UK Life Insurers: Are You Ready for BoE’s New Liquidity Squeeze?

Alright, UK life insurers, grab a cuppa and settle in. Your patch of the financial world? It’s about to get a proper shake-up. The Bank of England (BoE), working closely with its Prudential Regulation Authority (PRA), is genuinely tightening the screws on liquidity. By the stroke of midnight on 31 December 2025, every significant life insurer will need to prove, beyond a shadow of a doubt, that they’re truly up to snuff. If you’re leading, part of the team, or even just offering advice within a UK life insurer, truly getting to grips with these new BoE Liquidity Rules isn’t just important – it’s absolutely non-negotiable for keeping your firm on an even keel and navigating whatever choppy waters lie ahead.

Table of Contents

The Elephant in the Room: Why These New BoE Liquidity Rules, And Why Now?

For what feels like ages, the big preoccupation for life insurers has, quite rightly, been capital solvency. We’ve all been dead keen on making sure firms have enough reserves squirrelled away to meet those long-term policyholder promises. Solvency II has been the trusty backbone, no arguments there. But then, as we saw with the market’s unpredictable wobbles – especially that truly nerve-wracking Liability Driven Investment (LDI) crisis towards the close of 2022 – a glaring spotlight swung onto something many of us perhaps hadn’t focused on quite enough: liquidity.https://primelifecover.com/uk-inheritance-tax-policies-2026-hike/

Cast your mind back to that LDI episode. When gilt yields suddenly shot up, even firms with plenty of capital on paper found themselves in an absolute frantic scramble for cash just to meet urgent collateral calls. While pension funds bore the brunt of it, the message echoing loud and clear to the BoE and PRA was this: “We need far more robust BoE Liquidity Rules for all our systemically important financial players, and yes, that most definitely includes our life insurers.”

So, fundamentally, these new BoE Liquidity Rules are about ensuring life insurers – particularly those dabbling in a fair bit of derivatives or complex investment strategies – hold enough readily available cash or assets that can be easily turned into cash. The whole point? To enable them to ride out sudden market shocks without being forced into desperate fire sales or, heaven forbid, needing an emergency bailout from the BoE itself. It’s all about building in serious resilience before the storm even brews, rather than trying to bail water out of a sinking boat.

What’s Actually Changing with the BoE Liquidity Rules? Let’s Get Down to Brass Tacks.

Now, while the final, definitive rulebook is, by and large, still being penned (and you should always, always check the very latest PRA Policy Statements for every last syllable!), the direction of travel is as plain as day. Here’s what we’re certainly going to see:

- Much Tougher Stress Testing: Insurers will genuinely have to demonstrate they can withstand some truly severe, yet entirely plausible, liquidity crises. We’re talking about scenarios that go well beyond previous requirements – this isn’t just a simple tick-box affair; it’s about sophisticated, dynamic modelling that actually works.

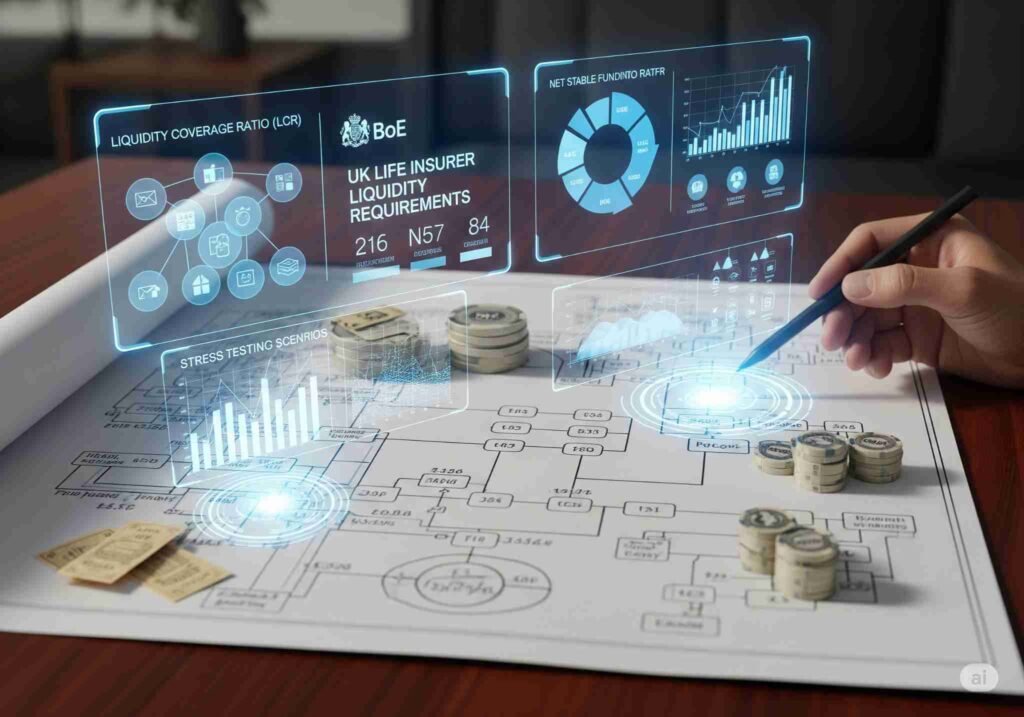

- Bigger Liquidity Buffers: Brace yourselves for requirements to hold more of those precious high-quality liquid assets (HQLA). This means less relying on assets that are a nightmare to shift quickly when you’re desperate for cash.

- Smarter Intraday Liquidity Management: The ability to keep a real-time, hour-by-hour eye on your cash position and manage it dynamically throughout the day – not just at the close of play – is going to become absolutely paramount. This will naturally demand savvy systems and instant data. https://primelifecover.com/uk-life-insurance-and-inheritance-tax-2026/

- Stepped-Up Governance and Controls: Boards and senior management will find themselves with much greater accountability for how liquidity risk is managed across the board. Think crystal-clear policies, regular and utterly transparent reporting, and iron-clad internal safeguards.

- A Laser Focus on Contingency Funding Plans (CFPs): Those plans won’t just gather dust on a shelf. Existing CFPs will need to be thoroughly stress-tested and proven genuinely workable, clearly laying out precisely what actions to take and exactly who’s responsible when a liquidity crunch hits.

- Brand-New Reporting Templates: As outlined in CP19/24, which closed for consultation in March 2025, the PRA has consulted on introducing fresh reporting. This includes a new ‘cash flow mismatch template’ and a ‘committed facilities template’. These are designed to provide the regulator with timely, consistent, and comparable data, particularly from firms exceeding certain thresholds (like having over £20bn in assets, £10bn in derivatives, or £1bn in securities financing transactions). moneyhelper.org.uk

These BoE Liquidity Rules are being meticulously crafted to be utterly comprehensive, ensuring that UK life insurers aren’t just solid as a rock over the long haul, but also have enough readily available funds to hand when things get seriously choppy.

A Small Snapshot: “Horizon Life Assurance PLC” in the Real World

Let’s quickly picture “Horizon Life Assurance PLC,” a fictional but very relatable large UK life insurer. Horizon, much like a good many others, had historically poured its energy into meeting the capital demands of Solvency II. Their LDI portfolio was quite sound on capital, don’t get me wrong, but it certainly used a fair bit of derivatives that demanded daily margin calls.

When that LDI crisis came knocking, Horizon, just like swathes of the market, faced frankly unprecedented demands for collateral. Their existing liquidity buffers, which had seemed perfectly adequate under the old regulations, simply evaporated surprisingly fast. They found themselves in a truly frantic scramble for cash, even having to consider offloading less liquid assets at potentially rubbish, fire-sale prices. They weathered the storm, bless ’em, but it served as a monumental, eye-opening wake-up call. https://primelifecover.com/homebuyer-life-insurance-uk-2025/

Now, with the new BoE Liquidity Rules firmly on the horizon, Horizon is getting seriously proactive:

- Rethinking their LDI game: They’re diversifying the types of collateral they use and exploring alternative hedging tools that aren’t quite so demanding on daily margin.

- Building a proper, robust HQLA buffer: They’re actively re-allocating some investments towards more liquid government bonds and top-notch corporate paper, even if it means a tiny, tiny dip in yield. It’s a trade-off they’re willing to make.

- Implementing real-time liquidity monitoring: This means investing in cutting-edge technology that gives them an instant, minute-by-minute view of their cash positions and all anticipated flows throughout the trading day.

- Overhauling their Contingency Funding Plan: They’re now running quarterly stress tests that throw truly extreme market movements at it, making absolutely sure their plan is workable and their entire team is drilled and ready to hit the ground running. https://www.vitality.co.uk/

Horizon’s journey perfectly illustrates how embracing these new BoE Liquidity Rules proactively can genuinely transform a potential weakness into a powerful strategic advantage, ultimately building far greater resilience and seriously boosting confidence among investors.

The Road Ahead: Getting Your Ducks in a Row for the BoE Liquidity Rules Deadline

That deadline at the end of 2025? It’s truly not as far off as it feels. For UK life insurers, this isn’t merely about ticking boxes for compliance; it’s about a fundamental, deep-seated re-evaluation of how you manage risk and how you strategise your investments.

Here’s a practical, actionable guide to ensure you’re absolutely ready for the new BoE Liquidity Rules:

- Know Your Starting Point: Kick things off with a thorough ‘gap analysis’. Where does your current liquidity management framework stand against what the incoming BoE Liquidity Rules are demanding? What are your vulnerabilities?

- Master Stress Testing: Don’t just tick the box. Invest heavily in sophisticated stress testing capabilities. Make sure your scenarios are tough, dynamic, and genuinely reflect the sort of extreme market conditions that could hit your specific balance sheet.

- Scrutinise Your Investment Portfolio: Look at your assets through a keen liquidity lens. Could you genuinely liquidate enough without causing a huge, damaging ripple in the market if push came to shove? The BoE Liquidity Rules will demand this level of preparedness.

- Tighten Governance & Reporting: Get your board and senior management completely on board and make sure they fully grasp the ramifications of these new BoE Liquidity Rules. Put clear reporting lines and iron-clad accountability firmly in place.

- Leverage Technology & Data: Can your existing systems provide the granular, real-time data you’ll absolutely need for effective intraday liquidity management and all the new reporting under the BoE Liquidity Rules? If not, now is undoubtedly the time to invest.

- Cultivate the Right Culture & Training: Make sure your teams really understand why liquidity risk is so incredibly crucial and that they’re fully equipped with all the skills to manage it. Foster a culture where liquidity is viewed as just as vital as capital – no less.

These new BoE Liquidity Rules mark a significant shift, for sure, a proper game-changer even. But they also offer a brilliant, perhaps even unique, opportunity for UK life insurers to truly bolster their resilience and build even deeper trust with policyholders and the wider market alike.

Frequently Asked Questions (FAQ)

Q: Which UK life insurers are most impacted by these new BoE Liquidity Rules?

A: The PRA’s primary focus is indeed on ‘major’ life insurers – essentially, the larger, more complex firms considered systemically important. However, it’s always sensible for all firms to be aware, as these principles often trickle down, influencing best practices across the sector eventually.

Q: How do these BoE Liquidity Rules actually link up with Solvency II?

A: Solvency II hones in on your long-term capital adequacy. These new BoE Liquidity Rules complement that perfectly by zeroing in on your immediate, short-term funding needs. It’s about making absolutely sure firms can meet obligations even when they’ve got plenty of capital, but it might not be easily accessible.

Q: Will these BoE Liquidity Rules affect investment returns for life insurers?

A: Potentially, yes. Holding more high-quality liquid assets might mean a slight drag on yield compared to holding less liquid, typically higher-returning assets. But frankly, the pain and financial cost of not having enough liquidity during a crisis far, far outweigh that small yield impact. It’s a wise trade-off.

Q: Where’s the best place to find the official word on the BoE Liquidity Rules?

A: Always, always go straight to the horse’s mouth! Refer directly to the official publications, policy statements, and consultation papers from the Bank of England and the Prudential Regulation Authority (PRA) on their own respective websites. They’re the definitive source.

Disclaimer

Just a quick note: This blog post is purely for general information purposes and should not, under any circumstances, be taken as financial, legal, or regulatory advice. The exact specifics of the Bank of England’s new liquidity rules are still subject to finalisation and potential slight tweaks by the Prudential Regulation Authority. Your firm should always secure tailored advice from its own professional advisors and refer directly to the official PRA and BoE publications for precise guidance and all compliance requirements concerning the BoE Liquidity Rules.

Don’t Get Caught Out on the Hop!

That deadline for complying with the new BoE Liquidity Rules is fast approaching. Getting organised and preparing proactively now is absolutely crucial if you want to navigate this significant regulatory shift successfully and confidently.

Ready to get a proper assessment of your firm’s readiness, or perhaps you need some expert guidance on these new BoE Liquidity Rules?

[Call to Action: Link to your contact page, a free consultation, or a whitepaper download related to liquidity management – make it easy for them to connect!]

**Author Box:**

*Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.