Life Insurance Policies That Suit the British Lifestyle in 2025: Don’t Get Caught Out – Essential UK Lifestyle Life Insurance!

Alright, folks, let’s have a proper natter about something crucial that too often gets swept under the rug: life insurance policies. If you’re cracking on with the British lifestyle in 2025 – whether you’re grafting away, raising a family, or just trying to get your foot in the door with a mortgage – chances are you’ve got a fair bit on your plate. But here’s the straight goods you really ought to hear: sorting out your UK lifestyle life insurance isn’t just a bit sensible; it’s an absolute game-changer for staying on top of things.

Let’s be dead honest: life here in Blighty in 2025 is a bit of a mad dash. From the daily grind to putting the kettle on, our routines are always on the go. But what if your personal routine suddenly packed up? If you’ve got loved ones – a partner, little ones, even your folks – their financial well-being could go properly sideways if you’re not around. That’s exactly where a solid UK lifestyle life insurance policy steps in, acting as your financial safety net. https://primelifecover.com/yourwebsite-com-best-life-insurance-uk/

Table of Contents

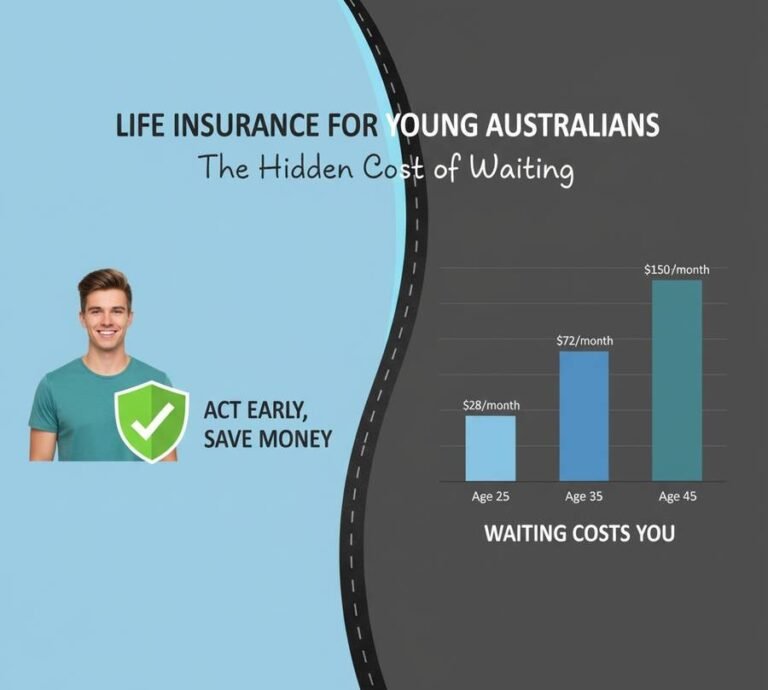

The Big British Myth: “I’m Too Young for Life Insurance!”

We’ve all heard it, haven’t we? Maybe even had a niggle of that thought ourselves over a cuppa: “Life insurance? Nah, that’s for when I’m old and ready to put my feet up!” But that’s an absolute load of old flannel, especially now in 2025. People up and down the UK, from the bustling towns to the quiet villages, are now firmly in their prime earning and family-raising years.

Just picture it:

- Growing Families: Loads of us are parents these days, with young kids who are totally dependent on our monthly pay packet.

- Property Ladder Dreams: You’re probably saving up for, or have already managed to bag, your first gaff, meaning a hefty mortgage to contend with.

- Student Debt Saga: That student loan debt often sticks around longer than a bad smell, well into your 30s and even 40s.

- Supporting the Folks: Many Brits are part of the “sandwich generation,” juggling it all – looking after both their kids and their elderly parents.

Putting off UK lifestyle life insurance now is like trying to navigate the M25 in rush hour without a Sat Nav – it feels fine until everything goes tits up. The younger and healthier you are, the dirt cheap your premiums will be. Locking in a cracking rate now means you’ll save a small fortune in the long run. This is precisely why getting your UK lifestyle life insurance sorted early doors is such a canny move.

What’s the Fuss About Life Insurance for the British Lifestyle?

So, why bother with UK lifestyle life insurance specifically? In plain speaking, life insurance pays out a lump sum of cash if you’re no longer here during the policy term. This payout goes to your nominated beneficiaries, helping them keep their heads above water financially when you’re gone. It’s a straightforward way to get some peace of mind.

Here’s why it’s a spot-on fit for you:

- Budget-Friendly Options: Let’s be honest, everyone’s got an eye on their pennies. UK lifestyle life insurance is designed to offer robust protection without breaking the bank. There are options to suit every budget, meaning you can get significant cover without feeling the pinch. This is crucial when you’re balancing daily living costs and saving for a rainy day.

- Mortgage Protection: For most Brits, a mortgage is the biggest financial commitment. A UK lifestyle life insurance policy can be set up to clear your mortgage if you’re no longer around, ensuring your family isn’t left in the lurch or forced to sell the family home. It’s a proper godsend.

- Income Replacement for Dependents: If you’re the main earner, or even a significant contributor to the household income, your absence would leave a massive hole. The payout from UK lifestyle life insurance can replace your income for years, allowing your family to maintain their standard of living, cover daily expenses, and achieve their financial goals. It’s about ensuring their future is sorted.

- Debt Management: Beyond the mortgage, consider any other debts like personal loans, car finance, or even outstanding credit card balances. A good UK lifestyle life insurance policy can clear these, preventing them from becoming a burden on your loved ones. It helps keep things shipshape.

- Childcare and Education Costs: Raising kids in the UK isn’t cheap – from nursery fees to school trips and eventually university. UK lifestyle life insurance can provide the funds needed to cover these ongoing costs, giving your children the best possible start in life, even if you’re not there to see it through. moneyhelper.org.uk

Real Talk: Scenarios Where UK Lifestyle Life Insurance Saves the Day

Let’s look at some everyday situations where UK lifestyle life insurance really makes a difference:

- The Young Couple in London: Sarah and Tom just bought a flat in Hackney. They’ve got a chunky mortgage and are thinking about starting a family. A 25-year UK lifestyle life insurance policy for both of them, covering the mortgage amount, means the surviving partner won’t be lumbered with the entire debt if something unexpected crops up.

- The Single Parent in Manchester: Emily is raising her two kids solo while working full-time. She knows how much they depend on her. A substantial UK lifestyle life insurance policy ensures that if she’s gone, her kids’ upbringing, education, and daily needs are fully covered, preventing financial hardship.

- The Entrepreneur in Bristol: David is building his tech start-up and is also chipping in to support his elderly mum. A 15-year UK lifestyle life insurance policy ensures his mum would be financially looked after if his entrepreneurial journey takes an unforeseen detour. It’s about being responsible.

- The Family with Student Loans: Jessica and Mark are both still plugging away at their student loans from uni. While some loan types differ, a UK lifestyle life insurance policy can be structured to pay off any private loans or ensure their remaining income is enough to cover household costs if one of them is no longer contributing.

These aren’t just hypotheticals; they’re the real deal for Brits in 2025. UK lifestyle life insurance provides a vital safety net, allowing you to live your life knowing your loved ones are protected.

Navigating the 2025 Landscape: What to Consider for Your UK Lifestyle Life Insurance

Right, so when you’re having a good nosey into UK lifestyle life insurance in 2025, bear these crucial points in mind:

- Shop Around, Seriously: Don’t just settle for the first quote that lands in your lap. The market for UK lifestyle life insurance is properly competitive. Get yourself onto some online comparison sites or, even better, have a word with an independent financial advisor to get quotes from a few different providers. Prices can do a fair bit of jumping about for the same level of cover, so it pays to look.

- Figure Out What You Actually Need: How much cover do you really need? Have a think about your income, any debts (mortgage, loans), future expenses (childcare, uni fees), what your partner would need if your income disappeared, and any final costs. A common rule of thumb is 10-15 times your annual income, but tweak that to fit your own unique British lifestyle. Don’t underestimate the use of a calculator designed for UK lifestyle life insurance needs – they’re surprisingly handy.

- Understand the “Term”: Pick a term length that matches your longest financial commitments. If your mortgage has 20 years left and your youngest child will be properly grown up and off to uni in 25 years, then a 30-year term might be the ideal ticket.

- Read the Small Print (Yes, Really!): Make sure you get your head around any exclusions, ‘riders’ (those extra bits), and the policy specifics. Don’t be shy about pestering them with questions. A decent advisor will happily talk you through everything to do with UK lifestyle life insurance until it all makes sense.

- Consider Joint vs. Single Policies: If you’re a couple, you might go for a joint policy (which typically pays out once) or two separate single policies (which pay out independently). Have a ponder about what works best for your UK lifestyle life insurance needs and family setup.

Types of UK Life Insurance Policies: A Quick Look

Getting your head around the common types of UK lifestyle life insurance is crucial for making the right choice. Here’s a quick comparison, no mucking about:

| Policy Type | Description | Pros | Cons | Ideal For |

| Level Term | Fixed payout, fixed premiums for a set period. | Dead simple, affordable, predictable. | No payout if you outlive the term. | Covering a specific debt (e.g., interest-only mortgage), income replacement. |

| Decreasing Term | Payout reduces over time, often linked to mortgage. | Properly affordable, designed to match a repayment mortgage balance. | Payout decreases, may not cover other needs. | Repayment mortgages. |

| Family Income Benefit | Pays a regular tax-free income (instead of lump sum) for the remaining term. | Provides regular income, easy for families to manage, often cheaper. | No lump sum, income stops when term ends. | Providing ongoing income for families with young children. |

| Whole of Life | Covers you for your entire life, guaranteed payout. | Guaranteed payout, can build cash value. | Much steeper premiums, more complex. | Estate planning, covering funeral costs, lifelong security. |

| Over 50s Plan | Guaranteed acceptance, no medical questions. | Easy as pie to get, small guaranteed payout. | Very low payout for the premiums paid, only for over 50s. | Covering basic funeral costs for older individuals. |

For most people navigating their UK lifestyle life insurance in their prime, Level Term or Decreasing Term are generally the most popular and bang-for-your-buck choices.

Frequently Asked Questions About UK Lifestyle Life Insurance

We get it, insurance can be a bit of a puzzle. Here are some common questions Brits have about UK lifestyle life insurance:

Q1: How much life insurance do I really need for my UK lifestyle?

A1: A common guideline is 10-15 times your annual income, but it’s best to do the maths based on your specific needs: outstanding debts (mortgage, loans), future expenses (childcare, uni fees), income replacement for dependents, and funeral costs. Don’t forget future inflation!

Q2: Is UK lifestyle life insurance worth it if I’m young and healthy?

A2: Absolutely, without a shadow of a doubt! This is the absolute best time to get UK lifestyle life insurance. The younger and healthier you are, the lower your premiums will be. Locking in a low rate now can save you a small fortune over the life of the policy. Plus, you never know what’s around the corner.

Q3: Can I get UK lifestyle life insurance if I have a pre-existing medical condition?

A3: Yes, it’s often possible. You might pay slightly higher premiums or have some exclusions, but many insurers specialise in covering individuals with various health conditions. It’s best to be upfront and compare quotes from different providers.

Q4: What happens if I outlive my term life insurance policy?

A4: If you outlive the term, your coverage simply runs out. At that point, you can choose to take out a fresh policy (though premiums will be higher due to your age), or decide you no longer need coverage if you’re financially independent. Many Brits find this is the right strategy for their UK lifestyle life insurance needs.

Q5: Is it better to get a single or joint life insurance policy in the UK?

A5: It depends on your situation. A single policy covers one person and pays out on their death. A joint policy covers two people but usually only pays out on the first death, after which the policy ends. Two single policies can offer more comprehensive cover and potentially two payouts, but they are typically more expensive. Your UK lifestyle life insurance needs should dictate the choice.

The Bottom Line: Don’t Procrastinate on UK Lifestyle Life Insurance

In 2025, being a Brit means being smart, adaptable, and planning for the future. Putting off UK lifestyle life insurance is like leaving a gaping hole in your financial safety net. It’s an affordable, essential safeguard that protects your loved ones from potential financial hardship should the unthinkable happen.

Don’t wait until you’re older, less healthy, and premiums skyrocket. Take control of your financial future today. Do your research, compare, and get your UK lifestyle life insurance sorted. It’s one of the smartest investments you can make in your family’s future and your own peace of mind. Your future self, and more importantly, your loved ones, will give you a big thumbs up for it.

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

Written by the Primelifecover Editorial Team

The Primelifecover Editorial Team consists of experienced insurance researchers and writers dedicated to providing reliable, easy-to-understand guidance on life insurance and financial protection across the USA, UK, Canada, and Australia. Our team ensures every article meets the highest editorial standards, with accurate, regularly updated information to help you make informed choices.

Contact us:https://primelifecover.com/contact-us-page/

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

One Comment