What’s Life Insurance & Why Do You Need It?

"Happy family representing what life insurance offers as financial security"Life’s pretty unpredictable, right? Although you can never predict what lies ahead, you can certainly prepare for it. One of the smartest moves you can make to protect your crew is getting insurance. It doesn’t matter if you’re just starting out, raising a family, or thinking about retirement; this coverage gives your loved ones a financial cushion when they need it most. It’s really about that peace of mind, knowing they’ll be okay no matter what happens.

Table of Contents

So, What Is Life Insurance?

Think of this coverage like a financial safety net for your family. It’s basically a deal between you and an insurance company. You pay them regular amounts of money (we call these premiums), and if something happens to you, they promise to give a big chunk of cash – called a death benefit – to the people you pick (your beneficiaries).

It’s a way to make sure your family stays afloat financially even if you’re not around. Whether it’s covering everyday bills, paying off debts, or helping with big future goals like college tuition, this insurance takes one huge worry off their plate during a super tough time.

How Does This Whole Thing Work?

This might sound complicated, but it’s actually pretty simple:

- You grab a policy: You decide how much coverage you want, and sometimes for how long (like 10, 20, or 30 years if it’s “term” life insurance).

- You pay your premiums: These are regular payments – monthly, every three months, or yearly – that keep your coverage active.

- If you pass away while your policy is active: The insurance company sends that cash payout (the death benefit) to the people you chose, like your spouse, kids, or other loved ones.

That money is usually tax-free and your family can use it for whatever they need – funeral costs, paying off the house, covering daily expenses, or saving up for your kids’ schooling. It’s truly financial peace of mind when it counts most.

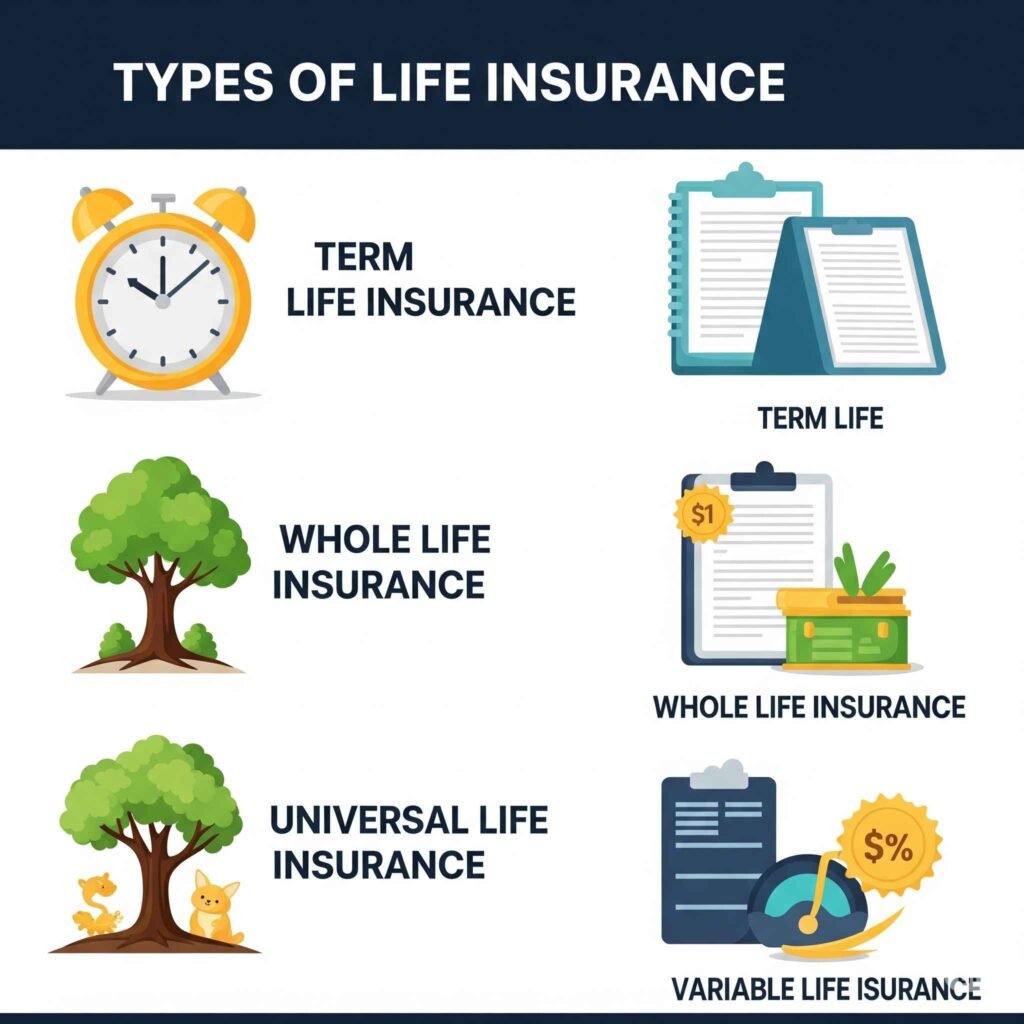

Main Types of Life Insurance

There are two biggies when it comes to this coverage:

- Term Life Insurance: This covers you for a specific number of years, like 10, 20, or 30. If something happens during that time, your loved ones get the payout. It’s usually the most affordable option and works great if you need coverage for a set period, like until your kids are grown or your mortgage is paid off.https://primelifecover.com/term-life-insurance-guide-usa-uk-aus-canada/

- Whole Life Insurance: This one lasts your entire life and also builds up cash value you can use later. Since it covers you forever and has that savings part, the payments usually cost more, but it can be a smart way to build wealth over time. More info naic.org

You’ve also got a few other options:

- Universal Life Insurance: This is super flexible. You can adjust your payments and coverage, and it also builds cash value.

- Final Expense Insurance: This one’s pretty straightforward. It helps cover funeral costs and any medical bills at the end of life so your family isn’t stuck with them.

Picking the right type depends on what you need and what you can afford, but honestly, having any life insurance is always a good move.

Why Do You Even Need Life Insurance?

Still wondering if this stuff is necessary? Here’s why it’s a big deal:

- Protect Your Family: It helps make sure your family can keep living their life and pay their everyday bills, even if your income isn’t there.

- Cover Debts: It can wipe out loans like your mortgage, car payments, or credit cards so your family doesn’t have that burden.

- Pay for Kids’ Education: It can help fund your kids’ school or college, giving them a real shot at a bright future.

- Peace of Mind: Just knowing you’ve got this safety net for your family helps you chill out and enjoy life without constant worry.

This insurance isn’t just about money; it’s about looking out for the people who mean the most to you.

Who Should Get Life Insurance?

This financial tool is a smart play for almost everyone, but especially if you:

- Have young kids

- Are married or have a partner

- Own a house with a mortgage

- Are self-employed and your income is critical

- Are retired and want to leave some money behind or cover your final expenses

If you care about your family’s financial security, a policy is a definite must-have.

When’s the Best Time to Buy It?

The best time to buy life insurance is right now – seriously, the earlier, the better. Payments are usually cheaper when you’re young and healthy. Getting coverage early means you’ll pay less and have more options. Starting today just gives you peace of mind knowing your loved ones are protected no matter what.

How Much Life Insurance Do You Need?

A good rule of thumb is to aim for coverage that’s about 10 to 15 times your yearly income. But also think about your debts, how much it costs to raise your kids, what your partner will need in the future, and funeral costs. Adding all that up helps make sure your family won’t have money troubles if the worst happens.

How to Pick the Right Policy

Choosing a policy doesn’t have to be a headache:

- Figure out your finances and what you want to protect.

- Learn a bit about the different types of life policies.

- Get quotes from a few different companies.

- Check out how reliable the insurance company is and how they handle claims.

- Read the fine print carefully and ask any questions before you sign anything.

https://www.kiplinger.com/

Do that, and you’ll feel good about your choice.

Common Life Insurance Myths

- “I’m young and healthy—I don’t need life insurance.”

Actually, being young and healthy is the absolute best time to buy because prices are cheaper and you lock in good rates. - “Life insurance is way too expensive.”

Term coverage can be super affordable – sometimes less than your daily coffee. It’s a small price for a lot of peace of mind. - “I have insurance through work—that’s enough.”

Work policies are nice, but they often don’t cover everything and might disappear if you leave your job. A personal policy keeps you covered no matter what.

FAQs

Q1. Is life insurance money taxed?

Nope. In most cases, the money your family gets from the death benefit isn’t taxed in the U.S., UK, Canada, or Australia.

Q2. Can I have more than one policy?

Yep. Lots of people combine their work policies with personal ones for full coverage.

Q3. What if I miss a payment?

Most policies have a grace period (a little extra time). But if you keep missing payments, it could get canceled.

Q4. Can seniors get a policy?

Yeah, but the premiums will be higher. “Final expense” or “guaranteed issue” policies are popular for seniors.

Final Thoughts

This coverage isn’t just about you – it’s about protecting the people who count on you. It’s a promise to keep their future secure and give them financial stability and peace of mind.

Whether you’re starting a family, running a business, or planning for retirement, there’s a plan that’ll fit what you need.

Don’t sit around waiting for the “perfect” time – the best time is right now. Taking that first step today means giving your loved ones the priceless gift of protection for tomorrow.

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

5 Comments