The Silver Economy and Life Insurance for UK Seniors: Bridging the Protection Gap in 2025

If you’ve been paying any attention at all to how things are changing here in the UK, you’ll have noticed there’s one group that’s quietly becoming the most powerful economic force of all: our seniors. Our over-60 population isn’t just the fastest-growing bunch around, but they’re also one of the most financially influential. And honestly, that’s exactly why this whole chat about the Silver Economy and life insurance for UK seniors matters so much more than ever before.

📌 Pull-Quote:

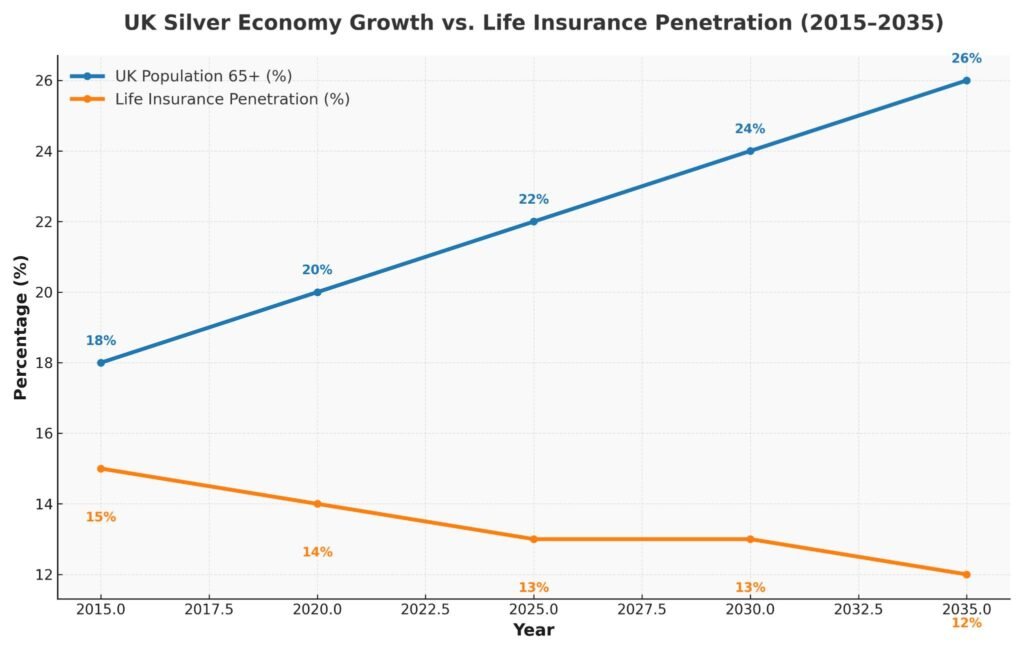

“By 2035, 1 in 4 UK residents will be over 65.”

That’s a huge number, isn’t it? To put it into perspective, within just a decade, almost every fourth person you see at the supermarket, in the park, or even on the train could be 65 or older. And while I think that sounds like a beautiful reflection of longer lives and better healthcare, it also brings up some pretty awkward questions.

Here’s the thing, and it’s a big one: despite their growing numbers and financial clout, so many seniors are just… underinsured. That gap — the one between the protection people really need and what they actually have — is what the insurance world calls the protection gap.

And believe me, it’s not just a minor issue. Families end up having to cover funeral costs themselves, inheritance tax takes a painful bite out of what’s left, and seniors often leave less behind than they could have — all because they didn’t get the right life insurance to close that gap.

In this blog, I’m going to get stuck into why this happens, what products actually make sense for people over 50 or 60, and how both insurers and seniors can take steps to sort this out before it’s too late. If you’ve ever wondered where the Silver Economy and life insurance for UK seniors connect, this one is definitely for you.

Table of Contents

What is the Silver Economy?

The term ‘Silver Economy’ may sound a bit like a corporate buzzword, but it’s a very real (and massive) phenomenon. Simply put, it’s the part of the economy that revolves around older adults — their spending power, their needs, their lifestyles.

Here in the UK, we often hear about the Grey Pound. And honestly, it’s far from pocket change.

📌 Pull-Quote:

“The Silver Economy is one of the largest untapped financial markets in the UK.”

Recent figures suggest the Grey Pound is already worth over £320 billion annually. That’s spending on everything from healthcare to housing, travel, leisure, and yes — financial stuff like insurance. And when we talk about insurance here, it’s directly tied to the Silver Economy and life insurance for UK seniors, because this is where protection meets spending power.

So why should insurers even care? Because older adults aren’t just living longer, they’re also more active, more engaged, and in many cases, wealthier than past generations were at their age. But here’s the catch: being wealthy doesn’t always mean you’re protected. A lot of seniors don’t have the right cover in place to protect themselves or their families financially.

And that’s exactly where the life insurance industry comes into its own.

The UK’s £2 Trillion Protection Puzzle

So, what on earth is this “protection gap” that everyone in the City keeps banging on about? In plain English, it’s simply the difference between the financial cover we all really need to shield ourselves from life’s nasties—like an early death, a debilitating illness, or just those pesky unexpected costs—and the amount we’ve actually got tucked away.

Just think about a typical couple in their 60s. They might own their home outright, have a decent chunk of savings, and perhaps even a tidy pension pot. Sounds pretty sorted, doesn’t it? But what happens if one of them pops their clogs and there’s a hefty inheritance tax bill to pay, or if they suddenly need cash for long-term care? Those hard-earned savings can go up in smoke in a flash, and families are often left scrambling to find the dosh.

The protection gap in the UK life insurance market is estimated at over £2 trillion.”

Yes, you read that right. Trillions. And trust me, that’s not just some made-up figure on a spreadsheet—it’s real money that UK families are missing out on in terms of protection. When you put that against the backdrop of the Silver Economy and life insurance for UK seniors, the mismatch is honestly quite alarming.

That chart would show something pretty worrying: while the senior population rises year after year, the percentage of insured seniors just hasn’t kept up.

Why UK Seniors Remain Underinsured

Now, let’s get into the “why.” From what I’ve seen, it boils down to two main things: what people think and the real-world barriers.

Common Misconceptions

- “Life insurance is only for young families.” I hear this all the time. People just assume that once the kids are grown and gone, the need disappears. But honestly, life insurance can be just as relevant in your 60s as it was in your 30s. Especially when you see how the Silver Economy and life insurance for UK seniors work together in estate planning.

- “I don’t need cover after paying off my mortgage.” True, you may not need mortgage protection anymore. But what about funeral costs, inheritance tax, or leaving a little something behind? Those things don’t just vanish when the mortgage does.

- “Premiums are too expensive after 50.” Sure, they’re a bit higher. But there are products designed specifically for older adults that keep premiums reasonable.

Real Barriers

- Lack of awareness: So many seniors just don’t know about products like Over-50s Life Cover, which offer guaranteed acceptance.

- Healthcare costs & longevity risk: People live longer now, but that also means a higher chance of health issues cropping up.

- Financial illiteracy: It’s a harsh truth, but a lot of people over 60 have never had financial advice beyond “save for retirement.”

Key Life Insurance Products for the Silver Generation

This is where things get really practical. What products actually make sense for people in their 50s, 60s, or even 70s? Let’s break it down.

- Over-50s Life Cover Guaranteed acceptance, no medical exam, and small payouts (perfect for funeral costs or small debts).

- Whole-of-Life Insurance This is permanent cover, and it’s best for inheritance tax planning. The premiums are higher, but it’s worth it if you want to leave something behind.

- Funeral Insurance / Prepaid Plans Covers funeral costs directly, which really takes the stress off the family.

- Health-Linked Policies These combine life cover with chronic illness or long-term care benefits. They’re getting more and more popular as people worry about dementia and other age-related issues.

Each of these sits right at the intersection of the Silver Economy and life insurance for UK seniors, designed for real, practical needs, not just some theory.

Role of Life Insurance in Inheritance Tax Planning

Here’s where things get really interesting and honestly, in my view, this is the most overlooked area of all. (UK Government guidance on Inheritance Tax double taxation relief)

Currently, the Inheritance Tax threshold in the UK is £325,000. It sounds generous, but with house prices the way they are, many families easily go over that line.

And here’s the kicker: from 2027, pensions will also be included in inheritance tax.

That means families could suddenly find themselves with tax bills in the tens or even hundreds of thousands.

Explore how UK life insurance and inheritance tax planning can protect your legacy under new 2026 IHT rules.

📌 Case Study Box Mr. & Mrs. Jones, Age 65 & 63

- Assets: £500,000 home + £200,000 savings.

- Concern: Their kids would face a 40% IHT bill above the threshold.

- Solution: Whole-of-life insurance written into a trust.

- Result: Saved over £100,000 in potential IHT.

That’s a huge difference, isn’t it? And it’s exactly why I keep saying — don’t think life insurance is just for people with young kids or a mortgage. It’s also a powerful tool for estate planning, especially in the bigger context of the Silver Economy and life insurance for UK seniors.

The New Face of Life Insurance

The good news? The insurance lot are finally getting with the programme. In fact, some of the most exciting stuff happening in finance right now is all about new products designed just for older people.

- Clever New Tech: Think smart ways of working things out that mean fewer trips to the doctor, and even a little reward—like a discount—for keeping on top of your health.

- All-in-One Packages: These are cracking new products that bundle things like your pension, annuities, and life cover into one easy-to-manage package.

- Straightforward Advice: Digital tools are popping up all over the shop, explaining your options in plain English, not that confusing jargon.

- Learn about the Bank of England liquidity rules for UK insurers in 2025 and their impact on financial stability.

The Big Opportunity for UK Insurers

From an insurer’s point of view, our ageing population isn’t a problem—it’s a massive golden opportunity. Just have a think about this for a second: the “Grey Pound” is set to be worth a staggering £600 billion by 2035. That’s a huge amount of cash, and a good chunk of it is still completely unprotected. The insurers who get this right—who actually design products older people want and understand—are the ones who’ll be laughing all the way to the bank.

That’s why the future of UK insurance is tied so closely to the “Silver Economy” and life insurance for seniors.

Sorting Out Your Own Policy

Right then, let’s switch our focus to you. If you’re 50, 60, or a bit older, where do you even begin?

- Compare the cost against the payout.

- Don’t forget about the tax perks.

- Look for flexibility.

- Have a chat with an FCA-regulated advisor.

Taking these small steps will make sure you’re not left behind while the Silver Economy and life insurance for UK seniors continue to change how we all plan for the future.

Final Thoughts: Closing the Gap

To sum it all up quickly:

- The UK’s older population is growing faster than ever.

- Loads of seniors are underinsured, which could leave their families in a right pickle.

- The right mix of products—and a bit of common sense—can close that gap.

In my view, this is one of those “act now or you’ll regret it later” situations. “If you’re over 50, don’t hang about—getting your life insurance sorted today means peace of mind tomorrow.”

FAQ Section

Q1. What’s the “Silver Economy” in the UK?

It’s basically all the money being spent by people over 60. They’ve often got a decent amount of spending power but are a bit under-protected financially. The connection between the Silver Economy and life insurance for UK seniors is crystal clear.

Q2. What is the protection gap?

It’s the difference between the cover people really need for things like death or illness, and the cover they’ve actually got.

Q3. Is life insurance for over-50s worth it in the UK?

Definitely. Over-50s life cover guarantees you’ll be accepted, while whole-of-life policies are a massive help with inheritance tax and funeral costs.

Q4. How can seniors cut down on inheritance tax?

By putting life insurance policies into a trust. This way, the payout goes straight to the beneficiaries and doesn’t get counted as part of your estate, so it stays tax-free.

Q5. What new things are changing senior life insurance?

Clever new ways of figuring out the risk, all-in-one pension-insurance packages, and discounts for staying healthy are the key things happening right now.

Disclaimer

This article is for general info only. For personalized advice, you should chat with a licensed financial advisor or life insurance pro in your area.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook