Life Insurance for FIFO Workers in 2025: Securing Your Future Down Under

You’re right, the FIFO life is a paradox! It offers good money and longer breaks with family, which is fantastic. However, being away from home in remote, demanding jobs can take a serious toll, both physically and mentally. If you’re in a FIFO role, you’re likely earning well, and that makes securing your financial future and protecting your loved ones even more important. That’s where FIFO life insurance in Australia becomes essential for peace of mind in 2025.

This piece we’re having a squiz at is your ultimate guide to navigating the sometimes-muddy waters of FIFO life insurance Australia. We’ll rip into why it’s so critical, what kinds of cover are floating around, the unique quirks that apply specifically to your line of work, and how to make bloody sure you’re getting a fair dinkum deal. If you’re a FIFO legend wondering how to best shield yourself and your mob, grab a cuppa; you’ve landed in the right spot.

Table of Contents

Understanding the FIFO Lifestyle and Its Insurance Implications

Doesn’t matter if you’re slogging it down a Western Australian mine, tackling the gas fields up in Queensland, or knocking up some serious infrastructure in the NT, the FIFO lifestyle pretty much sings from the same song sheet. Long stints away from your own pillow, often isolated, and jobs that can be dead-set physically demanding or carry a fair bit of risk – that’s all part and parcel. While the cash can be pretty good, these elements also chuck up some unique insurance headaches that your average, run-of-the-mill life insurance policy might not quite cut it for.

Let’s be straight up: FIFO work carries higher risks than a standard 9-to-5, with increased chances of workplace accidents and a significant mental toll from isolation and demanding schedules. This unique rhythm also complicates financial planning and your family’s safety net. That’s why understanding FIFO life insurance in Australia is crucial; it’s about getting the right coverage that genuinely fits your unique circumstances. https://primelifecover.com/term-life-insurance-millennials/

Types of Life Insurance Relevant to FIFO Workers

Trying to make sense of all the different types of life insurance can feel like wrestling a greased pig, but getting your head around each one will definitely help you pinpoint the best fit for your specific needs as a FIFO worker here in Australia. Here’s the drum:

| Insurance Type | Description | Why it Matters for FIFO Workers |

| Life Cover (Death Cover) | Pays a lump sum to your chosen beneficiaries if you pass away. | This one’s absolutely fundamental. It’s what keeps your family afloat, helping them cover the house, bills, and future costs if the worst happens while you’re out on site or even back home. It’s peace of mind, pure and simple. |

| Total and Permanent Disability (TPD) | Pays a lump sum if you become totally and permanently disabled and are unlikely to ever work again. | A ripper for FIFO workers, especially given the higher chance of serious bingles in some of these roles. It means you’ll have a solid payout if you can’t ever get back to work. |

| Income Protection (IP) | Pays a portion of your regular income if you’re unable to work due to illness or injury. | Think of it as your financial safety net. It’s absolutely essential for covering that income gap while you’re on the mend, particularly given the potential for workplace incidents or health issues that can crop up with the lifestyle. |

| Trauma/Critical Illness Cover | Pays a lump sum if you’re diagnosed with a specified serious illness (e.g., heart attack, stroke, cancer). | This offers a decent chunk of cash to help manage medical expenses and life changes during a major health crisis. It lets you focus on getting better without the added stress of financial worries. |

For heaps of FIFO blokes and sheilas across Australia, having a combination of these covers usually offers the most bulletproof protection. When you’re tossing up your options for FIFO life insurance Australia, really have a good think about how each type of cover speaks to the particular risks and financial responsibilities that come with your demanding profession.

Key Considerations When Choosing FIFO Life Insurance in Australia

Locking in the ideal FIFO life insurance Australia policy means doing a bit of homework and really focusing on a few factors that are pretty unique to your kind of work. asic.gov.au

Occupational Risk Assessment: Insurers aren’t just looking at your age or whether you’re fit as a fiddle; they’ll do a proper deep dive into the exact nature of your FIFO role. An underground miner, for instance, might be seen as a higher risk than someone flying in for a desk job, and that can certainly affect your premiums or even if a policy is available. It’s absolutely paramount to be straight-up and honest about your precise duties when you’re applying for FIFO life insurance Australia. Trying to pull a fast one can bite you big time later, with a claim getting knocked back – and nobody wants that headache.

Policy Exclusions: Get your reading glasses on and really comb through any exclusions in the policy. Some policies might have sneaky little clauses about hazardous activities, even if those activities are just part of your daily grind on a FIFO site. Also, be fully aware of how any existing medical conditions, including anything to do with mental health, might be handled. Given the undeniable stresses of the FIFO gig, truly understanding the coverage for mental health-related claims under FIFO life insurance Australia is becoming more and more crucial.

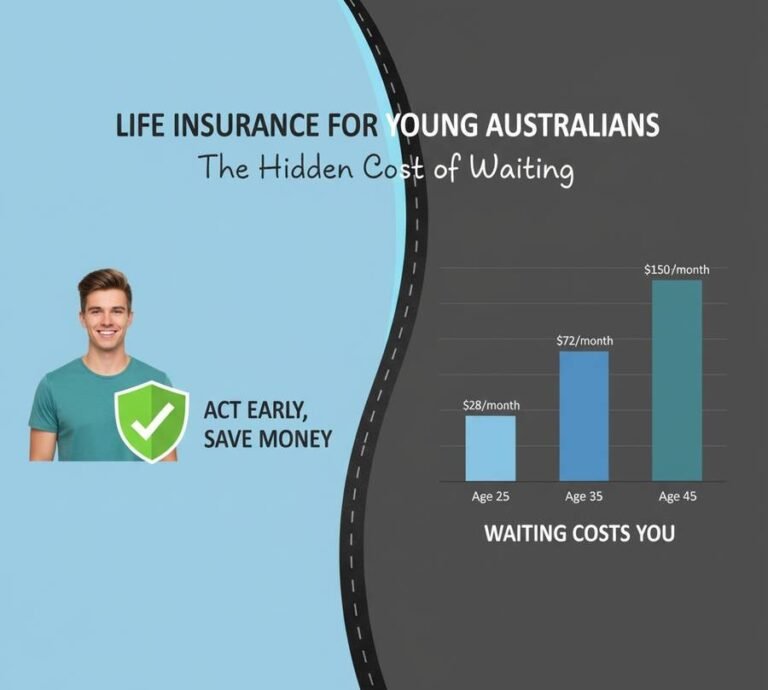

Loading and Premiums: Because some FIFO jobs are seen as carrying a bit more grunt and risk, insurers might whack a “loading” onto your premiums. All that means is you’ll pay a bit more than someone in a less risky job. It’s a dead-set smart move to get quotes from a few different insurers who really know their stuff when it comes to FIFO life insurance Australia to get a proper feel for the range of premiums and any loadings that might apply.

Geographical Considerations: If your FIFO work takes you to seriously remote spots or even offshore (though that’s a bit less common for your typical Aussie FIFO setup), double-check that your policy actually has you covered in those areas. Most standard FIFO life insurance Australia policies will protect you within Australia, but if your work takes you off the beaten track, it’s definitely worth getting clarification.

Underwriting Process: Get ready for what might be a more detailed underwriting process when you’re applying for FIFO life insurance Australia. Insurers might ask for more nitty-gritty details about your job, your daily routine, and your medical history to accurately size up the risk.

Duty of Disclosure: This point simply cannot be stressed enough. When you’re putting in an application for FIFO life insurance Australia, you are legally obliged to spill the beans on all relevant information truthfully and completely. Failing to do so can have genuinely devastating consequences if you ever need to lodge a claim. Don’t risk it.

Superannuation vs. Standalone Policies: A fair few FIFO workers find their life insurance tucked away within their superannuation fund. While this can be handy and sometimes cheaper to kick off with, the level of cover might be a bit thin, and making a claim can sometimes feel like wading through treacle. Standalone FIFO life insurance Australia policies, on the other hand, usually offer a lot more wiggle room in terms of how much cover you get and the features included, though they might come with a higher price tag. Really weigh up what you need personally and give both options a proper look.

Giving your FIFO life insurance Australia needs a regular health check is super important, especially as your income, family situation, or job role shift. That policy you snagged years ago might simply not stack up for the protection you need in 2025.

FAQs about FIFO Life Insurance Australia

Q1: Can my FIFO work make my life insurance premiums jump up?

A: Yeah, absolutely. Depending on the exact nature of your role, your premiums for FIFO life insurance Australia could be a bit steeper because of the perceived higher risks tied to certain FIFO jobs.

Q2: What happens if I switch FIFO roles or companies?

A: It’s super important to let your insurer know about any big changes to your job or the kind of work you’re doing. This could change how they see your risk, and potentially affect your premiums or what’s covered under your FIFO life insurance Australia policy. Don’t get caught out.

Q3: Is mental health covered under FIFO life insurance Australia?

A: Coverage for mental health can be a bit of a mixed bag between different policies. Some FIFO life insurance Australia policies might have specific exclusions or limits when it comes to mental health conditions. It’s crucial to dive into the PDS and have a good chat with your advisor about this. Income protection policies are often more directly relevant if mental health issues prevent you from working.

Q4: How do I actually claim on my FIFO life insurance Australia policy?

A: The claims process will vary a bit depending on the insurer you’re with. Generally, you’ll need to get in touch with them pronto and hand over all the necessary paperwork, like a death certificate, medical reports, or proof of disability. Your financial advisor can usually give you a good hand through the claims process for your FIFO life insurance Australia policy.

Q5: Should I get insurance through my super or a standalone FIFO life insurance Australia policy?

A: Both options have their ups and downs. Insurance through your super can be handy and sometimes cheaper to kick off with, but the level of cover might not be as comprehensive. Standalone FIFO life insurance Australia policies usually offer more tailored coverage but might come with higher premiums. The best pick really comes down to your personal situation and what you need financially.

Conclusion

As a dedicated FIFO worker here in Australia, you’re plugging away and making a massive contribution to our nation’s economy. And just like you take your job seriously, making sure your financial security is buttoned up and protecting your loved ones is something you’re probably pretty keen on. Having the right FIFO life insurance Australia in place is absolutely the cornerstone of that security.

Don’t ever underestimate how crucial it is to tailor your life insurance to the unique demands and potential risks that come with your profession. By truly wrapping your head around the different types of cover, having a good think about the specific factors that apply to FIFO work, and reaching out for expert advice, you can enjoy that sweet peace of mind knowing you’ve truly locked in your future, no matter what 2025 and beyond might throw your way.

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

Written by the Primelifecover Editorial Team

The Primelifecover Editorial Team consists of experienced insurance researchers and writers dedicated to providing reliable, easy-to-understand guidance on life insurance and financial protection across the USA, UK, Canada, and Australia. Our team ensures every article meets the highest editorial standards, with accurate, regularly updated information to help you make informed choices.

Contact us: https://primelifecover.com/contact-us-page/

Call To Action

Don’t leave your family’s future to chance. Get on the blower and speak to a qualified financial advisor today to nut out your tailored FIFO life insurance Australia options for 2025.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

2 Comments