan | $250k–$1M+ | ✅ Yes | ✅ Yes (customized) |

👉 Group insurance is nice to have—but it’s not a plan you should bet your family’s future on.

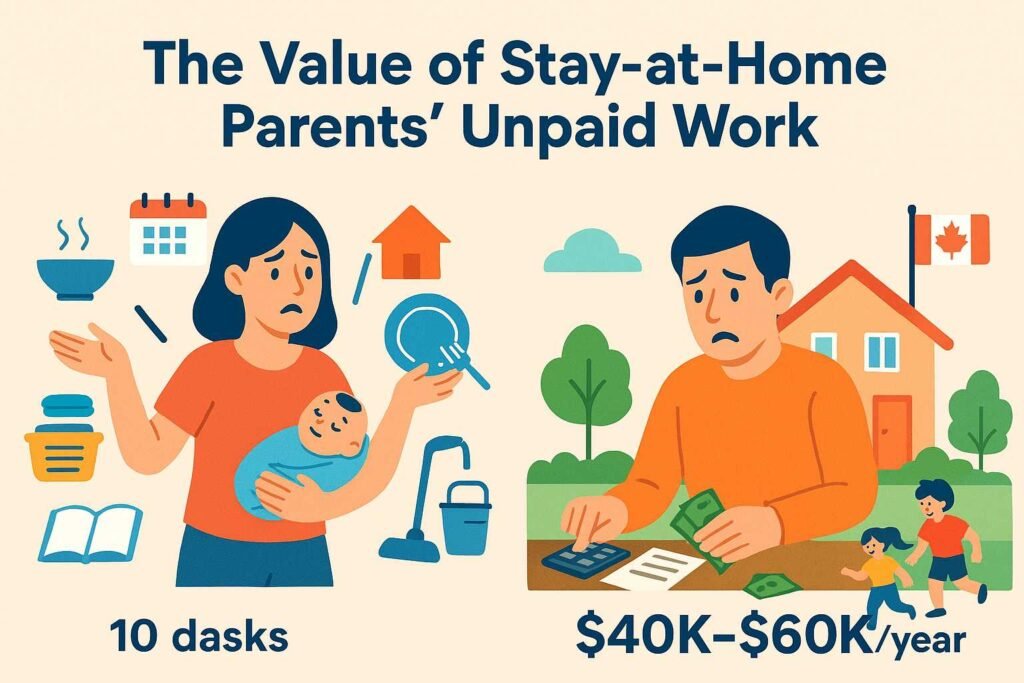

Myth #4: Stay-at-Home Parents Don’t Need Life Insurance

Why This Myth Sticks

Here’s a myth I hear too often: “Since one parent isn’t earning a paycheck, why would they need coverage?”

On paper, it almost makes sense—no income, no replacement needed. But in real life? That couldn’t be further from the truth.

The Reality: The Value of Unpaid Work

A stay-at-home parent wears about 10 hats every day: caregiver, cook, driver, tutor, nurse, cleaner—you name it. If something happened, replacing that unpaid work would cost a fortune.

According to a Canadian cost-of-living estimate, the annual value of household work done by a stay-at-home parent can be $40,000–$60,000+.

Real-Life Example: The Martins in Ottawa

The Martins are a family of four in Ottawa. Mom stayed home with their two young kids while Dad worked full-time. When they crunched the numbers, they realized that if something happened to Mom, childcare alone would cost around $2,000 a month.

That’s $24,000 a year—and that’s just childcare. Add in meal services, tutoring, and extra help around the house, and the replacement costs shot up to nearly $50,000 annually.

Dad admitted, “We never thought of her work in dollar terms until we saw the numbers. Then it hit us—without coverage, we’d be in real trouble.”

Why This Myth Hurts Families

- Childcare costs in Canada are high (even with subsidies).

- Daily household support vanishes if the parent isn’t there.

- Financial stress doubles when one partner is left handling both income and household duties.

👉 Bottom line: Just because a parent isn’t bringing home a paycheck doesn’t mean their role doesn’t have a massive financial value.

Myth #5: Life Insurance Payouts Are Taxed in Canada

Why People Believe This

Let’s be honest, in Canada we kinda expect the CRA to show up everywhere. We pay tax on gas, groceries, phone bills—you name it. So it’s natural for people to assume, “If my family gets $500,000 from life insurance, surely the taxman will take a cut.”

Reality: 100% Tax-Free

Here’s the kicker—life insurance death benefits in Canada are tax-free. No strings, no deductions, no “surprise” letters from the CRA.

Your family gets the full amount. The only time taxes could sneak in is if the money is later invested and earns income—but the payout itself is completely safe.

Real-Life Example: The Johnsons in Winnipeg

A reader once told me about her neighbours, the Johnsons. When David passed away suddenly at 52, his wife was terrified about finances. She thought half the $750,000 payout would disappear in taxes.

When her advisor explained it was 100% tax-free, she said it felt like “breathing again.” That payout cleared their mortgage, set aside money for the kids’ tuition, and gave her the space to grieve without financial panic.

👉 Imagine if she had skipped insurance because of that myth? The family would have been left scrambling.

Wrapping Things Up

Okay, so let’s call it like it is: life insurance myths Canadians believe are stubborn. But the truth is simple:

- Myth #1: “Too expensive” → Reality: cheaper than your Uber Eats budget.

- Myth #2: “I’m young, I don’t need it” → Reality: that’s the BEST time to lock it in.

- Myth #3: “My work insurance is enough” → Reality: it’s a tiny band-aid, not a plan.

- Myth #4: “Stay-at-home parents don’t need coverage” → Reality: their unpaid work is worth tens of thousands.

- Myth #5: “Payouts are taxed” → Reality: tax-free, period.

Life insurance isn’t about being morbid—it’s about giving your family breathing room if life throws the worst at them.

FAQs Canadians Ask All the Time

Q1. What’s the best age to buy life insurance?

Honestly, the sooner the better. I’ve seen 25-year-olds lock in dirt-cheap rates, while their 40-year-old friends kick themselves paying double.

Q2. Should I get term or whole life?

If you’re starting out, term is usually the smart play. It’s affordable, covers the “big years” (mortgage, kids, debts). Whole life has perks but it’s heavier on the wallet.

Q3. Do payouts actually come fast?

Yes. I’ve heard from families who got their payout within a few weeks. It’s not instant, but it’s not a drawn-out nightmare either.

Q4. Can immigrants or newcomers to Canada buy insurance?

Absolutely. As long as you’re a resident, most companies will insure you—even if you haven’t been here forever.

Q5. Can I adjust my policy later?

Totally. You can up your coverage, renew, or even switch policies as life changes. Think of it like upgrading your phone plan.

Call to Action

If you’re Canadian and reading this, don’t let life insurance myths Canadians still believe run the show. Take 5 minutes today to actually see what life insurance costs you.

Spoiler: it’s probably less than your Netflix + Disney+ combo.

👉 Check real quotes at PrimeLifeCover.com and see for yourself.

Quick Disclaimer

I’m not your financial advisor—just someone sharing research, numbers, and real stories. Policies vary based on your age, health, and where you live in Canada. Always double-check with a licensed advisor before you sign anything.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook