Can You Get Life Insurance at 60+? Tips & Costs for Seniors in Australia 2025

Can You Get Life Insurance at 60? You Bet Your Boots You Can!

Thinking about getting life insurance when you’re over 60? A lot of us blokes and sheilas are asking that very question. And the good oil is, you can. Not only can you, but sorting out a policy at this stage in life is a bloody smart move for heaps of people. Whether you’re a recent empty nester, still on the tools, or just enjoying a well-earned retirement, making sure your loved ones are looked after is always a top priority. This yarn will walk you through what you need to know about Life Insurance at 60 in Australia, including some handy tips, what it might set you back, and everything in between.

Table of Contents

Why Even Bother with Life Insurance at 60?

You’re probably thinking, “I’ve paid off the house, the kids are all grown up. Why on earth would I still need life insurance?” Yeah, fair enough. For some, it might not be a must-have, but for a good many, getting a policy at this age gives you a real weight off your mind. Here’s the good oil on why:

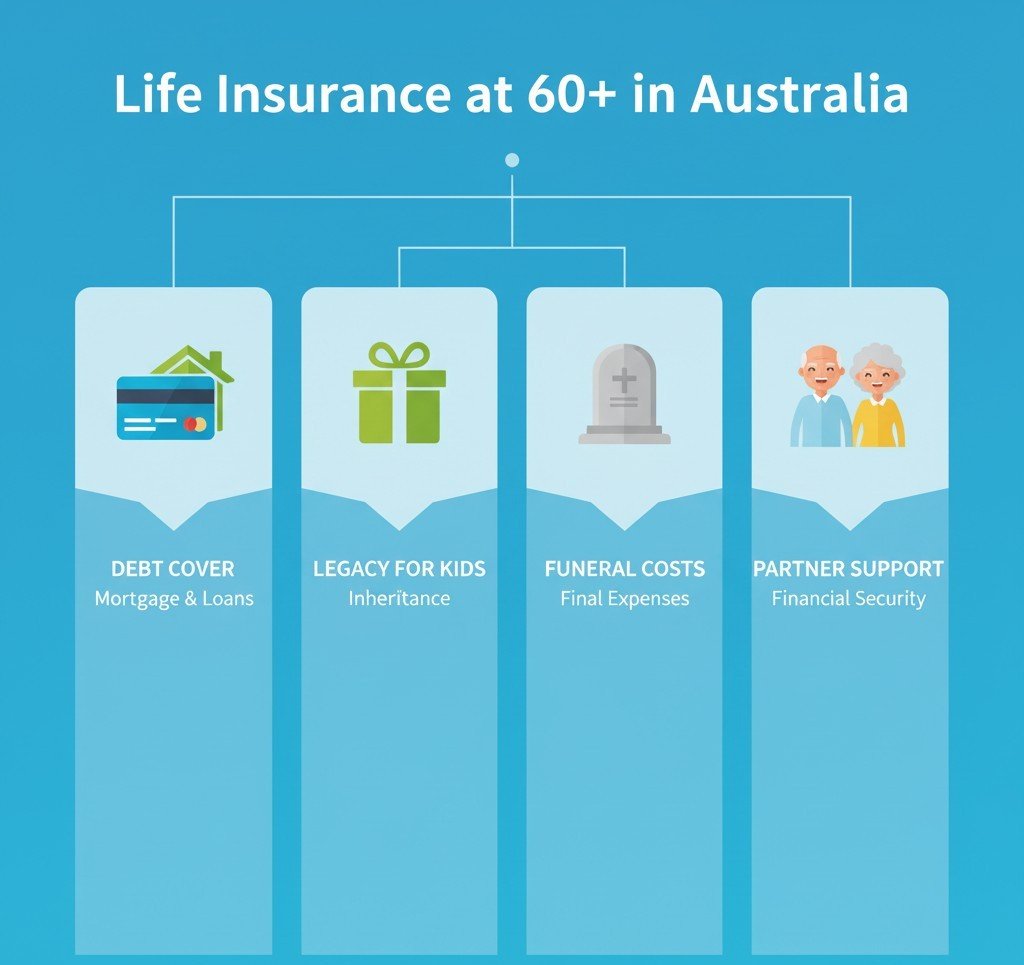

- Covering Debts: Even if the mortgage is gone, you might have other bits and bobs to pay off, like a personal loan, a car loan, or credit card debt. This cover can make sure your family isn’t left to deal with that financial drama.

- Leaving a Legacy: Maybe you want to leave a nice little nest egg for the grandkids, or help your kids with their own mortgage. Having a policy in place is a great way to do that, leaving a bit of cash for them to use however they need.

- Funeral Costs: Funerals in Australia can be a real killer on the wallet. A good policy can cover these costs, so your family doesn’t have to stress about finding the cash during an already tough time.

- Supporting a Partner: If your partner relies on your super or pension, what happens when you’re not around? Life Insurance at 60 can provide a lump sum to help them keep the wolf from the door and keep things ticking along.

Life insurance isn’t just about protecting your kids; it’s about making sure your partner is looked after too. It’s all about giving your family a fair go when you’re not there.

The Nitty-Gritty: How It All Works

Getting this type of cover is a bit different from when you’re a young buck. The main thing to remember is that premiums, or what you pay each month, are generally higher the older you get. That’s because, from the insurance company’s side of things, the risk of a claim is higher. But don’t let that get your goat. There are a few different types of policies to consider, and a few ways to get a handle on the costs.

Different Types of Cover

- Term Life Insurance: This is the most common type. It pays out a lump sum if you pass away or are diagnosed with a terminal illness within a set period (the ‘term’). You can usually get a policy for a fixed number of years, say 10 or 20, or until you reach a certain age, like 85 or 90. This is often the go-to for Life Insurance at 60.

- Funeral Insurance: This is a simpler policy that’s just for covering funeral costs. The payout is usually smaller, but it’s often easier to get. You can get funeral cover as a type of life insurance.

- Accidental Death Cover: This one only pays out if you die from an accident, not from a health issue. It’s often cheaper, but the cover is limited. It’s an option, but for a solid life insurance plan, a full policy is usually a better bet.

Stepped vs. Level Premiums

When you’re looking into life insurance, you’ll come across these two terms:

- Stepped Premiums: These start off cheaper but go up each year as you get older. For someone just starting with a policy in their sixties, this might seem a ripper deal at first, but the yearly increases can get pretty hefty.

- Level Premiums: These are higher to begin with but generally stay the same over the life of the policy. For a mature-age policy, this can be a real winner in the long run, as you’ll have more predictable costs and might save a packet down the track.

The best choice for your life insurance depends on your financial situation and how long you plan to keep the policy.

Tips for Getting a Good Deal on Life Insurance at 60 💰

Getting the right cover can feel a bit like a dog’s breakfast, but these tips will help you navigate it like a pro.

- Shop Around: Don’t just go with the first mob you see. Prices can vary heaps between insurers. Use an online comparison tool or have a yarn with a financial advisor who can help you find the best Life Insurance at 60 deal.

- Be Honest About Your Health: When you’re applying for cover, the insurer will ask about your health history. It’s bloody important to be fair dinkum. If you’re not, they could knock back a claim later on, and that would be a total shocker.

- Check Your Super: A lot of Australians have some life insurance through their superannuation. It’s often a basic level of cover, but it’s worth checking to see what you’ve got and if it’s enough for your needs.

- Work Out What You Really Need: Do you need a million bucks in cover? Maybe not. Think about your debts, your partner’s financial needs, and the cost of a funeral. A smaller policy might be all you need, and a lower sum insured means cheaper premiums for your cover.

- Look for ‘Guaranteed Acceptance’ Policies: Some policies are designed specifically for people getting a policy over 60. They often have no medical questions, but the cover might be limited and the waiting periods longer.

How Much Does Life Insurance at 60 Cost?

This is the big question, and the answer is a bit like, “how long is a piece of string?” The cost of a policy depends on a few things:

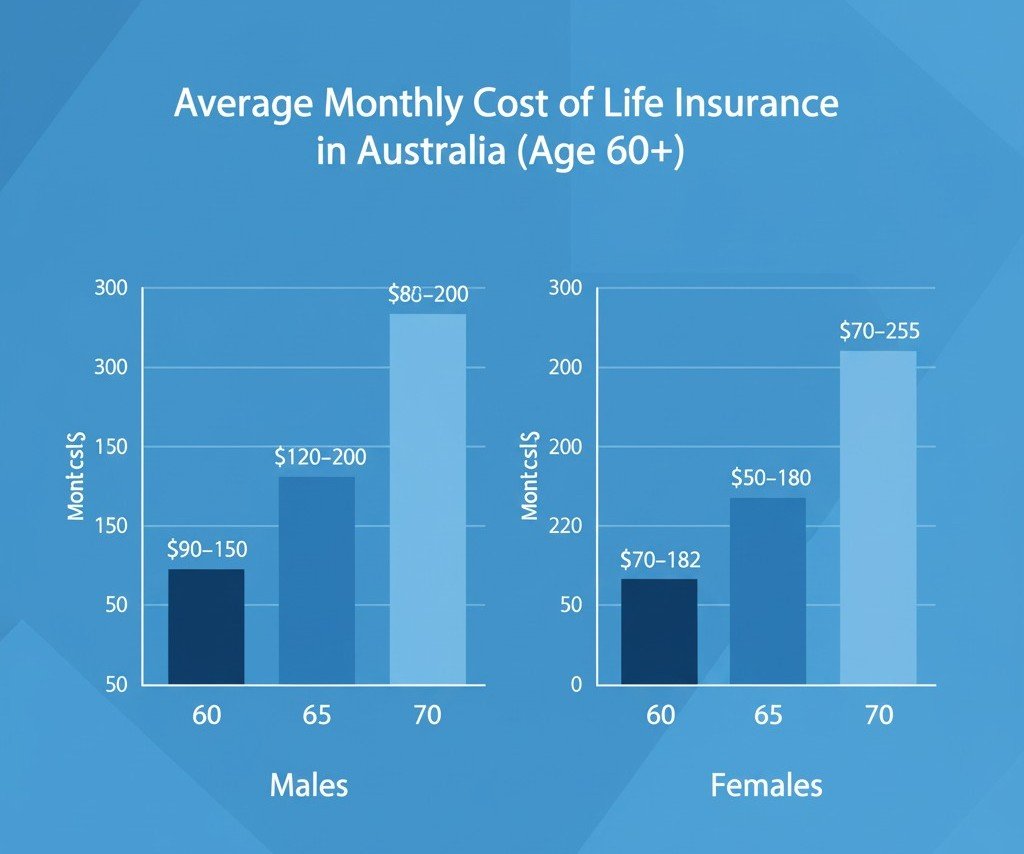

- Your Age: The older you are, the more it costs.

- Your Gender: On average, women pay a bit less than blokes.

- Your Health: If you’re fit as a fiddle and don’t have any health issues, you’ll pay less.

- Smoking Status: Smokers pay way, way more. If you’ve had a puff in the last 12 months, you’re considered a smoker by the insurers.

- The Amount of Cover: The more you want to be covered for, the more you’ll pay.

To give you a rough idea, we’ve put together a table showing some average monthly costs for Life Insurance at 60 for a non-smoker for a basic level of cover. These are just estimates and can change heaps, so always get a proper quote.

| Age | Male (non-smoker) | Female (non-smoker) |

| 60 | $90 – $150 | $70 – $120 |

| 65 | $150 – $250 | $120 – $200 |

| 70 | $250+ | $200+ |

As you can see, the cost of getting this cover goes up pretty quick. That’s why it’s a deadset winner to get in and get it sorted sooner rather than later.

FAQs About Life Insurance at 60

Q: Is it too late to get life insurance at 60?

A: Not at all, mate! Many insurers in Australia offer policies for people up to age 74, and some even go higher. So, getting Life Insurance at 60 is definitely on the cards.

Q: What’s the best life insurance for someone over 60?

A: There’s no one-size-fits-all answer. The best life insurance for you depends on your financial situation, your health, and what you want the cover for. It’s always a good idea to have a yarn with a financial advisor to figure out the right policy.

Q: Do I need a medical exam for life insurance at 60?

A: It depends on the policy and the amount of cover. For larger sums, insurers might ask for a medical check-up. For smaller policies, especially those with guaranteed acceptance, they might not need one.

Q: Can I get life insurance through my super at 60?

A: You might already have it! Check your superannuation statement. But be aware that this cover might not be enough and it often has an expiry age. Getting a separate policy might be a better way to go.

Q: How long does a life insurance policy last?

A: It depends. Some policies expire at a certain age, like 85 or 90. With term policies, it lasts for the number of years you choose. For this type of cover, you’ll want a policy that covers you for as long as you need it.

The Final Word

Getting Life Insurance at 60 is a ripper of an idea if you want to make sure your family is looked after. While the cost can be higher than for younger people, the peace of mind it offers is worth its weight in gold. Take the time to work out what you need, shop around, and be straight with the insurer. Getting your cover sorted now means you can get on with enjoying your life, knowing your mob is safe and sound.

Disclaimer

This blog post is a general guide only. We’re not financial advisors, and the information here is not personal advice. Before you make any decisions about Life Insurance at 60, you should have a yarn with a licensed financial advisor who can give you advice that’s right for your own situation. The costs and details mentioned are examples only and can change. Always have a good squiz at the Product Disclosure Statement (PDS) for any policy you’re thinking of buying.

Read our more blog on SMSF life insurance

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook