“Single Moms Life Insurance USA: Affordable Options to Protect Your Crew”

What’s up, supermoms? If you’re a single mom here in the U.S. of A., you’re probably juggling a million things. Thinking about life insurance might feel like just another item on an endless to-do list. But here’s the real talk: it’s one of the smartest moves you can make to truly secure your kids’ future, no matter what curveballs life throws your way. And guess what? Finding affordable single moms life insurance USA isn’t as tough as you might imagine. Pinky promise.

As a single mom, you’re not just the primary breadwinner, you’re the chief caregiver and the absolute rock for your kiddos. Without you, their financial stability could be on shaky ground. That’s why having a solid life insurance plan is so crucial. It’s not just about covering final expenses; it’s about providing a safety net for college tuition, covering daily living costs, and ensuring your children’s dreams can still come true, even if you’re no longer around. This post is all about navigating the world of single moms life insurance USA and zeroing in on options that won’t totally empty your wallet.

Table of Contents

Why Every Single Mom Needs Life Insurance – Seriously!

Let’s be real for a sec. When you’re a single mom, you’re often flying solo financially. If something unexpected were to happen to you, who would step in to cover the bills? Who would make sure your kids get the education you always dreamed of for them? This isn’t meant to scare you, but to highlight the absolute necessity of being prepared. Single moms life insurance USA offers that peace of mind you crave, big time.

Consider these key benefits:

- Income Replacement: Your income is probably the backbone of your household. Life insurance steps in and replaces that income, allowing your kids to maintain their standard of living.

- Debt Repayment: Mortgages, car loans, credit card debt – these don’t just vanish. Life insurance can clear these debts, preventing them from becoming a massive burden on your children.

- Future Expenses: College tuition is no joke! Life insurance can fund a trust or provide a lump sum for your children’s higher education, making those dreams attainable.

- Childcare Costs: If you’ve got younger kids, who would pay for their ongoing childcare?

- Peace of Mind: Knowing your kids are covered financially, no matter what, is absolutely priceless. This is the core benefit of securing single moms life insurance USA. It lets you sleep at night.

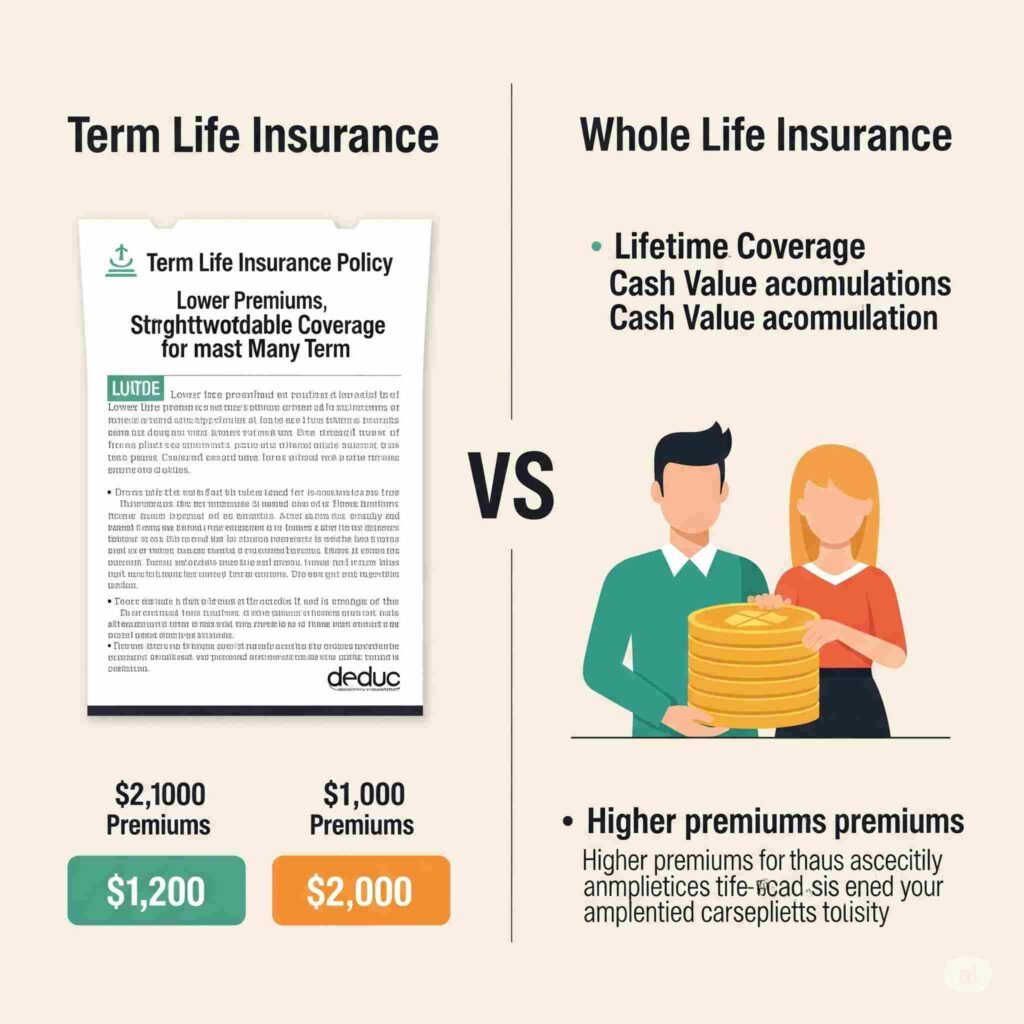

Demystifying Life Insurance: Term vs. Whole Life for Single Moms

Okay, so you know you need it. Now, what kind of life insurance actually makes sense for a single mom on a budget? The two main types are Term Life and Whole Life.

Here’s a quick rundown to help you figure out which type of single moms life insurance USA might be your best bet: https://primelifecover.com/life-insurance-usa-2025/

| Feature | Term Life Insurance | Whole Life Insurance |

| Coverage Period | A specific number of years (like 10, 20, or 30) | For your entire lifetime, as long as you keep paying |

| Cost | Generally way more affordable | Way higher premiums, generally. Can be a budget buster. |

| Cash Value | Nope, no cash value here. Just coverage. | Builds cash value you can borrow from or withdraw. Kinda like a savings account. |

| Primary Goal | Replacing your income during those crucial dependent years. Protecting your kids while they’re growing up. | Lifelong coverage, maybe for estate planning or long-term savings/investing. |

| Best For | Most single moms looking for solid coverage without breaking the bank. | Folks with specific long-term financial goals way beyond just income replacement. |

Term Life Insurance: Your Wallet’s Best Friend For most single moms, term life insurance is usually the most affordable and practical choice. Here’s why it’s often the go-to:

- It’s Simple: You pick a specific period (the “term”), like 10, 20, or 30 years. If you pass away within that term, your beneficiaries (your awesome kids!) receive a payout. If you outlive the term, the policy simply ends. No fuss, no muss.

- It’s Affordable: Because it only covers a specific period, term life insurance premiums are significantly lower than whole life. This is a HUGE win when you’re on a tight budget and looking for affordable single moms life insurance USA.

- It Aligns with Needs: You can pick a term that covers the period your kids are most dependent on you – say, until they’re out of college. Makes perfect sense.

Example: If your youngest is 5, a 20-year term policy would cover them until they’re 25, likely seeing them through college and maybe even getting their first “real” job.

Whole Life Insurance: A Long-Term Play Whole life insurance is a permanent policy that covers you for your entire life, as long as you keep paying those premiums. It also has a cash value component that grows over time, which you can sometimes borrow against or withdraw from.

While whole life has its perks, for most single moms focused on maximizing coverage for their children’s most vulnerable years without totally draining their bank account, term life insurance often wins out. It’s all about finding the best bang for your buck for single moms life insurance USA.

How Much Coverage Do You Really Need? Let’s Crunch Those Numbers

This is where it gets super personal. There’s no one-size-fits-all answer. A good rule of thumb is to shoot for 5-10 times your annual income. But let’s break it down further for a single mom. Consider these factors when you’re figuring out your ideal single moms life insurance USA coverage:

| Financial Factor | Description |

| Current Debts | Your mortgage, car loans, credit cards, student loans – don’t want your kids inheriting that mess. |

| Future Income Replacement | How many years of your income would your children realistically need? Factor in inflation. |

| Future Education Costs | College tuition, grad school, vocational training. Think big bucks. |

| Ongoing Living Expenses | Food, utilities, clothing, extracurriculars, healthcare. The everyday stuff that adds up. |

| Childcare Costs | If your kids are young and would need ongoing care after you’re gone. |

| Final Expenses | Funeral costs, any lingering medical bills not covered by health insurance. These can be a shocker. |

And hey, don’t forget to factor in any existing savings or assets. Use an online life insurance calculator, or even better, chat with a reputable insurance agent who specializes in helping families. They can really help you dial in the right amount of single moms life insurance USA.

Finding Affordable Life Insurance Options for Single Moms in the U.S.

Alright, you’re convinced. You’re ready to make this happen. Now, how do you actually find affordable single moms life insurance USA without getting totally ripped off?

1. Shop Around, Seriously!

Don’t just jump on the first quote you get. Different companies offer different rates based on your age, health, and the type and amount of coverage you’re seeking. Use online comparison tools or, even better, work with an independent insurance agent who can pull quotes from a bunch of different carriers. This is your secret weapon to finding really good deals on single moms life insurance USA.

2. Embrace Good Health Habits

Your health plays a massive role in your premiums. The healthier you are, the lower your rates. It’s that simple. This means:

- Don’t Smoke: Smokers pay significantly more for single moms life insurance USA.

- Maintain a Healthy Weight: Carrying extra pounds can unfortunately drive up premiums.

- Manage Chronic Conditions: If you have diabetes or high blood pressure, keeping them under control can seriously help lower your costs.

- Regular Check-ups: Knowing your health status helps you be proactive.

Even small improvements can lead to big savings on your single moms life insurance USA policy. usa.gov

3. Consider Group Life Insurance through Work

A lot of employers offer group life insurance as part of their benefits package. This is often a fantastic, low-cost option, sometimes even free for a basic amount of coverage.

- Pros: Often super affordable and usually easy to get (minimal underwriting).

- Cons: Coverage might be limited, and it’s tied to your employment. If you leave your job, the coverage is gone.

It’s a fantastic starting point for single moms life insurance USA, but you might want to consider supplementing it with an individual policy for extra security.

4. Explore Riders Wisely

Riders are basically add-ons to your policy that offer extra benefits. Some can be genuinely useful, others might just add to your cost without much payoff. Choose wisely.

- Waiver of Premium Rider: If you become disabled and can’t work, your premiums are waived. This could be an absolute lifesaver.

- Child Rider: Provides a small amount of coverage for your children. Usually pretty affordable.

- Accelerated Death Benefit Rider: Allows you to access a portion of your death benefit early if you’re diagnosed with a terminal illness.

Only add riders that genuinely align with your needs and budget for your single moms life insurance USA plan.

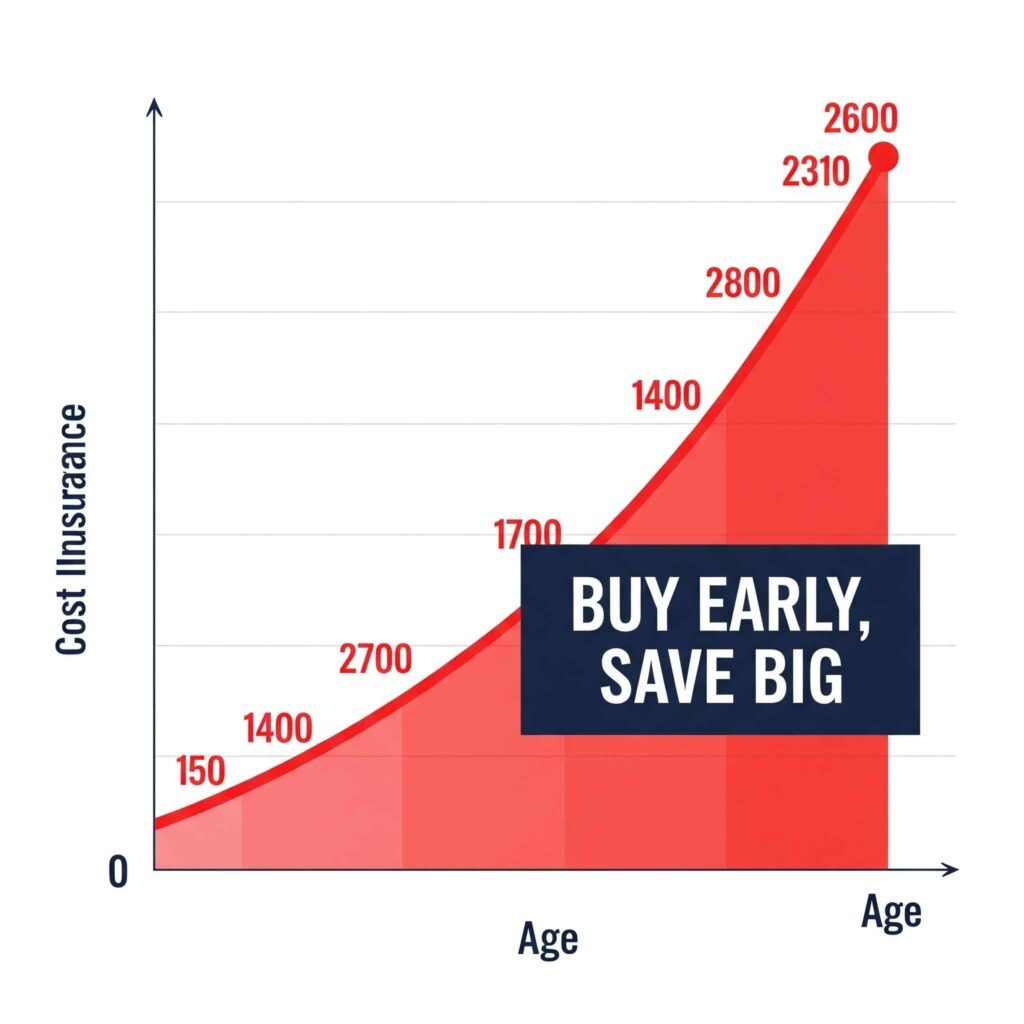

5. Don’t Procrastinate – Age Matters!

Here’s the deal: The younger and healthier you are when you buy life insurance, the cheaper your premiums will be. Premiums creep up as you age, simply because the risk of passing away increases. So, seriously, don’t put this off! Getting your single moms life insurance USA in place sooner rather than later is one of the smartest financial moves you can make.

Real Talk: Overcoming Common Hurdles for Single Moms

You might be thinking, “But I don’t have enough extra cash!” or “My health isn’t perfect.” You’re not alone. Let’s tackle some common concerns.

- “I can’t afford it.” Look, start small. Even a modest term policy can provide significant peace of mind. Something is always better than nothing. Many policies are surprisingly affordable, especially term life. There are options out there that fit your current budget for single moms life insurance USA. Don’t write it off before you even look.

- “I have pre-existing health conditions.” Don’t despair. Many insurance companies offer policies to individuals with various health conditions. You might pay a bit more, but coverage is often still available. Just be upfront and honest about your health history.

- “I don’t know who to trust.” Work with a licensed, independent insurance agent who has solid reviews and can explain things clearly without a bunch of confusing jargon. Look for agents who genuinely specialize in helping families. Online comparison sites can also be a good jumping-off point for finding reputable carriers for single moms life insurance USA.

Frequently Asked Questions about Single Moms Life Insurance USA

Here are some common questions single moms like you often ask:

Q1: How much does single moms life insurance USA cost, really?

The cost varies wildly based on your age, health, coverage amount, term length, and insurer. Term life is generally more affordable, with basic policies possibly starting from $15-$30 a month for a healthy young mom.

Q2: Do I truly need life insurance if I’m young and healthy?

You bet! It’s the best time to get it because your premiums are lowest when you’re young and healthy. Waiting can mean higher costs and fewer options down the road.

Q3: What if I get married or have more kids later?

Most policies are flexible. You can often increase coverage or add riders as your family grows. If you marry, you can discuss whether your current policy still meets your family’s needs or if a joint policy makes more sense.

Q4: Can I name a guardian as my beneficiary?

You can name a guardian, but it’s often a smart move to set up a trust for your children and name that trust as the beneficiary. This helps ensure funds are managed exactly how you want for your children’s benefit until they’re grown.

Q5: Is life insurance taxable?

Generally speaking, the death benefit paid out to your beneficiaries from a life insurance policy is tax-free. But, as always, it’s super wise to consult a financial advisor or tax professional for specific advice.

The Bottom Line for Single Moms Life Insurance USA

Being a single mom is a superpower. And securing your children’s financial future is one of the most powerful things you can do. Investing in affordable life insurance isn’t just a boring financial transaction; it’s an act of profound love and responsibility. It makes sure that even if you’re not there, your incredible legacy of care and provision continues on.

So, take the plunge. Do your research, get those quotes, and have a straight-up chat with a professional. You owe it to yourself, and more importantly, to your amazing kids. Protecting your crew with solid single moms life insurance USA is the ultimate win-win. Seriously, don’t delay; start today! Your future self, and even more importantly, your kids, will thank you for it down the line.

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

Written by the Primelifecover Editorial Team

The Primelifecover Editorial Team consists of experienced insurance researchers and writers dedicated to providing reliable, easy-to-understand guidance on life insurance and financial protection across the USA, UK, Canada, and Australia. Our team ensures every article meets the highest editorial standards, with accurate, regularly updated information to help you make informed choices.

Contact us: https://primelifecover.com/contact-us-page/

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook