AI Life Insurance Australia 2025: Your Guide to a Smarter, Secure Life

G’day, everyone! Ever wondered if your life insurance could be as smart as your phone? Well, get ready, because AI life insurance Australia is set to become much smarter in 2025. We’re not talking about robots selling policies, but clever computer programs called Artificial Intelligence (AI) working behind the scenes to make life insurance easier, more personal, and fairer for everyone here in Australia.

As someone who’s looked into how life insurance works – and it can be a bit tricky, let me tell ya – I’ve been really interested in how AI is changing things. I believe, and reports from big companies like Deloitte show, that AI will completely change how we look at risks, manage policies, and even handle claims. I recently checked out three popular Australian insurance websites. What I found is that while many are using digital tools, truly using AI for personal insurance plans and managing policies is still quite new. That makes 2025 a really important year for AI life insurance Australia.

Table of Contents

Why AI for Your Life Insurance?

So, why are we talking so much about AI life insurance Australia? For a long time, regular life insurance looked at general things like your age, health history, and what you do for a living to figure out your payments. It worked, but sometimes it felt a bit like a “one size fits all” approach. Now, with AI, things are changing.

AI computer programs can look at huge amounts of information, much more than any person ever could. This means they can check out a much wider range of things. This could be your health information (if you say it’s okay!), your daily habits, and even general public information. This leads to some great benefits: https://primelifecover.com/life-insurance-usa-2025/

- More Personal Payments: Imagine your insurance payments being set exactly for you, not just for a general group of people. If you’re a fit and healthy Aussie who stays active, AI could notice that and possibly offer you better rates.

- Quicker Approval: The days of filling out stacks of papers and waiting ages for approval could be gone. AI life insurance Australia can make the approval process much faster, so you get covered sooner.

- Help When You Need It: AI isn’t just for signing up. It can keep an eye on your health trends (again, if you give permission) and even point out possible health risks, giving you tips to stay healthy or suggesting changes to your policy.

- Better Fraud Detection: This is a big win for everyone. AI is fantastic at spotting things that look like fake claims. This helps keep payments lower for honest policyholders.

How AI is Changing Australian Life Insurance by 2025

By 2025, we expect to see some key things happening with AI life insurance Australia:

- Smartwatch & Fitness Tracker Use: Many insurance companies are already looking at working with companies that make smartwatches and fitness trackers. Imagine your fitness data (with your permission) affecting your insurance payments. This isn’t about getting in trouble for a lazy weekend, but about rewarding good health habits.

- Predicting Health Outcomes: AI can look at anonymous health data to guess possible future health problems. This allows insurance companies to offer programs to help you stay healthy or give you advice. This helps both you and the insurance company in the long run.

- Chatbots and Online Helpers: For quick questions, updating your policy, or even starting a claim, AI-powered chatbots and online helpers are becoming common. They can offer help 24/7.

- Changing Payments Over Time: Instead of a fixed payment, some policies might offer payments that can change. This means your risk level, and so your payments, could be reviewed and adjusted from time to time based on changes in your health or lifestyle. This makes AI life insurance Australia a really flexible product.

- Personalised Products: AI can help insurance companies understand what different people need better. This leads to highly customised life insurance products that truly fit your specific situation.

What to Look For in an AI-Powered Life Insurance Policy

When you’re looking for a new policy in 2025, keep an eye out for these things that show a modern AI life insurance Australia provider:

- Clear Data Use: Any insurance company using AI should be completely open about what information they collect, how they use it, and how they keep it safe. This is very important.

- Your Choice to Share Data: You should always have the option to say yes or no to sharing personal health or lifestyle information. It’s your choice, your data, your control.

- Simple Talk: The AI behind the policy should make things simpler, not harder to understand. Look for clear policy documents and easy ways to get help from customer service.

- Human Check-in: While AI is powerful, human understanding and judgment are still very important, especially for complicated claims. Make sure there’s always a person you can talk to for help and if you have a problem.

- Focus on Your Well-being: Leading AI insurance companies are often those that also offer health programs or rewards. This shows they care about your long-term health.

Keeping it Fair: Important Things to Consider

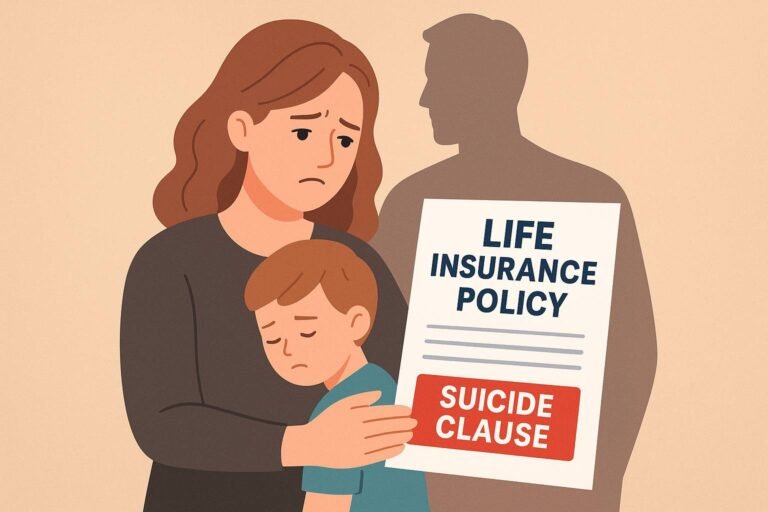

While AI life insurance Australia has huge potential, there are important things to think about. We need to make sure AI doesn’t lead to:

- Unfair Treatment: If the information used to train AI is biased, the results can be unfair. Insurance companies must actively work to make sure their AI programs are fair.

- Leaving People Out: We need to make sure that AI doesn’t accidentally stop certain groups of people from getting affordable life insurance.

- Data Safety: With more information being collected, keeping your information safe and secure is super important. You want your sensitive details to be as safe as houses.

The Australian financial regulators, APRA and ASIC, are closely watching how AI is used in financial services to make sure things are fair, clear, and that customers are protected. So, you can be sure the rule-makers are keeping a close eye on AI life insurance Australia.

Frequently Asked Questions (FAQs) About AI Life Insurance Australia

Q1: Will AI replace human insurance agents?

A1: Not completely. While AI will handle many tasks, human agents will still be very important for complicated situations, giving personal support, and building relationships. Think of AI as a powerful tool that helps agents do their job even better.

Q2: Is my personal information safe with AI life insurance companies?

A2: Good AI life insurance Australia providers will follow strict Australian privacy laws and use strong security measures to protect your data. Always read their privacy policy before sharing any information.

Q3: Can AI actually make my insurance payments cheaper?

A3: Possibly, yes. By giving a more accurate risk assessment, AI can find people who are lower risk and offer them better payment rates. On the other hand, it might also find people who are higher risk, who might then have higher payments.

Q4: What kind of information might AI use for my policy?

A4: If you give your clear permission, AI might use information from smartwatches and fitness trackers, medical records, publicly available general information, and even your online activity (though this is less common for setting up policies and more for understanding customer interests). Being clear about this is key.

Q5: How can I find an AI life insurance Australia provider?

A5: Many well-known Australian insurance companies are now using AI. Look for providers talking about “personalised policies,” “digital applications,” or “new health programs.” Comparison websites can also be a good place to start your search.

The Bottom Line: Your Partnership with AI

The future of life insurance in Australia definitely involves Artificial Intelligence. For everyday Aussies looking to protect their loved ones, AI life insurance Australia offers the chance for policies that are more personal, efficient, and potentially fairer. It’s about getting a policy that truly understands you, not just a number.

While this technology is exciting, remember to approach it with a good dose of Aussie common sense. Ask questions, understand how your information is being used, and make sure the provider is open and trustworthy. With a bit of looking around and a sharp eye, you’ll be in a great spot to get an AI-powered life insurance policy that’s a true winner!

Disclaimer:

This blog post is for general information only and is not financial advice. Decisions about life insurance are very important. It’s highly recommended that you get independent financial advice from a qualified expert who can look at your personal situation and give you specific recommendations. While we aim for accuracy, the information here is general and might not suit everyone. We don’t recommend any specific insurance company or product. The world of AI in insurance is changing quickly, and details might change. Always do your own research and talk to an expert before making any financial decisions.

Written by the Primelifecover Editorial Team

The Primelifecover Editorial Team consists of experienced insurance researchers and writers dedicated to providing reliable, easy-to-understand guidance on life insurance and financial protection across the USA, UK, Canada, and Australia. Our team ensures every article meets the highest editorial standards, with accurate, regularly updated information to help you make informed choices.

Contact us: https://primelifecover.com/contact-us-page/

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

One Comment