Gift Inter Vivos Policy – The Complete UK Guide to Protect Your Loved Ones from IHT

Introduction: Why Everyone’s Talking About the Gift Inter Vivos Policy

If you’ve ever helped your child with a house deposit, given your grandchildren a lump sum, or gifted a big chunk of your savings to a loved one, you probably felt good knowing you’d made a difference.

But here’s the part that many people in the UK don’t realize:

If you gift more than a certain amount and die within seven years, inheritance tax (IHT) could be due—and the person you helped might be the one left with the bill.

That’s where the gift inter vivos policy steps in. It’s a very specific type of life insurance designed to cover the IHT that could arise from a lifetime gift. It doesn’t aim to replace your income, pay off your mortgage, or cover general family needs—it exists purely to protect your recipient from a nasty tax surprise.

With recent talk of changes to IHT rules, rising house prices, and more people gifting large amounts to help family get on the property ladder, it’s no wonder this type of policy is becoming a hot topic. Learn more about UK inheritance tax policies 2026 hike for the latest updates. For official guidance on inheritance tax, check the HMRC inheritance tax guidance.

In this guide, you’ll learn:

- What a gift inter vivos policy is and how it works

- Real UK examples of how it protects families

- The taper relief rules it’s based on

- Myths and misunderstandings about this type of cover

- How it compares to other life insurance options

- Whether it’s right for your situation

- Practical steps to set one up

Table of Contents

What Is a Gift Inter Vivos Policy?

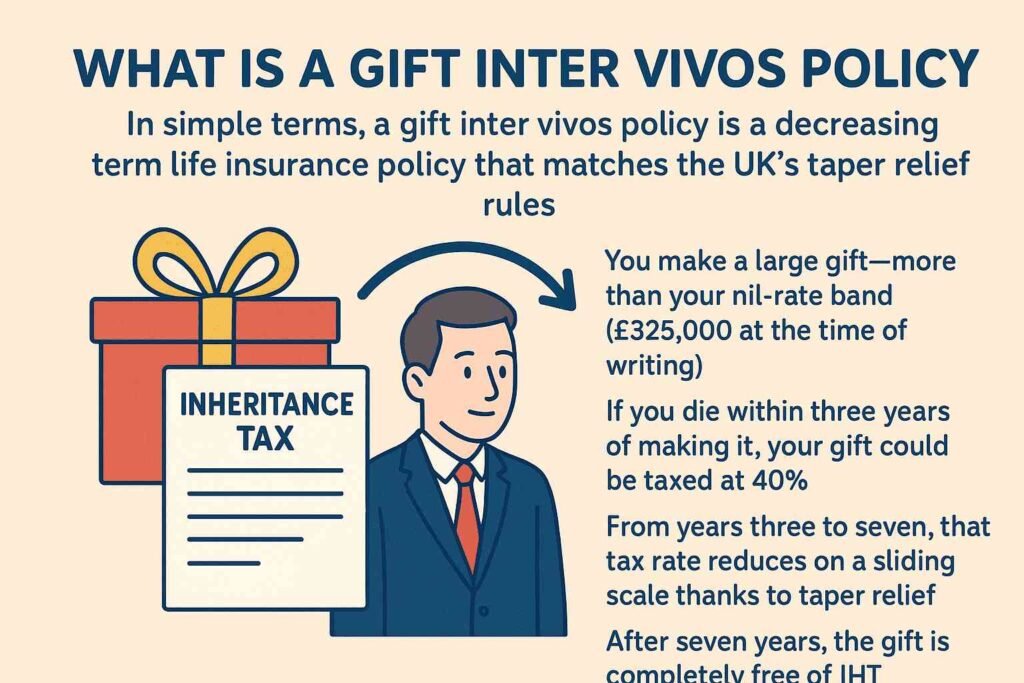

In simple terms, a gift inter vivos policy is a decreasing term life insurance policy that matches the UK’s taper relief rules.

The phrase “inter vivos” is Latin for “between the ”living”—meaning it’s about gifts made while you’re alive.

Here’s the situation it’s designed for:

- You make a large gift—more than your nil-rate band (£325,000 at the time of writing).

- If you die within three years of making it, your gift could be taxed at 40%.

- From years three to seven, that tax rate reduces on a sliding scale thanks to taper relief.

- After seven years, the gift is completely free of IHT.

The gift inter vivos policy provides cover for that tax liability during the seven-year period. As time goes on, and the potential tax bill reduces, the amount of cover the policy provides also decreases. This is why the premiums are often lower than for level term life insurance.

Why This Policy Exists

The UK’s inheritance tax system allows you to give away as much as you like, but it comes with a catch. Large gifts are classed as Potentially Exempt Transfers (PETs). They only become fully exempt from IHT if you survive for seven years after giving them.Learn more about calculating IHT on gifts from GOV.UK Work Out Inheritance Tax Due.“

If you pass away within that window, the taxman may come knocking—and it’s not HMRC’s problem where the recipient finds the money.

A gift inter vivos policy plugs that gap. For context on broader UK life insurance and inheritance tax planning, see UK life insurance and inheritance tax 2026.

Real-Life Story: Emma and the House Deposit

Let’s take a real-world example.

Emma, a 65-year-old grandmother from Manchester, wanted to help her son James buy a home for his young family. She gifted him £500,000 for the deposit and some renovations.

Her financial adviser explained the seven-year rule and how, if Emma died within that period, James could face a tax bill of over £70,000 – money he didn’t have lying around.

Emma decided to take out a gift inter vivos policy for seven years, starting with a cover amount to match the potential IHT bill. Each year, the cover amount reduced in line with the taper relief rules. That way, if she died in year two, the policy would pay out enough to cover the full tax bill. If she died in year six, it would still pay enough to cover the smaller amount due.

How Taper Relief Works (and How the Policy Mirrors It)

Taper relief doesn’t reduce the value of your gift – it reduces the rate of tax payable on it.

Here’s the standard UK taper relief scale:

| Years Between Gift & Death | IHT Rate on Gift | % of Full Tax Paid | Typical Policy Payout Level |

| 0–3 years | 40% | 100% | 100% of cover |

| 3–4 years | 32% | 80% | 80% of cover |

| 4–5 years | 24% | 60% | 60% of cover |

| 5–6 years | 16% | 40% | 40% of cover |

| 6–7 years | 8% | 20% | 20% of cover |

| 7+ years | 0% | 0% | Policy ends |

The gift inter vivos policy decreases each year in line with these percentages, meaning you’re never paying for more cover than you need.

For additional context on insurer rules, see BOE liquidity rules UK insurers 2025.

Benefits of a Gift Inter Vivos Policy

- Peace of mind – Your loved one won’t face a surprise tax bill at the worst possible time.

- Cost-effective – As the cover drops over the years, the premiums work out a fair bit cheaper than keeping a level term policy.

- Tailored protection – It’s set up to match the gift exactly, so you’re not paying for anything extra. Quick payout – When written in trust, the payout avoids probate and reaches your beneficiary faster.

- Quick payout – If you put it in trust, the money skips probate and gets to your loved ones much quicker.

Drawbacks to Be Aware Of

- Expires after 7 years – If you outlive the policy (good news for you!), there’s no payout.

- Specific cover – Only protects the one gift, not your whole estate.

- Multiple gifts – You may need more than one policy.

- Premium commitment – Missing payments could cause the policy to lapse.

- Not an investment – No cash value if you cancel early.

Myth-Busting

Myth 1: “Taper relief cuts the tax right away.”

Truth: It only reduces the rate – the taxable amount above the nil-rate band stays the same.

Myth 2: “It’s just for the rich.”

Truth: With average UK house prices topping £280,000, even helping with a deposit can push a gift over the nil-rate band.

Myth 3: “Any life insurance will do.”

Truth: Regular life insurance doesn’t reduce in line with taper relief – you could end up paying more than necessary.

Myth 4: “You can take it out after you die.”

Truth: No policy can be set up posthumously – it has to be in place at the time of gifting.

Gift Inter Vivos vs Other Life Insurance Options

| Feature | Gift Inter Vivos Policy | Level Term Life Insurance | Whole-of-Life Insurance |

| Cover amount | Reduces over 7 years | Fixed | Fixed |

| Best for | Specific large gift | General family protection | Estate planning |

| Cost | Usually cheaper | Mid-range | Most expensive |

| Duration | 7 years | Flexible (e.g. 10–25 years) | For life |

| IHT focus | Yes | No (unless structured) | Yes (covers whole estate) |

Who Should Consider One?

- Parents or grandparents gifting property deposits.

- Business owners transferring shares to children.

- Individuals gifting amounts above the nil-rate band.

- Anyone who wants to ensure generosity doesn’t cause financial stress for the recipient.

FAQs

Q1: Can I cover more than one gift with one policy?

A: Usually no – you’ll need separate cover for each gift.

Q2: Should I put the policy in trust?

A: Yes, to keep the payout outside your estate.

Q3: Do premiums go up each year?

A: No, most are fixed for the 7-year term.

Q4: What happens after 7 years?

A: The gift is exempt from IHT; policy ends.

Q5: What if I die after 5 years?

A: Policy pays enough to cover the reduced tax bill per taper relief.

Q6: Is this better than whole-of-life insurance?

For one gift, yes – it’s cheaper and focused.

Q7: Can I cancel early?

Yes, you can – but the cover ends and what you’ve paid won’t come back.

Q8: Is it affected by IHT rule changes?

A: Yes, though core principles of PETs and taper relief have been stable.Learn more about UK inheritance tax policies 2026 hike.

________________________________________

Call to Action

If you’ve made a significant gift in the past year – especially above £325,000 – don’t leave it to chance. Speak to a UK-regulated financial adviser today about a gift inter vivos policy. It’s one of the simplest ways to protect your loved ones from an unexpected tax bill.

________________________________________

Disclaimer

This blog is just for general information – it’s not personal financial or tax advice. Remember, tax rules can change and what applies really depends on your own situation. So before making any big money decisions, it’s always best to chat with a qualified adviser.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.