How Much Life Insurance Do I Need? (Mortgage, Debts & Final Expenses Guide)

Be honest—have you ever sat down and really thought, “If I wasn’t around tomorrow, how would my family cope?”

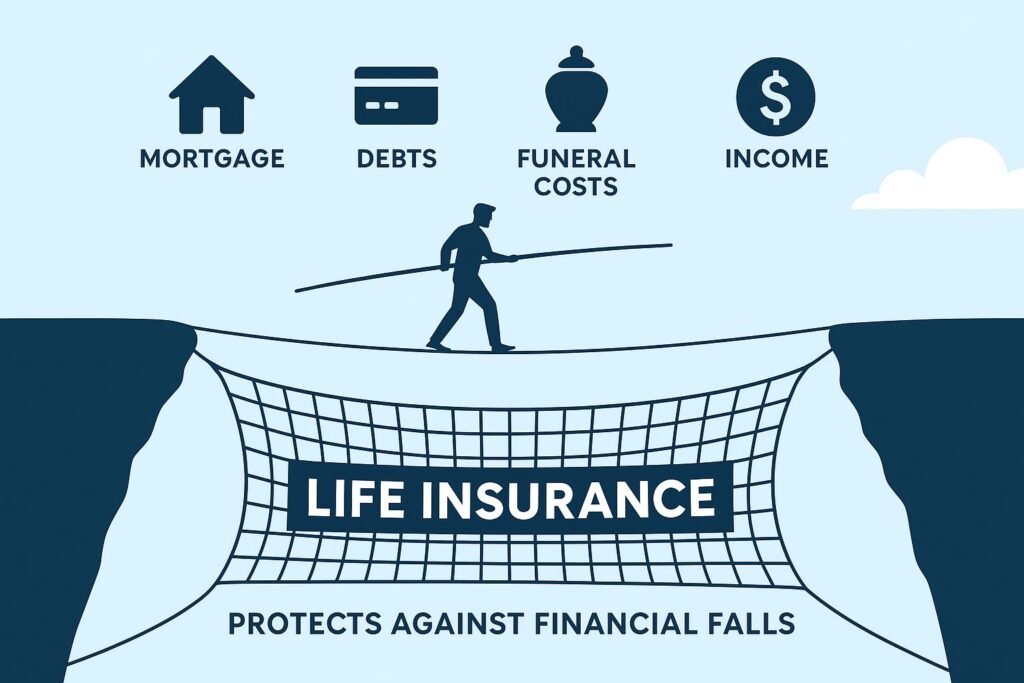

That’s a tough thought. Most people avoid it, and I get why. But here’s the thing: bills don’t stop when you do. Mortgages, credit cards, car loans… they all keep coming. And that’s where life insurance comes in.

The big question is always the same: “How much life insurance do I need?”

And let me tell you, there isn’t a one-size-fits-all answer. For one family, $250,000 might be plenty. For another, even $1 million feels tight.

This first part of our guide digs into the basics—why coverage matters so much, and the three big factors you absolutely have to cover before anything else: your mortgage, your debts, and final expenses. Once those are taken care of, we can start thinking about income replacement and future goals.

Table of Contents

Why Life Insurance Coverage Matters

Look, I know this isn’t the most exciting topic. Talking about life insurance feels like admitting we’re not invincible. But let’s face it—life happens. Every single day in the U.S., families are caught off guard because a parent or spouse didn’t have enough coverage.

Here’s why coverage isn’t optional:

- Your Home

Think about your mortgage. It’s probably the biggest bill in your life. Without coverage, your spouse or kids might lose the home you worked so hard for. That’s heartbreaking, and completely avoidable. - Your Debts

Student loans, car loans, credit cards—sadly, they don’t just vanish. Somebody will be stuck with them, and usually that “somebody” is your family. - The Final Goodbye Costs Money

A funeral in the U.S. can easily cost $8,000–$12,000. Add burial plots, flowers, and medical bills, and you’re looking at $20,000 or more. Imagine your family scrambling for that while grieving. - Lost Paycheck = Stress

If you bring home $60k a year, losing that income overnight is like pulling the rug out from under your family. Life insurance is basically a paycheck replacement plan. - Peace of Mind

Honestly, this one matters most. Having coverage is like knowing you’ve left behind a safety net. That’s priceless.

So the next time you catch yourself asking “how much life insurance do I need?”, remember: it’s not about the paperwork—it’s about keeping the people you love safe.

Factor #1: Mortgage Protection

Let’s start with the elephant in the room: your mortgage. For most families, it’s the biggest financial commitment they’ll ever make.

Picture this. You’re 38 years old, married, two kids, still owe $280,000 on the house. If you weren’t around tomorrow, could your spouse really keep making that $1,600 monthly payment? Probably not. And that’s why mortgage protection is so critical.

Example: John and Emily

- John, 35, married with two small kids.

- Household income: $70,000 (he earns $50k, Emily earns $20k).

- Remaining mortgage: $300,000.

If John passed away suddenly, Emily would be left trying to cover the mortgage, childcare, and bills on just $20k a year. That’s nearly impossible.

Now imagine John had a $300,000 term life policy. Emily could pay off the mortgage immediately, and suddenly the pressure is gone. She still has challenges, of course, but at least the house is safe.

👉 Rule of thumb? Your policy should at least equal your mortgage balance. That way, your family won’t lose their home.

Factor #2: Debts & Loans

Mortgages aren’t the only bills we juggle. Let’s be real—we live in a debt-driven society. Car loans, student loans, and credit cards are part of everyday life.

And here’s the kicker: debts don’t die with you. Creditors still want their money. If your parents co-signed, they’re on the hook. If you’re married, your spouse may inherit the payments.

Example: Sarah’s Story

- Sarah is 42, single mom with a teenage son.

- Mortgage: $180,000.

- Car loan: $25,000.

- Credit card debt: $15,000.

That’s $40,000 of non-mortgage debt. If Sarah only covered her mortgage in her life insurance, her son would still be stuck with $40,000 in unpaid bills. And that’s before funeral costs.

Her advisor asked her a simple question: “Sarah, how much life insurance do you need if you want your son debt-free and secure?” The real number wasn’t $180k. It was closer to $600,000 when everything was added up.

👉 Lesson: Always include debts in your calculation. Mortgage + debts = your baseline coverage.

Factor #3: Final Expenses

Here’s something people rarely plan for: the cost of saying goodbye.

In America, funerals are expensive:

- Service & burial: $8,000–$12,000.

- Burial plot, headstone, extras: $3,000–$5,000.

- End-of-life hospital bills: $5,000–$20,000.

Put together, your family could need $15,000–$25,000 just to cover those first painful weeks. And if you don’t have life insurance? They’ll probably turn to credit cards or GoFundMe.

I once spoke to a friend in Texas who lost his father unexpectedly. The family didn’t have coverage, and they had to take out a loan just to afford the funeral. He told me later, “That loan payment felt like a constant reminder of our loss.” Trust me, you don’t want that for your loved ones.

👉 Solution? Add $15k–$25k into your life insurance plan for final expenses. It’s small compared to other costs, but it makes a world of difference.

How Much Life Insurance Do I Need? (Income Replacement, Real-Life Examples & DIME Formula)

So far, we covered the basics—mortgage, debts, and final expenses. That’s the foundation. But let’s be honest: those things only take care of the past and present. What about the future?

That’s where the real magic of life insurance kicks in: income replacement.

Why Income Replacement Matters

Imagine your paycheck disappearing tomorrow. Bills keep coming, kids still need food, college isn’t getting cheaper, and retirement for your spouse doesn’t stop being important.

When people ask, “how much life insurance do I need?”, they’re really asking:

👉 “How many years of my income should I replace if I’m not around?”

Here’s the truth—covering your mortgage and debts isn’t enough. Your family needs time. Time to grieve, adjust, and rebuild without being crushed by financial pressure.

The Golden Rule: 10x Your Income

A popular guideline says you should carry 10–12 times your annual income in life insurance.

So, if you earn $60,000 a year:

- Minimum coverage: $600,000

- Better coverage: $720,000 (12x rule)

Why 10x? Because it gives your family about a decade of breathing room. Imagine your income replaced for 10 years straight. That’s powerful.

Real-Life Example: The Davis Family

Let’s paint a picture.

- Mark (40 years old), earns $75,000/year.

- His wife, Anna, works part-time and makes $20,000/year.

- They have two kids, ages 7 and 10.

- Mortgage: $250,000.

If Mark died tomorrow, Anna’s $20k wouldn’t cut it. Childcare, mortgage, food, school, it all adds up.

Mark followed the 10x rule and got a $750,000 term policy. Here’s how that would actually play out for Anna:

- Pay off the mortgage ($250,000).

- Cover funeral + debts ($30,000).

- Still left with nearly $470,000.

Invest that $470k in a conservative account earning 5% returns, and it generates around $23,500 per year. Combined with Anna’s $20k, that’s $43,500 annually—enough to keep the family afloat while the kids grow up.

👉 That’s why income replacement matters. It’s not about leaving millions; it’s about making sure your family can live without panic.

According to a Kiplinger report on financial hardship after loss, 62% of Americans were unprepared for the sudden costs of a loved one’s death. With average funeral bills hitting $6,300–$8,300, it’s no wonder families struggle when no life insurance is in place

The DIME Formula

If rules of thumb feel too vague, here’s a more structured approach: the DIME formula.

It stands for:

- D = Debts (other than mortgage)

- I = Income replacement (usually 10–12 years)

- M = Mortgage (remaining balance)

- E = Education (future cost for kids)

Add these up, and you’ll get a solid estimate of how much life insurance you really need.

Example: Lisa’s Calculation

Lisa is 36, earns $65,000/year, married with one child.

- Debts: $20,000 (car + credit cards)

- Income replacement: $650,000 (10 years of salary)

- Mortgage: $200,000

- Education: $120,000 (one kid’s future college)

Total = $990,000

Lisa initially thought $300k coverage was fine. After DIME, she realized she actually needed closer to $1 million. Huge difference, right?

Step-by-Step Checklist: Finding Your Number

Here’s a simple way to figure out your own answer to “how much life insurance do I need?”

- Write down your mortgage balance.

That’s non-negotiable. - List every debt.

Credit cards, car loans, student loans. - Add $15k–$25k for final expenses.

Funeral + hospital bills. - Multiply your salary by 10–12.

That’s your income replacement. - Add future education costs.

College, private school, anything big you want covered.

Now total it all. That’s your coverage need.

👉 Example:

- Mortgage: $220,000

- Debts: $30,000

- Final expenses: $20,000

- Income replacement (10x $70k): $700,000

- Education: $100,000

Total coverage needed = $1,070,000

It might sound like a scary number, but remember—term life insurance is surprisingly affordable. A healthy 35-year-old male can often get a $1 million term policy for under $40/month. That’s less than a family pizza night.

Common Mistakes People Make

Let me be blunt: most Americans are underinsured. Studies show nearly 50% of households would run into financial trouble within six months if the primary breadwinner passed away.

Here are the mistakes I see all the time:

- Only covering debts

People think, “If I pay off the house, we’re fine.” Nope. Income still matters. - Forgetting education costs

College tuition is skyrocketing—by 2035, a four-year degree could cost $200k+. Ignore it at your own risk. - Thinking work coverage is enough

Many jobs give you a small life insurance benefit, like 1–2x your salary. That’s nice, but it’s not nearly enough. - Not adjusting as life changes

Get married? Buy a bigger house? Have kids? Your coverage needs to grow with you.

How Much Life Insurance Do I Need? (Policy Types, FAQs & Final Thoughts)

By now, we’ve already walked through the essentials—mortgage, debts, final expenses, and even income replacement. But here’s the catch: just knowing the number isn’t enough. The real game is choosing the right policy and avoiding those mistakes that so many families regret later.

I’ll be straight with you—this part is where most people trip up. Let’s fix that.

Term Life vs Whole Life: Let’s Clear the Confusion

Whenever I sit with someone to talk insurance, this question always pops up: “Should I buy term or whole life?” And honestly, the answer depends on your situation.

Term Life Insurance

- Covers you for 10, 20, or 30 years.

- Cheap—sometimes shockingly cheap.

- Pure protection, nothing extra.

👉 Perfect if your main goal is protecting your family during your working years.

Quick story: A buddy of mine, 32 years old, grabbed a 20-year term policy worth $750,000. His premium? Less than his monthly gym membership. He laughed when he realized pizza night cost him more than protecting his family.

Whole Life Insurance

- Lasts your entire lifetime.

- Builds “cash value” (like a savings bucket you can borrow from).

- Costs way more than term.

👉 Best for people who already have strong finances and want long-term wealth tools.

Here’s the honest truth: for 80% of people, term life is the smarter choice. Whole life has its place, but most families simply need affordable protection.

Mistakes I See People Make All the Time

If you only take one thing from this blog, let it be this: don’t underinsure yourself. I’ve seen it happen too often.

Here are the common slip-ups:

- Buying tiny coverage

Folks grab $100k policies thinking it’s plenty. It isn’t. One funeral and a year of bills, and poof—it’s gone. - Depending only on job insurance

I can’t stress this enough. Lose the job, you lose the coverage. Not worth the risk. - Not shopping around

Companies price policies differently. Two quotes for the same coverage can be hundreds apart. Always compare. - Ignoring lifestyle factors

Smokers, I’m looking at you. Quit smoking, and your premium could literally be cut in half. - Waiting too long

Every year you wait, your price goes up. And if health issues creep in? Forget it. It skyrockets.

What’s Trending in the Life Insurance World

The U.S. market is shifting fast. A few things you should know:

- Millennials are buying now. Many skipped insurance in their 20s, but once houses and kids came into the picture, they woke up.

- Term life rules. About 7 out of 10 new policies are term. No surprise—it’s affordable and straightforward.

- Digital applications are huge. You can now get covered online in minutes. No mountains of paperwork.

- Rates are still low. Even with inflation everywhere else, life insurance is one of the few things that

- hasn’t blown up in price.

Top 5 Questions People Always Ask Me

1. Do I really need life insurance if I’m single?

Short answer: probably. If nobody depends on you, maybe not. But if you’ve got student loans with a co-signer, or you’d like to leave something for your parents or a cause you care about, it’s worth having.

2. How often should I review my coverage?

Life changes, so should your policy. Rule of thumb—every 3–5 years, or any time you hit a milestone: marriage, baby, house, new job.

3. Isn’t term life a waste if I outlive it?

Not at all. You don’t complain about car insurance if you never crash, right? Same logic. The win is peace of mind.

4. I’m the only earner—how much do I need?

This is where you don’t cut corners. Minimum 10–12x your salary, plus debts and mortgage. You’re the backbone—your family can’t afford gaps.

5. Can I stack policies?

Absolutely. Lots of smart folks layer coverage. Maybe a 30-year term to cover the mortgage, plus a 20-year term for kids’ education years. Flexible and often cheaper than one giant policy.

Wrapping It Up: Your Number, Your Peace of Mind

So after all this, how do you answer the big question—“How much life insurance do I need?”

Here’s your quick cheat sheet:

- Kill the mortgage.

- Clear all debts.

- Add $15–25k for final expenses.

- Replace your income (10–12 years).

- Add college costs if you’ve got kids.

For most American families, that comes out somewhere between $500k and $1.5 million. And thanks to term life, it’s usually cheaper than you think.

- “If you’re currently taking medications like Ozempic, your coverage needs might differ. Here’s a detailed guide on Ozempic and life insurance in 2025 that explains what insurers look for and how to qualify.”

Final Thoughts

Look, no one likes talking about death. But here’s the reality: life insurance isn’t really for you—it’s for the people who love you.

I’ll be blunt: if the idea of your family struggling without you keeps you up at night, then you already know your answer. Don’t wait. Get the coverage. Lock in peace of mind.

Because when it comes to protecting your family’s future, there’s no such thing as “too early”—only “too late.”

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook