Life Insurance Advice for Young Australians: Why So Many Miss Out and How to Get It Right

Here’s a surprising fact: almost half of Aussies under 35 say they’d like advice about life insurance, but only a handful actually do something about it. Sounds odd, right?

We’re talking about a generation juggling rent, HECS debts, car repayments, Netflix subscriptions, and trying to save for a holiday at the same time. In that busy mix, insurance usually feels like the last thing worth thinking about.

But here’s the catch: the earlier you act, the cheaper and smarter it gets. That’s why proper life insurance advice for young Australians is a lot more important than most people realise.

In this guide, we’ll look at:

- Why young Aussies avoid taking advice

- The hidden cost of waiting too long

- A real story that proves the point

- Where to find the right kind of help

By the end, you’ll see that getting life insurance advice for young Australians isn’t just about planning for “what if”—it’s about saving money and locking in peace of mind early.

Table of Contents

Why Young Australians Avoid Life Insurance Advice

So, if so many under-35s know they need advice, why do most of them push it aside? There are a few common reasons:

1. “I’m too young for that stuff.”

Plenty of people think life insurance is for middle-aged parents with a mortgage and kids. The reality? The younger and healthier you are, the cheaper it is. Getting life insurance advice for young Australians in your 20s can save you thousands over the years.

2. “It’s too expensive.”

A lot of young Aussies imagine life cover costs $150 a month or more. In reality, it can be less than a dollar a day—cheaper than a takeaway coffee. Without good advice, myths like this stop people from even checking.

3. “Workplace cover is enough.”

Sure, your super fund or employer might throw in some group cover. But in most cases, it’s just one year of your salary. That’s hardly enough to cover a mortgage, let alone look after family or future goals. Personalised advice usually shows how big the gap is.

4. “It’s all too complicated.”

Let’s be honest: policy documents are full of jargon and fine print. Many just give up after the first page. A bit of clear, simple life insurance advice for young Australians can make the difference between confusion and confidence.

5. “I’ve got other priorities.”

At this age, the budget’s already stretched—rent, travel, weekends out. Insurance feels like something to worry about later. The problem is, waiting only makes it more expensive. Acting early can mean locking in low costs before life gets more complicated.

Real-Life Example: Emma’s Story

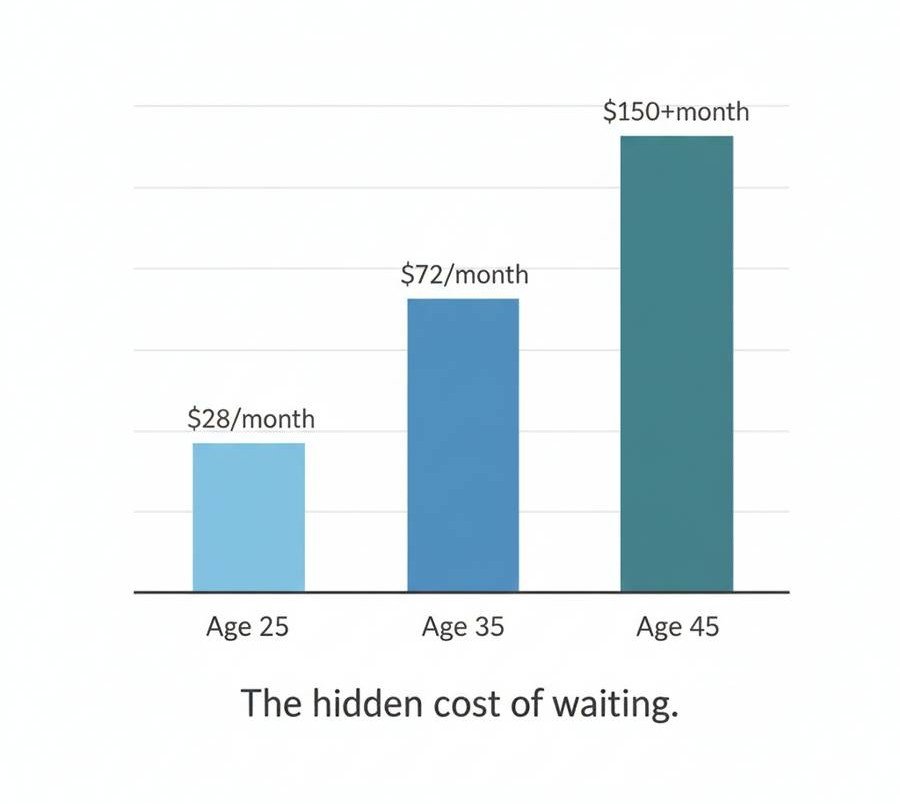

Take Emma, a 27-year-old marketing professional in Sydney. Back then, she thought insurance was only for parents. If she had taken cover at that age, her monthly premium could’ve been about $28 for half a million dollars of protection.

She didn’t. Fast forward to 35: Emma has a mortgage, two kids, and a history of mild asthma. When she finally looked into it, the same cover was $72 a month—almost triple. Over time, that’s an extra $12,000–$15,000 out of her pocket.

Emma’s story isn’t unusual. It shows exactly why early life insurance advice for young Australians matters—it’s not about being scared of the future, it’s about being smart with money right now.

Why Waiting on Life Insurance Can Cost Young Aussies More

Let’s Be Honest

Most people in their 20s or early 30s don’t want to think about life insurance. I get it. Rent’s a pain, groceries are expensive, and weekends are meant for beach trips or brunch, not reading product disclosure statements. But here’s the kicker: putting it off often costs way more than you expect.

I’ve had mates laugh when I bring it up—“I’m young, I’ll sort it later.” And fair enough, none of us like paying for something that doesn’t feel urgent. But a couple of years down the track, those same mates are shocked at how much more expensive it’s become. That’s why a bit of life insurance advice for young Australians early on can save a serious chunk of cash.

Why Age Matters More Than You Think

Insurance companies aren’t guessing when they set prices. They’re basically betting on risk. The younger and healthier you are, the cheaper you look to them. Once you hit your mid-30s, things change—slower recovery from the gym, maybe a cholesterol check that isn’t as pretty as before, or a doctor suggesting “keep an eye on that blood pressure.”

These little changes make insurers nervous. Nervous insurers = higher prices. And sometimes, they even write exclusions into policies. That’s the stuff nobody thinks about at 25 but everyone regrets at 38.

A Simple Money Picture

Forget spreadsheets and technical terms. Picture this instead:

- At 25, someone pays about the same as a couple of Uber Eats orders each month for half a million bucks of cover.

- At 35, that same person is now paying what feels like a solid gym membership plus Spotify plus Netflix all bundled together.

- By 45, it’s closer to what you’d spend on a decent used car repayment each month.

Over time, the difference adds up to tens of thousands of dollars. And none of us want to waste money like that, especially with rent and interest rates climbing.

Liam’s Story

I’ll give you a real-world example. Liam, a 29-year-old software guy from Melbourne, thought insurance was for “later.” He was fit, played soccer twice a week, didn’t even think about health problems.

Fast forward to 33, and he’s dealing with recurring back pain from too much desk time. When he finally looked at cover, not only were premiums almost double, but some policies added conditions excluding anything related to his back.

His words to me: “If I’d just sorted it in my twenties, I’d be paying less and stressing less.” That’s the exact trap a lot of young Aussies fall into.

It’s Not Just About the Price Tag

The thing about waiting is it’s not just the monthly premium that stings. There are other hidden costs, like:

- Options shrinking – The older you get, the fewer choices you have. Some of the really good extras, like critical illness add-ons, might not be available.

- Stress factor – Ever try buying insurance after a medical scare? It’s stressful as hell.

- Exclusions – Even little things (like asthma or migraines) can mean you’re not fully covered later.

So yeah, money matters. But the peace of mind and flexibility you lose is just as big a deal.

Zoe’s Wake-Up Call

Here’s another one. Zoe, a 31-year-old nurse in Brisbane, decided she’d “deal with it after buying a house.” Fair enough—housing in Brisbane isn’t exactly cheap.

At 35, she finally applied. The premiums were way steeper than she’d expected. A couple of providers even asked for full medicals. She told me, “If I’d done it earlier, I would have had more options and way less stress.”

Her story isn’t rare. In fact, I’d say it’s the most common thing I hear when chatting with people in their thirties.

Why Acting Early Is Smarter

When you strip away the noise, the benefits of starting early are simple:

- It’s cheaper.

- You lock in coverage while you’re healthy.

- You’ve got more choices on the table.

- It teaches good financial habits.

- And honestly, it’s just one less thing to stress about.

Even if you’re single, think about it: who covers rent or car repayments if something happens? Your parents? Siblings? Friends? Sorting a modest policy now makes sure nobody else gets stuck with your bills.

That’s why some straightforward insurance tips for young Australians go a long way.

How to Get Started Without Overcomplicating It

The idea of life insurance sounds huge, but getting started doesn’t have to be.

- Start small – You don’t need a million-dollar policy tomorrow. Even $200–300k of cover is a great start.

- Compare properly – Don’t just accept the first quote. There are comparison sites, and financial advisers who can break it down for you.

- Check your work cover – A lot of super funds have default life insurance, but it’s usually not enough. One or two years’ salary is gone in a flash when you’ve got a mortgage.

- Talk to an expert – It’s literally their job to explain the boring parts in plain English.

Taking action doesn’t mean locking yourself into something huge right now. It’s about putting a solid base in place and adjusting as life changes.

Why It Matters More Than Ever

Cost of living is brutal right now. Rent’s going up, groceries are higher, and mortgage repayments make plenty of Aussies sweat. Because of that, a lot of people ditch the idea of insurance completely.

But here’s the weird part: the times when money feels tight are exactly when you don’t want extra surprises. Paying $25–30 a month now to avoid paying $70–150 later is one of the smartest money plays a young Aussie can make.

In simple words: the earlier you start, the easier it is to carry the cost—and the longer you’ve got that safety net sitting there, just in case.

Where Young Aussies Can Actually Get Life Insurance Advice

So, you’ve decided to at least think about life insurance. Good move. But where do you even start? Most people I talk to have no idea where to go for real, trustworthy advice.

Here are a few practical options:

- Independent financial advisers – Yep, the boring-but-valuable professionals. They can explain the fine print without the jargon. Think of them as translators between “insurance-speak” and normal English.

- Comparison websites – Sites like Canstar or Finder give you a quick snapshot of prices. They don’t tell you everything, but they’re a good start.

- Superannuation funds – Many Aussies don’t even realise their super includes some default cover. The catch? It’s usually minimal and might not fit your actual needs.

- Licensed insurance brokers – These folks shop around on your behalf. You tell them your budget and situation, they come back with options.

No matter where you start, the key is asking the right questions: How much cover do I really need? What’s covered? What’s excluded? How long will the premiums stay the same?

And remember—good life insurance advice for young Australians should feel personalised, not pushy.

FAQs About Life Insurance for Young Australians

I get heaps of questions from people under 35 about this stuff. Let’s clear up some of the common ones.

1. Do I really need life insurance if I’m young and healthy?

Short answer: maybe not a huge policy, but some cover makes sense. Even if you don’t have kids yet, debts, car loans, or rent don’t just vanish. Someone else (parents, partner, siblings) would end up footing the bill.

2. Isn’t the group cover through my super enough?

Usually not. Most super funds throw in default life insurance, but it’s often just one or two years of salary. If you’ve got a mortgage, kids, or even just long-term rent commitments, that won’t stretch very far.

3. What if I can’t afford much right now?

That’s okay. Start small. You can always increase cover later. Locking in while you’re young and healthy means your base cost is low and doesn’t suddenly spike as you get older.

4. Can I get rejected?

Yes, but not in the way you think. If you’re young and healthy, you’re unlikely to be fully rejected. But waiting means insurers can add exclusions. For example, if you’ve developed asthma, they might exclude anything related to it.

5. Isn’t life insurance for families, not singles?

Not exactly. Singles still have debts, bills, and sometimes family relying on them in small ways. Plus, locking in cover early means if you do start a family later, you’re already sorted.

6. Is life insurance really tax-free in Australia?

Generally, yes. The payout your beneficiaries receive is usually tax-free if it’s paid to dependants. But as always, check with an adviser or accountant for your specific situation.

A Real Chat: Sam and Casey

Sam, 27, works in Sydney’s marketing scene. He told me, “I don’t see the point—I don’t even have kids yet.” Fair call. But when we walked through his situation—rent, a car loan, a credit card, and parents who would cop the debt if something happened—he admitted, “Okay, I never thought about it like that.”

Casey, 33, a teacher in Adelaide, had the opposite view. She got insurance early because her parents had health issues young. “It’s peace of mind for me,” she said. “And now I pay less than my colleagues who waited.”

These are the kinds of conversations real Aussies are having. Not about spreadsheets or big numbers, but about responsibility, family, and peace of mind.

Why “Later” is the Most Expensive Word

There’s a pattern here. Most people don’t say “no” to insurance, they say “later.” But later usually means higher premiums, stricter conditions, and less choice.

By taking a bit of life cover guidance for under-35s now, you get ahead of the curve. And honestly, it’s not as boring or painful as it sounds—it’s one phone call, one online form, or one coffee chat with an adviser.

A Gentle Push (Call to Action)

If you’re under 35 and reading this, here’s my nudge: don’t push this off. At the very least, do one of these today:

- Jump on a comparison site and get a ballpark figure.

- Call your super fund and ask what cover you already have.

- Book a free initial chat with a licensed adviser.

You don’t have to buy anything today. But knowing your options is free, and waiting too long costs way more.

“You can also check independent ratings on Canstar to see which providers score well for value and benefits.”

So yeah, your future self will thank you.

Final Word & Disclaimer

Life insurance isn’t glamorous. It won’t get you likes on Instagram or free drinks at the pub. But it’s one of the smartest, most underrated financial moves young Aussies can make.

And just to be clear: this article is general information only. I’m not giving you personal financial advice here. Everyone’s situation is different. Before you make any big decision, talk to a licensed financial adviser or check the official PDS (Product Disclosure Statement) from insurers.

That said, if you’re young, healthy, and still on the fence—this is probably the cheapest and easiest time you’ll ever have to sort it.

Read our other blog on Climate risk insurance in Australia

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook