Is Life Insurance Tax Deductible in Canada in 2025? Facts, Myths & What You Need to Know

When you sit down and think about your family’s future, getting life insurance is one of those big, important steps. It’s really about taking care of the people you love most, making sure they’re safe if you’re not around to look after them. But as you look at different plans and policies, a common question pops into your head: is life insurance tax deductible in Canada?

This is a question I hear all the time, and it’s a big source of confusion for so many people. The quick and simple answer for most folks is no, it’s not. But like with a lot of things tied to taxes here in Canada, there are a few important twists and turns. It’s not just a simple yes or no answer.

Let’s clear things up once and for all and talk about the real deal when it comes to whether life insurance is tax deductible in Canada for 2025. We’ll get rid of some common misunderstandings and give you the real facts so you can make smart, confident choices for your family’s financial future.

Table of Contents

The Simple Truth: Why You Can’t Usually Deduct Premiums

For the average Canadian family, the money you pay for your life insurance policy—what we call premiums—doesn’t count as a tax-deductible expense. You can’t write it off on your tax return to lower the amount of income you have to pay taxes on.

Think of it this way: the government sees your life insurance premiums as a personal expense. It’s just like the money you spend on groceries, or gas for your car, or that new jacket you bought. It’s a choice you’re making to protect your family, and it’s not part of running a business or earning a living in a way that the tax rules would allow for a tax break.

So, if you’re just a regular person with a standard life insurance policy, whether it’s a short-term one or one for your whole life, the money you put into it won’t save you anything on your taxes. The real value is in the peace of mind and the protection it gives your family, not in a tax benefit. This is the main thing to remember about life insurance tax deductible in Canada.

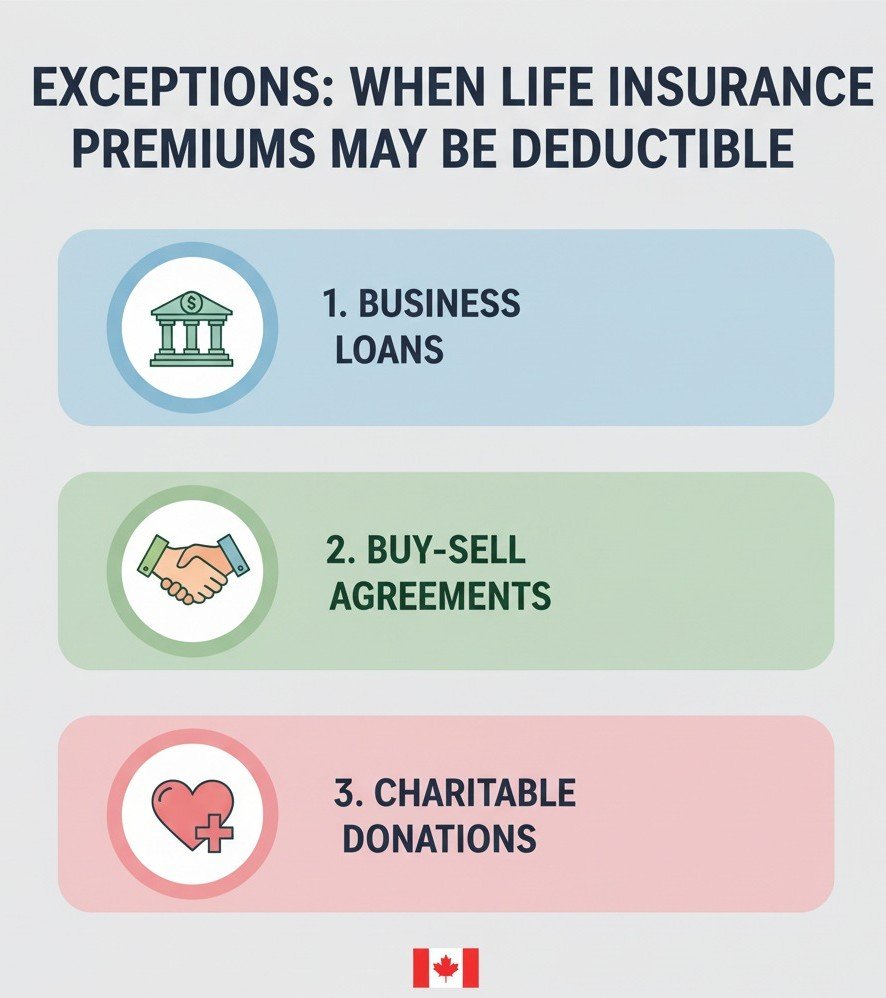

A Few Exceptions: When Life Insurance CAN Be Tax Deductible

While the big rule is no, there are a few special situations where your life insurance premiums might be something you can deduct. These usually have to do with business stuff, not just your personal family life.

1. When a Loan Needs It

This is one of the most common exceptions. If a bank or lender says you have to get a life insurance policy as a guarantee for a loan, the money you pay for it can sometimes be something you can deduct. This is a common thing for business owners.

Here’s an example: A small business owner needs a loan to expand their shop. The bank says, “We’ll give you the loan, but you need to get a life insurance policy and make us the beneficiary. If something happens to you, we get paid back.” In this case, because the policy is a required part of the business loan, the premiums you pay might be deductible.

But there’s a catch: The loan has to be used for a business purpose that brings in money. You can’t just take out a personal loan and use this rule. It has to be directly tied to your business. This is a very specific rule, and it’s where the question of is life insurance tax deductible in Canada gets a little more detailed.

2. Business Partners Looking Out for Each Other

If you run a business with one or more partners, you might have something called a buy-sell agreement. This is a legal paper that says if one partner passes away, the other partners will buy their part of the business from their family. A life insurance policy is often the way you get the money to do this.

For example, imagine you and a friend own a coffee shop together. You might each get a life insurance policy on the other person. If your friend passes away, you would get the insurance money and use it to buy their half of the business from their family. In this special case, the money you pay for that policy could be deductible. The whole point of the insurance is to help the business keep going, and it’s part of a formal business plan. This is another situation where life insurance tax deductible in Canada can actually happen.

3. Giving to a Good Cause

Sometimes, people give a life insurance policy to a charity. You can either donate a policy you already have or buy a new one and make a registered charity the beneficiary.

If you give an existing policy to a charity, you might be able to claim a tax credit for the money it’s currently worth. If you buy a new policy and make the charity the owner, you can often claim the premiums you pay each year as a donation tax credit. This isn’t exactly a deduction, but it still helps you on your taxes. This is a really kind and smart way to leave a lasting gift, and it’s a way to get a tax benefit with your life insurance. It’s good to know this when you’re thinking about life insurance tax deductible in Canada.

What About the Payout? Is the Payout Taxable?

Now, let’s talk about the best part. What about the money your family receives from the life insurance policy when you’re gone?

This is fantastic news for your loved ones. In almost every single case, the death benefit—that big chunk of money paid out by the insurance company—is not taxable. Your family gets the full amount, and the government doesn’t take a cent.

So, while you can’t usually write off the money you pay for the policy, the money that gets paid out to your family is completely tax-free. This is a huge benefit and a big reason why life insurance is such a smart tool for planning your family’s finances. It’s a way to give a cash gift to your family without the government taking a piece of it. This is a crucial point to remember when you ask yourself, is life insurance tax deductible in Canada. The payout is tax-free, even if the premiums aren’t deductible.

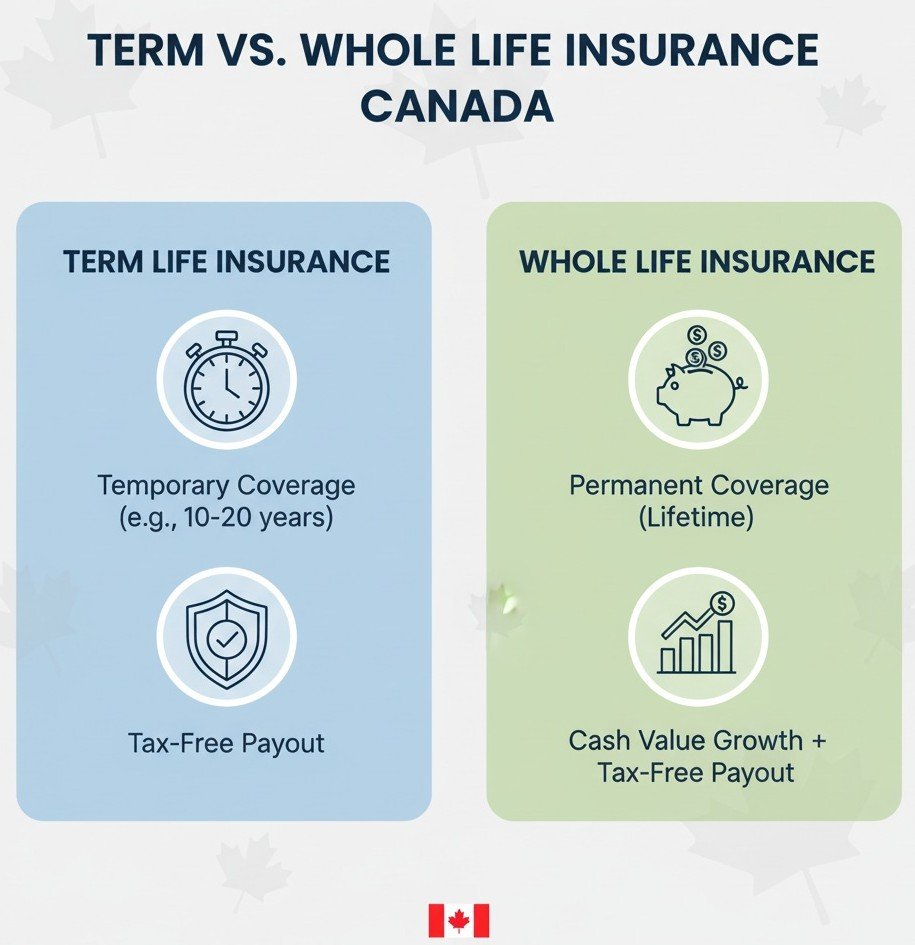

Term Life vs. Whole Life: Is There a Difference?

People often wonder if there’s a difference between term and whole life insurance when it comes to taxes.

- Term Life Insurance: This is the most straightforward kind. You pay money for a set amount of time (like 10, 20, or 30 years). If you pass away during that time, your family gets the payout. The premiums aren’t tax-deductible, and the payout is tax-free. This is the simplest answer to the question, is life insurance tax deductible in Canada.

- Whole Life Insurance: This kind of plan has a savings or investment part to it, called a cash value. A small part of the premiums you pay goes into this cash value, which grows over time. While the premiums themselves are still not tax-deductible, the growth of that cash value inside the policy is tax-deferred. This means you don’t have to pay taxes on that growth each year. This is a pretty neat feature and a good reason to think about this type of policy for long-term savings. Again, the premiums themselves are not part of the life insurance tax deductible in Canada conversation, but the policy’s growth is a different story.

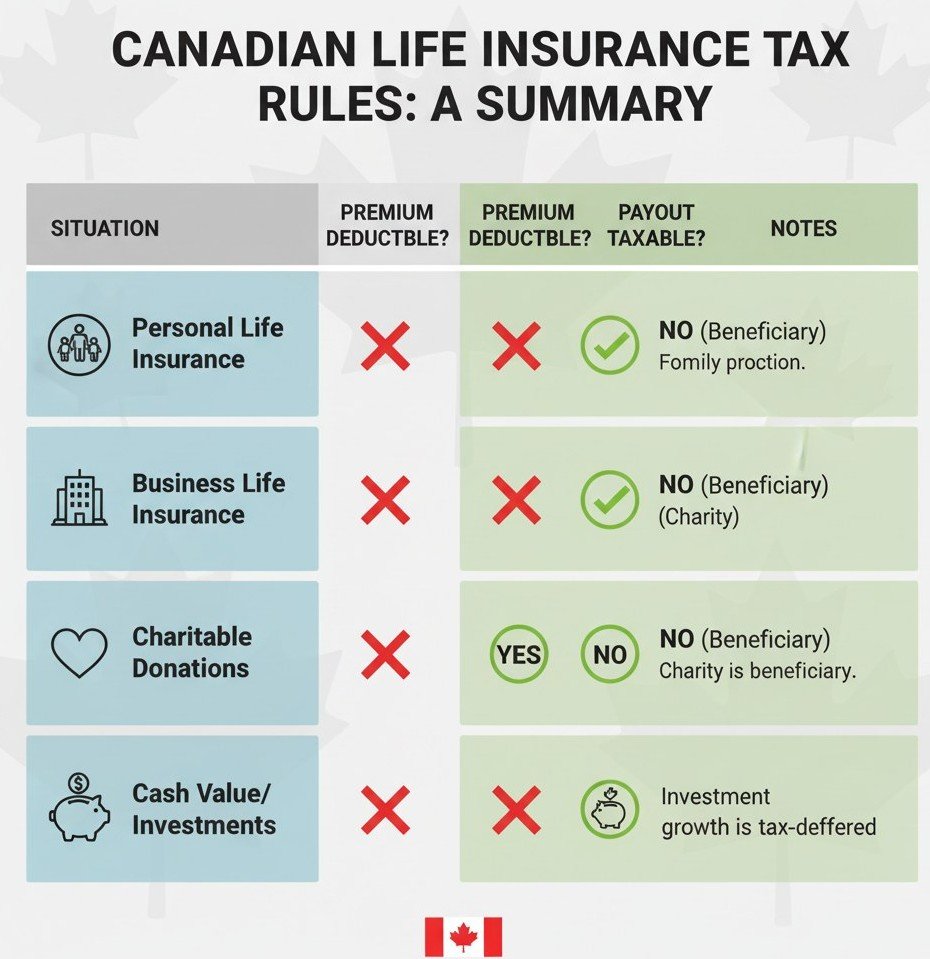

Let’s Look at a Simple Table

To make this all a little easier to see, here’s a quick look at common life insurance questions and their answers for 2025. This table should help clear up any confusion about is life insurance tax deductible in Canada.

| Situation | Is the Premium Tax Deductible? | Is the Payout Taxable? | The Scoop |

| Personal Use | No | No | For most people, the money you pay is a personal expense. The death benefit is paid to your family tax-free. This is the most common situation. |

| Business Loan Collateral | Yes, maybe | No | Only if the loan is needed for a business that makes money. A very specific rule. The payout is still tax-free. |

| Business Partnership Agreement | Yes, maybe | No | If the policy is used to fund a formal agreement between partners. The payout is still tax-free. |

| Charitable Donation | Yes | No | The premiums can be claimed as a tax credit for donations if the charity owns the policy. The payout is tax-free. |

| Whole Life Cash Value | No | No | The premiums aren’t deductible. But the money that grows inside the policy is tax-deferred. The final payout is tax-free. |

This table shows that while there are a few exceptions, the big rule is that is life insurance tax deductible in Canada is a no for premiums, but a big yes for the tax-free payout.

The Importance of Talking to a Real Person

Trying to figure out insurance and taxes can feel like a maze. It’s so easy to get lost in all the little rules and details. That’s why it’s so important to talk to a professional. A good financial advisor or insurance broker can help you understand all these rules and make sure you’re picking the right plan for your own life. They can help you figure out if any of those exceptions apply to you and which type of policy is the best fit. Don’t just guess at the answer to is life insurance tax deductible in Canada. Get some real help from someone who knows what they’re doing.

Frequently Asked Questions (FAQ)

Q1: So, is life insurance tax deductible in Canada for my family?

A: For a regular personal policy, the money you pay is not tax-deductible. This is the situation for almost all Canadians.

Q2: What about the money my family receives? Is that taxed?

A: Nope! The money your family gets from the policy (the death benefit) is paid out completely tax-free. This is a major plus for life insurance.

Q3: Does it matter if I have term or whole life insurance?

A: The money you pay for both term and whole life insurance is generally not tax-deductible for personal policies. However, the savings part that grows inside a whole life policy grows without you having to pay taxes on it each year, which is a big benefit.

Q4: Can a business deduct life insurance premiums?

A: In some very specific situations, yes. For example, if a policy is needed as a guarantee for a business loan, the premiums might be deductible. But this doesn’t apply to every policy a business might get.

Q5: Is there any way to get a tax benefit from life insurance?

A: Yes, there are a few ways. You can get a tax benefit if you use a policy for a business loan, a buy-sell agreement, or if you donate it to a charity, which can give you a tax credit. But for most people, the main benefit is the tax-free money your family receives. This is the most important thing to remember about life insurance tax deductible in Canada and its tax benefits.

Final Thoughts & A Little Note for You

The question of is life insurance tax deductible in Canada is a common one, and it’s easy to get confused. The most important thing to take away is this: for your own personal policy, the money you pay isn’t a tax deduction, but the money paid to your loved ones is tax-free. That’s a powerful and simple truth. The special cases are for very specific business or charitable situations.

Just a note: This article is meant to give you general information and is not financial or legal advice. Tax rules can be complicated and they can change. You should always talk to a professional financial advisor, tax expert, or accountant to talk about your personal situation before you make any big decisions. This info is here to help you understand the basics of life insurance tax deductible in Canada, but it shouldn’t be the only thing you rely on for important financial choices.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook