Blog: Gen Z Life Insurance Cost – Why Misconceptions Are Creating a Coverage Gap

Introduction: Why Gen Z Gets Life Insurance Costs Wrong

Let’s be real for a sec—Gen Z has flipped the script on money. They hustle with side gigs, invest in crypto, follow finance TikTok, and would rather spend on experiences than big long-term commitments. But when the topic of life insurance pops up? Almost everyone in their 20s or early 30s rolls their eyes.

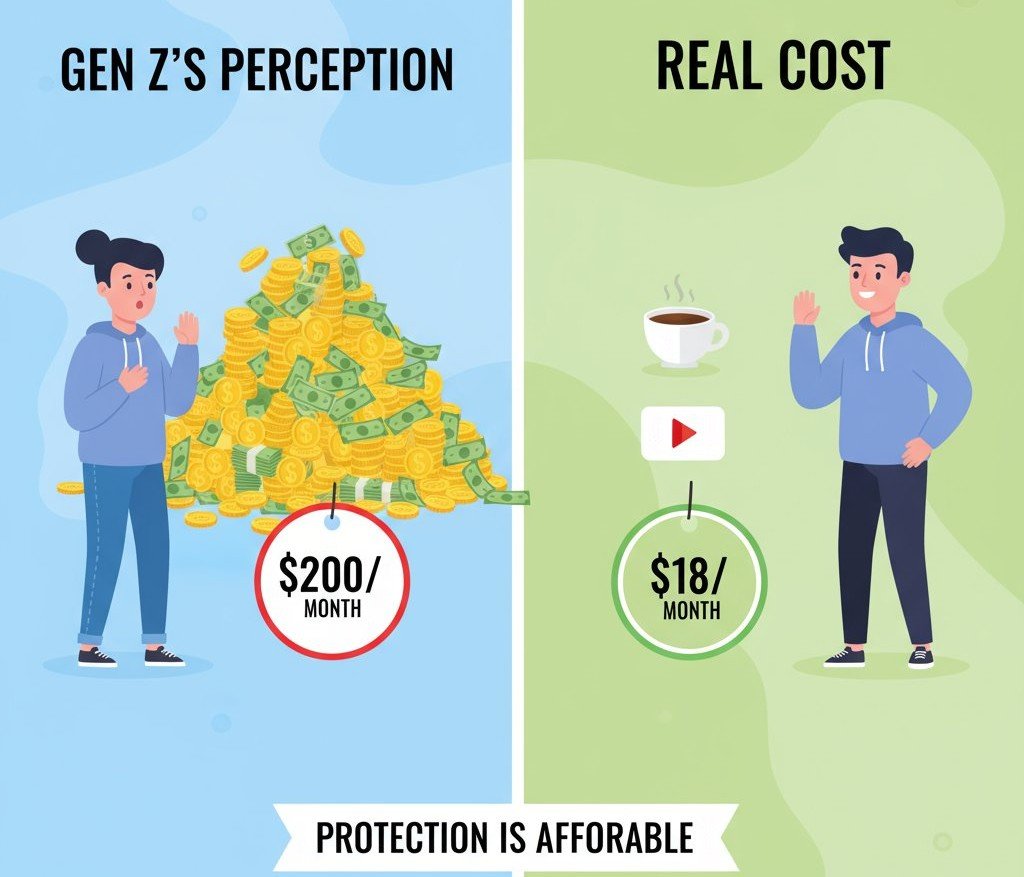

Here’s the kicker: surveys keep showing that most Gen Z adults massively overestimate what life insurance costs. Some think it’s ten times pricier than it really is. Imagine believing you’d need $150 a month, when in reality, the Gen Z life insurance cost for a healthy 25-year-old is more like $18. That’s less than your Friday night Uber Eats splurge.

So, what’s happening here? Simple—the issue isn’t affordability, it’s perception. And this misunderstanding is leaving a huge gap in coverage across the United States.

Table of Contents

In this guide, I’ll break down:

- Why so many myths exist around insurance costs

- The actual numbers (spoiler: way cheaper than you think)

- Real stories that show how waiting hurts your wallet

- How to start smart without overcomplicating things

By the end, you’ll see why tackling the Gen Z life insurance cost early isn’t just smart—it’s a total money hack.

The Reality vs. Perception of Gen Z Life Insurance Cost

What Studies Say About the Price Gap

A major industry survey from LIMRA and Life Happens in 2024 found something wild: Gen Z overestimates the price of life insurance by 10–12x. For example, a 25-year-old non-smoker often guesses that $250,000 in term coverage would cost $150+ per month. The real number? Around $18.

Think about that for a second. This simple misunderstanding means thousands of young people never even bother to get a quote. They assume it’s out of reach, when in reality, the Gen Z life insurance cost is less than most streaming bundles.

The Real Numbers – What Term Life Actually Costs

Let’s put it in black and white (average numbers, U.S. 2025):

| Age | Coverage Amount | Gen Z Estimate | Actual Cost (Monthly) |

| 25 | $250,000 | $150 | ✅ $18 |

| 30 | $500,000 | $200 | ✅ $28 |

| 35 | $500,000 | $250 | ✅ $40 |

When you see the actual math, it’s obvious—Gen Z life insurance cost is nowhere near the scary price tags floating around TikTok or group chats.

The Biggest Myths Behind the Confusion

Here are the usual lines I hear whenever life insurance comes up with young adults:

“That’s for parents, not me.”

Wrong. The earlier you buy, the cheaper it stays. Locking it in now saves you thousands later.

“It’s way too expensive.”

Nope. In most cases, it’s literally cheaper than your monthly Netflix + Spotify combo.

“I already get some at work.”

Maybe, but employer coverage usually equals one year of salary. If you’ve got debt, rent, or family, that won’t stretch far.

“It’s so complicated.”

It used to be. But with no-medical policies and quick online apps, it’s now easier than booking flights.

These myths are exactly what widen the gap. By buying into them, Gen Z keeps thinking life cover is out of reach, when the truth is the Gen Z life insurance cost is one of the most affordable financial tools out there.

Why Putting It Off Costs More

Let’s be honest—most 20-somethings don’t wake up thinking, “I should buy life insurance today.” Between rent, car payments, or saving for a weekend trip, it feels like the last thing on the list. But here’s the hidden truth: the longer you wait, the more expensive it becomes.

For example, at age 25, a healthy non-smoker might pay around $18 a month for $250k coverage. Wait until 35, and the same coverage jumps to $40+. By 45? You’re staring at $100 or more each month. That’s a huge difference, and it’s exactly why locking in the Gen Z life insurance cost early pays off big time.

Health Factors Add Up

Another thing Gen Z sometimes forgets—your health today isn’t guaranteed tomorrow. A back problem, asthma, high blood pressure, or even mild anxiety on your medical record can change how insurers view you.

Waiting often means:

- Higher premiums because of age + health changes

- Extra medical exams during application

- Exclusions for pre-existing conditions (like asthma or migraines)

This is why smart planning in your 20s is so underrated. The Gen Z life insurance cost is lowest when you’re young and healthy.

Lost Savings Over Time

Think of life insurance like rent vs. buying. The earlier you get in, the more money you save over time.

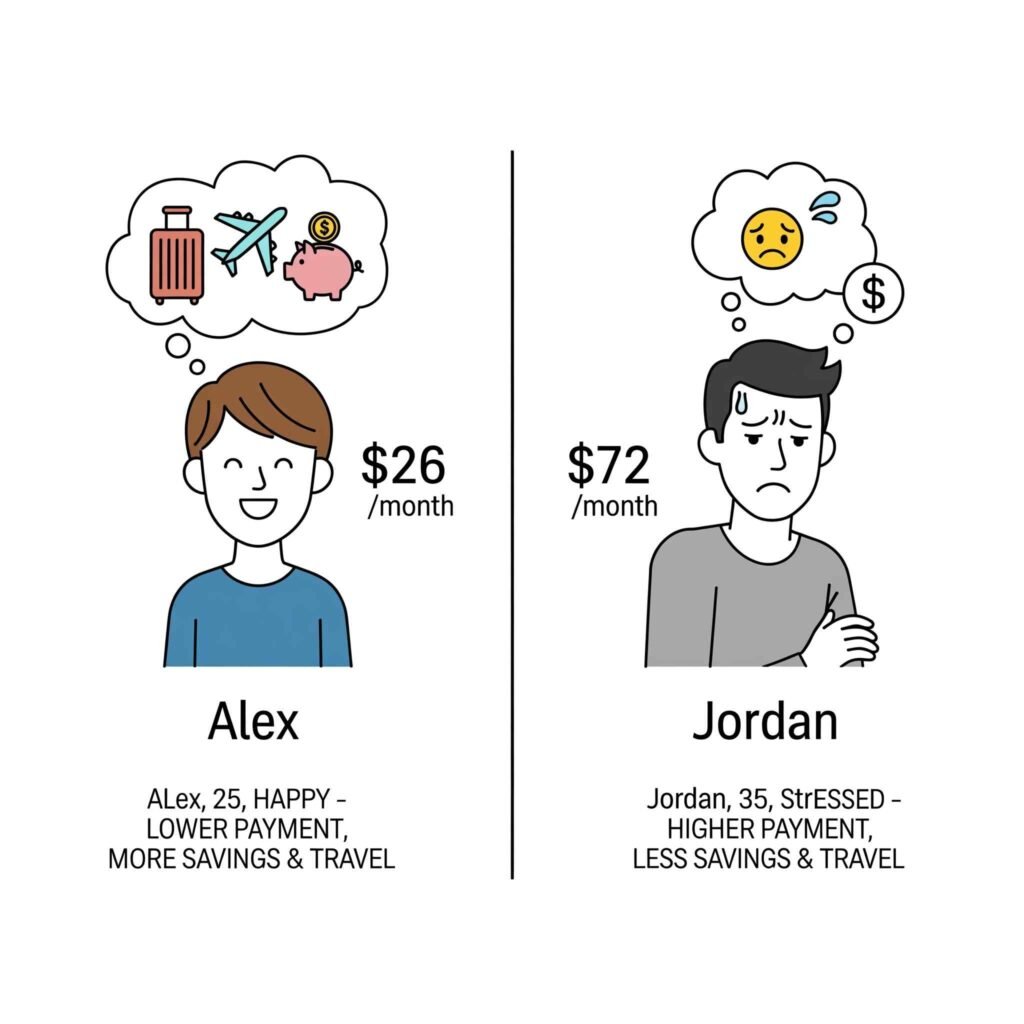

Let’s do a quick comparison:

- At 25: $500k policy = $26/month

- At 35: same policy = $72/month

Over 20 years:

- 25-year-old total = $6,240

- 35-year-old total = $17,280

That’s an $11,000 difference for the exact same coverage. Imagine what else you could do with that money—invest, travel, pay down debt. That’s the hidden cost of waiting.

Real-Life Stories from Gen Z

Alex vs. Jordan – A Tale of Two Friends

Alex, a 25-year-old software engineer from Austin, took action early. He grabbed a $500k term life policy for just $26/month.

His buddy Jordan brushed it off, thinking, “I’ll deal with that later.” Fast-forward ten years—Jordan is 35, with the same job type and health profile. When he finally applies, his premium comes back at $72/month.

Over 20 years, Alex spends just over $6k, while Jordan spends more than $17k. The gap? Nearly $11,000.

Jordan summed it up perfectly: “If I’d just done it earlier, I’d be paying less and stressing less.”

Zoe’s Wake-Up Call

Zoe, a 31-year-old nurse in Denver, figured she’d buy life insurance “after the house.” By the time she finally applied at 35, premiums were steeper, and insurers asked for medical checks. She told me, “If I’d sorted this five years ago, I’d have more options and less hassle.”

Her story isn’t unique—it’s exactly what happens when myths about Gen Z life insurance cost keep people on the sidelines for too long.

Why Acting Early is the Smart Play

When you strip it down, the benefits of starting early are obvious:

- Lower monthly costs you can actually afford

- Locked-in coverage while you’re healthy

- More policy choices and flexibility

- Less stress down the road

Even if you’re single, it matters. Think: who covers rent, loans, or your car payment if something happens? Your parents? Your siblings? Starting small now ensures no one else carries that burden.

The truth is simple—the Gen Z life insurance cost is lowest today. Tomorrow, it only goes up.

Where Gen Z Can Actually Find Life Insurance Advice

So maybe you’re thinking, “Alright, I get it—this stuff matters. But where do I even start?” Don’t worry, you’ve got options:

- Independent financial advisers – Think of them as translators. They take boring policy language and explain it in plain English.

- Comparison websites – Tools like NerdWallet or Policygenius give you a quick look at average prices. It’s not the full story, but a good first step.

- Your employer or super fund equivalent (in the U.S., workplace benefits) – Many jobs include some group cover, but it’s usually tiny—like one year of salary. That won’t cover debts, let alone future family needs.

- Licensed insurance brokers – They shop around for you. You tell them your budget, they bring you options.

No matter which path you take, the important part is asking the right questions: How much cover do I need? What’s excluded? How long will premiums stay level? A good adviser won’t pressure you; they’ll help you make sense of the real Gen Z life insurance cost without the myths.

FAQs About Life Insurance for Gen Z

I get asked the same questions again and again, so let’s clear a few up:

1. Do I really need life insurance if I’m young and single?

Maybe not a huge policy, but some cover makes sense. Student loans, car debt, or rent obligations don’t just vanish. Someone—usually your parents or family—would end up responsible.

2. Isn’t my work policy enough?

Probably not. Workplace policies are often just 1–2x salary. For most people, that’s gone in a year. Real coverage is designed to actually protect your future goals, not just pay off a few bills.

3. What if I can’t afford much right now?

That’s the beauty of starting early. You don’t need a $1 million policy. Even a small starter policy locks in today’s low Gen Z life insurance cost. You can always add more later.

4. Can I be denied?

If you’re young and healthy, rejection is rare. But waiting increases the chance of exclusions. For example, develop asthma or chronic back pain, and insurers may exclude it or raise your premiums.

5. Is life insurance really tax-free?

In most U.S. cases, yes—the payout your beneficiaries receive is tax-free. Always check with a licensed adviser for specifics, but generally, this myth is exactly that—a myth.

Real Conversations That Change Minds

Take Sam, 27, a graphic designer from Chicago. He told me, “I don’t have kids, so I don’t see the point.” But when we walked through his car loan, credit card debt, and the fact that his parents would be on the hook, he paused. “Okay, I never thought about it like that,” he admitted.

Then there’s Casey, 32, a teacher in Seattle. She bought cover early after watching her parents face health issues. “Now I pay less than my colleagues who waited,” she said.

These aren’t abstract case studies—they’re everyday stories showing why tackling the Gen Z life insurance cost sooner rather than later is a smart move.

Why “Later” Is the Most Expensive Word

Here’s the pattern: most people don’t say “no” to insurance, they say “later.” But later almost always means higher premiums, fewer choices, and stricter conditions.

Acting now locks in affordability, flexibility, and peace of mind. And honestly? It’s easier than you think—sometimes just an online form or a 15-minute call.

A Gentle Push (Call to Action)

If you’re under 35 and reading this, here’s your nudge:

- Hop on a comparison site and get a ballpark quote.

- Call your HR department and ask what your work policy actually covers.

- Book a free chat with a licensed adviser.

You don’t have to buy today. But knowing your real options is free—and every year you wait, the Gen Z life insurance cost goes up.

Final Word & Disclaimer

Life insurance won’t win you Instagram likes or bragging rights at a party. But it will protect your financial future, and it’s way more affordable than most of Gen Z thinks.

Disclaimer: This article is for general information only. It’s not personal financial advice. Everyone’s situation is different, so before you make decisions, talk to a licensed adviser and check the official Product Disclosure Statement.

That said, if you’re young, healthy, and still on the fence, this is likely the cheapest and simplest time you’ll ever have to lock in cover. Future you will be glad you did.

For more details about covering dependents, check out our Child Life Insurance Guide USA 2025.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook