Ozempic Life Insurance 2025: 5 Powerful Ways Weight Loss Drugs Are Changing Premiums in the USA

Remember Sarah? She’s a mom from Atlanta. For years, she wanted to get life insurance to protect her family, but her weight and a new diabetes diagnosis made the prices crazy high. It was like the insurance companies were saying she was a huge risk, and it made her feel pretty bad.

Then her doctor told her about Ozempic Life Insurance. It wasn’t a miracle cure, but with some healthy eating and exercise, it changed everything. She lost 75 pounds! Her blood sugar got normal, her blood pressure dropped, and she felt like a new person. When she tried to get life insurance again, she was shocked. The price was cut in half! Sarah’s story shows a big change happening right now. It shows how modern medicine is not only making people healthier but also making life insurance more fair.

For a long time, insurance companies looked at your weight and health like it was a done deal. If you were a certain weight, you got a bad price, no matter what. But now, with popular drugs like Ozempic, Wegovy, and Mounjaro, that’s all changing. This isn’t just a small trend; it’s a huge shift that could save many families thousands of dollars on their life insurance.

At PrimeLifeCover.com, we think knowing about these changes is the first step to a better financial future for your family. This guide will walk you through the five biggest ways Ozempic life insurance is shaking up the industry in 2025.

Table of Contents

1. The Underwriting Revolution: From Old Rules to New Thinking

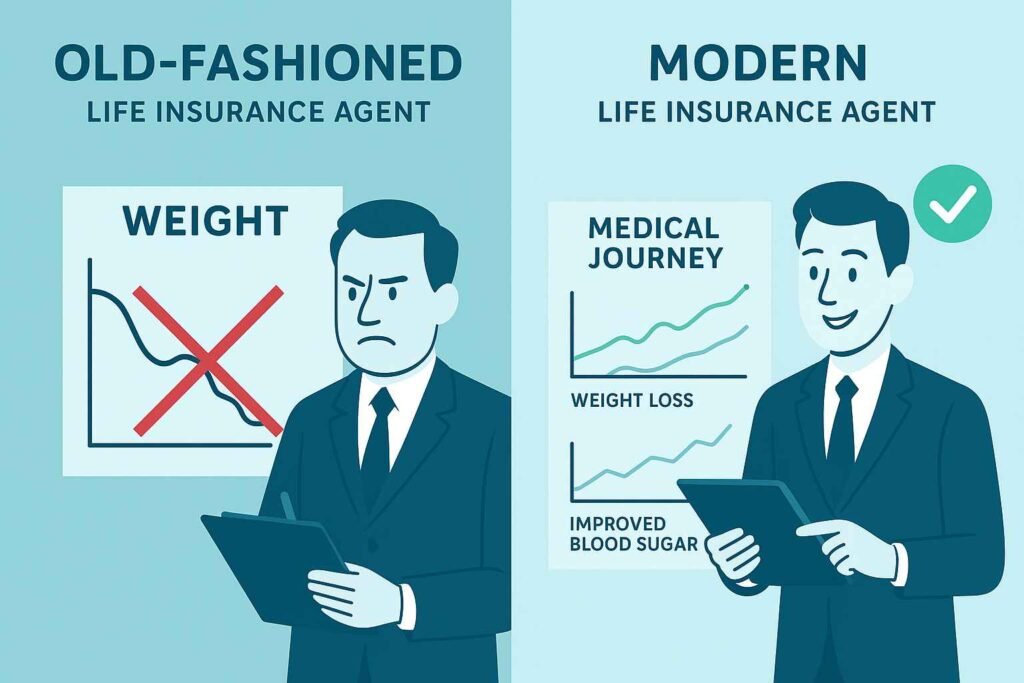

The single biggest change from drugs like Ozempic is how life insurance companies are now deciding on your risk. Before, a person with a high weight and health problems like diabetes would automatically get a high-risk rating and a much higher price.

Old School vs. The New Way

In the past, an insurance agent would look at a simple chart. If your weight was above a certain line for your height, you were a high risk. It didn’t matter what you were doing to get healthier.

Today, the smartest insurance companies are starting to see Ozempic use not as a warning sign, but as a positive sign of someone taking charge of their health. They’re not just looking at your weight today, but at your journey and how far you’ve come.

Learn more about how GLP-1 drugs are causing “mortality slippage” in the life insurance industry—and why underwriting forms are lagging behind—via this recentInvestopedia analysis.

Here’s what they are now looking at:

- Big and Lasting Weight Loss: Someone who has lost a lot of weight (like 50+ pounds) and kept it off for over a year is a much lower risk.

- Better Health Numbers: Insurance companies are giving big credit for better health. This includes normal blood sugar levels, lower blood pressure, and better cholesterol. These improvements can lead to a much better price.

- The Reason for the Medicine: Was Ozempic for diabetes or just for weight loss? While both are good, the reason can change the decision. Someone whose diabetes is now gone is a much better risk than they were before.

This change means that instead of a super expensive policy, a person who has successfully used Ozempic life insurance to improve their health could get a standard or even a “Preferred” price.

2. Getting Cheaper Prices and Better Policies

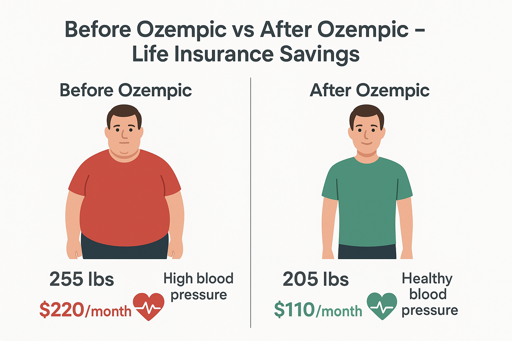

A better rating class means a lower price. The difference between a “Table 4” rating (which is very expensive) and a “Standard” rating for a $500,000 policy can save you thousands of dollars every year.

Let’s look at a simple example:

Example Person: A 50-year-old man, who doesn’t smoke, wants a $500,000, 20-year term life insurance policy.

| Before Ozempic | After Ozempic (18 months later) | |

| Weight | 255 pounds | 205 pounds |

| Health | Type 2 Diabetes, High Blood Pressure | Diabetes is gone, blood pressure is normal |

| Underwriting Class | Table 4 (Very High Risk) | Standard |

| Monthly Cost | $220 | $110 |

| Yearly Savings | – | $1,320 |

| Total Savings in 20 Years | – | $26,400 |

As you can see, the money you can save is huge. The secret to getting these savings is not just to lose the weight, but to show the journey. Talk to your doctor to get all the records of your progress. This is where a good advisor comes in handy.

3. Best Life Insurance Companies for People Using Ozempic in 2025

While all insurance companies are slowly changing, some are ahead of the game. These companies understand the science behind drugs like Ozempic and are more willing to give you a fair price based on your current health, not just your past.

Here’s a list of some of the top U.S. life insurance companies known for being more flexible with people who have used Ozempic life insurance to get healthier.

| Company | How They See Ozempic Users | What’s Good About Them |

| Protective Life | Known for being flexible about weight loss and health issues. They often give a much better rating than you’d expect to people who show big, proven health improvements. | Very flexible, good prices, and many different policy lengths (up to 40 years). |

| Lincoln Financial Group | They look at each case on its own. They are known for handling tricky health histories, including those who have managed their diabetes and lost weight. | Many different types of policies, from simple term to more complex ones. They are known for great customer service. |

| Prudential Financial | A leader in insuring people with high-risk health issues. Prudential is more likely to offer a policy to someone with past health problems, as long as they can show they’ve gotten much better. | Many different products, including a special feature that lets you use your death money early if you get a serious illness. |

| MassMutual | They look at your whole health story. They look past just one number and see the full picture, including lasting lifestyle changes. | A very strong and stable company with a history of paying out good money to policyholders. |

| Penn Mutual | Known for their personal approach. They are a good choice for someone who has a strong story to tell about their health journey with Ozempic life insurance. | A company that focuses on long-term relationships. Offers both term and permanent policies. |

When you are looking for Ozempic life insurance, don’t just take the first price you get. Work with a broker who can show your information to many companies to find the one that gives you the best price for your unique situation.

4.The Good and Bad of Applying with Ozempic

Look, when you’re thinking about getting life insurance and you’re on a drug like Ozempic, you gotta know a few things. There are some huge upsides, but also a couple of things to be smart about.

The Great News

- Way Better Prices: This is the best part. When you get healthier, the insurance company sees you as less of a risk. And guess what? When you’re less of a risk, they give you a better deal. It’s that simple.

- You Can Finally Get a Policy: For a long time, if you were overweight or had certain health issues, you couldn’t even get life insurance. Or it cost a ton of money. Ozempic life insurance can change that. It opens doors that were shut before.

- Easier Paperwork: A healthier you means less hassle. No more long medical tests. The whole process is just way smoother.

- It’s Not Just About Money: Honestly, the biggest win here isn’t the life insurance. It’s your health! Lowering your risk for heart attacks and other stuff is a huge deal. The lower price on your policy is just a sweet bonus.

Things to Watch Out For

- Don’t Jump the Gun: Insurance companies want to see that your weight loss is for real and will stick around. If you apply too soon after starting Ozempic, they might not be convinced. Most of them want to see you at a steady weight for at least a year. Just be patient.

- Why Are You Taking It?: Some companies are still a little iffy if you’re taking the drug just for weight loss and not for a medical issue like diabetes. This is a key reason to have a pro on your side who knows which companies are cool with Ozempic life insurance.

- Be Honest: I can’t say this enough. You have to be completely upfront about using this medicine. If you hide it and something happens later, the company could refuse to pay your family. Being honest is the only way to go.

5. What About Taxes and Claims in 2025?

Okay, let’s talk about the final details. Getting your Ozempic life insurance policy is a great step, but it’s also smart to know how it all works.

Life Insurance and Your Taxes

In the U.S., life insurance is a slick way to save on taxes. The rules from the IRS haven’t really changed in 2025.

- Your Family Gets the Money Tax-Free: Here’s the best part: the money your family gets from your policy is almost always tax-free. That means they get every penny, which is a huge help for their future.

- Cash Value Grows Tax-Free: If you have a policy that builds cash, that money grows without you paying taxes on it. You only pay taxes if you take the money out.

- Borrowing from the Policy: You can often borrow money from your policy’s cash value, and those loans are usually tax-free.

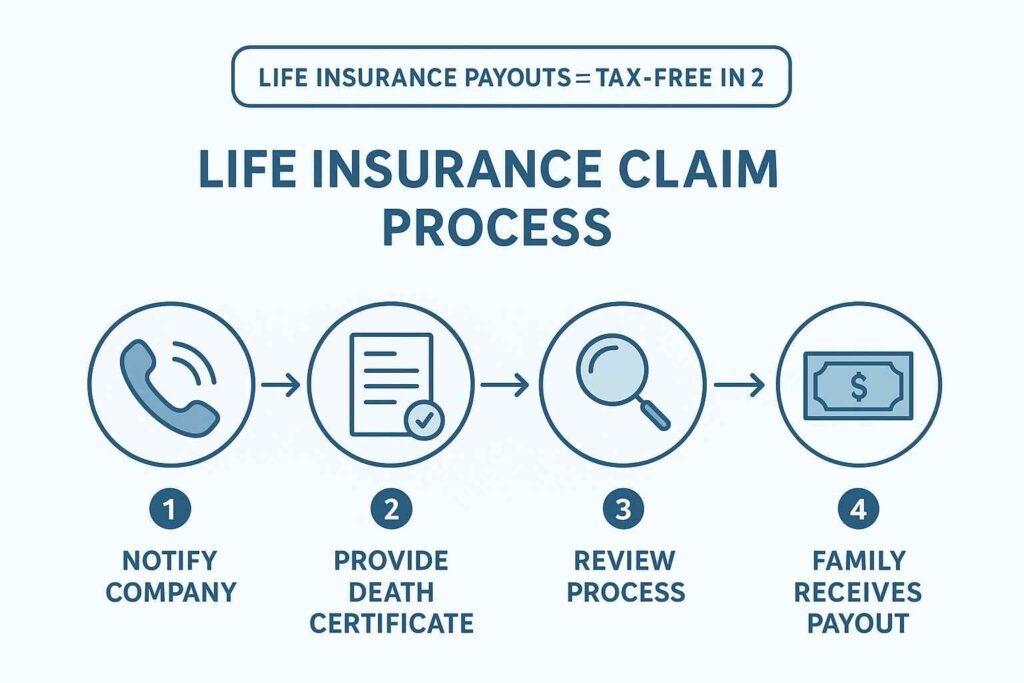

The Claim Process

The process for your family to get the money after you pass away is pretty simple.

- Notify the Company: The first step is for your family to call the insurance company and let them know.

- Provide the Paperwork: They’ll need a copy of your death certificate and a few other forms. The company will guide them through it.

- The Company Checks Things: The company will review the claim. This is where your honesty about your health (and your Ozempic life insurance) is super important. If you passed away within the first two years, they might double-check your application to make sure everything was truthful.

- Payout: Once everything is approved, they’ll send the money. Your family can choose to get it all at once or in payments.

For more details, please check out our full guide on “How to File a Life Insurance Claim.”

Your Questions, Answered (FAQs)

What is the “contestability period” in the U.S.?

Think of it as a two-year trial period. The insurance company has that time to review your application. If they find you weren’t honest about something important, they could deny the claim. That’s why being truthful about your Ozempic life insurance is so important.

Will my medical exam show I’m taking Ozempic?

Yep. When you do the medical exam for life insurance, they take blood and urine. The medicine in Ozempic will likely show up. It’s always best to be straight up about it from the very start.

How long should I wait after starting Ozempic to apply?

You can apply whenever, but to get the best price, it’s smart to wait until you’ve had significant weight loss and have kept it off. Most companies like to see a steady weight for at least 6 to 12 months.

What if I stop Ozempic and gain the weight back?

The price you get for your policy is locked in. For a 20-year term policy, your rate won’t change, even if your health does. But if you were to apply for a new policy down the road, your current health would be a factor again.

Do all insurance companies have the same rules for Ozempic?

Nope, and this is a big deal. Every company is different. Some are way more open to rewarding people for taking control of their health, while others are still old-school. This is exactly why you need a pro to help you find the right company for Ozempic life insurance.

Can I be denied life insurance just because I take Ozempic?

It’s super unlikely. They don’t deny people for taking a medicine that’s helping them get healthier. They might say no if your underlying health problems are really serious, but using Ozempic is usually seen as a positive step.

My Final Advice & What to Do Now

The world of life insurance in the U.S. is changing fast. What was once a problem for millions of people is now a great opportunity. Ozempic and other drugs like it aren’t just a medical game-changer; they’re a financial one, too.

If you or someone you care about is going through this, don’t let your past health struggles stop you. Here’s what you can do:

- Celebrate your progress: Taking steps to improve your health is a big achievement. Give yourself credit—it really matters.

- Keep your records handy: Ask your doctor for a simple summary of your journey. Note things like your starting weight, where you are now, your blood pressure, and any other key details.

Read our more blogs

1. whole life insurance in the USA (2025 benefits and rising dividends)

2.compare life insurance quotes for 2025

Just a heads-up

this post is only for general information. It’s not medical or financial advice. The details shared here reflect what’s known in 2025, but things can change. Before you make any important decisions, talk it over with your doctor and a licensed life insurance professional. Insurance rules, including those from the NAIC, may be updated at any time.