Best Life Insurance Australia 2025: Market Overview, Top Providers & How to Choose

If you’ve ever tried to sort out your life insurance in Australia, you’ll know it’s not exactly a walk in the park. It’s more like trying to buy a new ute—so many choices, heaps of opinions, and then there’s all the fine print that just makes your eyes glaze over. I’ve been down that road myself, spent way too many nights scrolling through comparison sites, and thought, “you know what, let’s break it down in plain English.” Hopefully this will give you a better idea of where the market’s at in 2025, who the big players are, and how you can actually choose something that suits you—not just what looks flashy in an ad. This is my take on the Best Life Insurance Australia 2025.

Table of Contents

Why Life Insurance Still Matters in 2025

Let’s be honest—life insurance isn’t anyone’s favourite topic over a beer. But if you’ve got a family, a mortgage, or even a small business you’re worried about, it’s one of those grown-up things you can’t just ignore. In my view, it’s not about being morbid—it’s about peace of mind. Knowing that your partner or kids won’t be left scrambling if something happens to you, that’s worth its weight in gold.

And with the cost of living biting harder than ever, plus all the conversations around mental health and long-term health risks, more Aussies are starting to look seriously at their cover. It’s no wonder “Best Life Insurance Australia 2025” is one of the most-searched phrases in finance right now, and a question many are asking is, what is the Best Life Insurance Australia 2025 for me?

The Australian Life Insurance Market in 2025

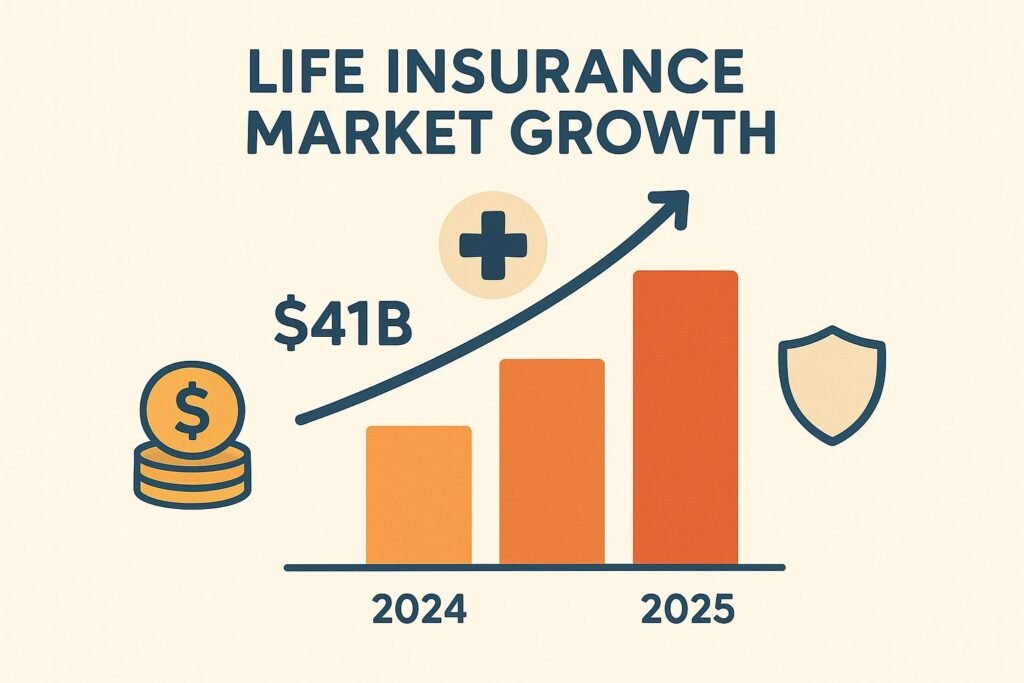

This market’s massive. Reports say it was valued at over $41 billion in 2024,(APRA life insurance statistics) and it’s still growing. That tells me two things: one, Aussies are finally waking up to how important this stuff is, and two, insurers are fighting hard for our attention. This competition is great for finding the Best Life Insurance Australia 2025.

Something that stood out to me is that most payouts these days aren’t even death benefits—they’re “living benefits.” Think income protection, trauma cover, or TPD (total and permanent disability). TAL, which is the biggest player, said more than 70% of claims last year went towards these. It makes sense when you think about it—people aren’t just worried about the worst-case scenario anymore, they’re worried about what happens if they can’t work for months or years.

And then there’s the tech. Some insurers are linking up with wearables like Fitbits to personalise premiums. Others are using AI to speed up applications and claims. Part of me thinks that’s brilliant—we all want things faster—but part of me goes, “do I really want my insurer tracking my steps?” Anyway, it’s the reality now, and it affects what makes up the Best Life Insurance Australia 2025.

The Big Players in 2025

When you’re searching for the Best Life Insurance Australia 2025, you’ll see a few big names pop up over and over again. These are the companies that have a lot of the market share, and for good reason. From what I’ve seen, these are the ones everyone talks about:

- TAL: These guys are the big kahunas. They pretty much own a third of the market. They’re a safe bet, and in 2024, they paid out over $4 billion in claims, which is a massive number. They’ve got all the different types of cover you could want—life, trauma, TPD, income protection—and their online stuff is surprisingly easy to use. A lot of people see them as the most reliable option for the Best Life Insurance Australia 2025.

- AIA Australia: You’ve probably heard of their “AIA Vitality” program. It’s their big thing. It gives you rewards for living a healthy life. It’s a cool idea if you’re already a gym junkie or a health nut, but if you’re not into the whole “my insurer knows my step count” thing, maybe it’s not for you. It’s a real choice you have to make when looking for the Best Life Insurance Australia 2025.

- Zurich: Big name, worldwide. Aussies know ’em well, mostly for their trauma cover. They can be a bit pricey, yeah, but plenty of people reckon the extra bucks are worth it for peace of mind. For some folks, Zurich’s the go-to when they think about the Best Life Insurance Australia 2025.

- MLC Life Insurance: If you’re after something that’s not too complicated and won’t break the bank, MLC is a great shout. They’re known for having flexible policies and pretty good prices. They’ve really been trying to improve their customer service, which is always a good sign. They’re a solid option, especially for a family looking for the Best Life Insurance Australia 2025 on a budget.

- Others: Don’t forget about some of the others either. Resolution Life took over AMP Life, so they’re still a big name. ClearView is a bit smaller but they’re getting more attention, and there are a bunch of new tech start-ups trying to shake things up.

A Simple Comparison

Here’s a quick look at how the main players stack up. This isn’t a deep dive, but it should give you a starting point in your search for the Best Life Insurance Australia 2025.

| Provider | Why They’re Good | Who They’re Best For |

| TAL | They’re the biggest and they pay out a lot. They’re reliable. | People who want a provider they can trust. |

| AIA | Their “Vitality” program rewards you for being healthy. | Someone who’s already into fitness and wants a discount for it. |

| Zurich | They have a great reputation, especially for serious health issues. | Someone who wants top-tier protection and doesn’t mind paying a bit more. |

| MLC | Their policies are easy to understand and well-priced. | Families or people who want something simple and affordable. |

| Resolution/ClearView | They’re often good for simple, easy-to-get cover. | Younger folks who just need a basic policy to get started. |

How Do You Choose the Right One?

Here’s where it gets personal. The Best Life Insurance Australia 2025 for me isn’t necessarily the best for you. It really depends on your lifestyle, family, and money situation. But here’s how I tackled it:

- Figure out what you need. For me, it was more about income protection than a huge death benefit. Ask yourself: is it the mortgage you’re worried about? The kids’ schooling? Keeping your partner afloat if you can’t work? This is the first step to finding your Best Life Insurance Australia 2025.

- Don’t just chase the cheapest. I nearly got stung with a cheap policy that excluded mental health. With mental health claims on the rise, that’s a big red flag. The cheapest isn’t always the Best Life Insurance Australia 2025.

- Check the fine print. Yeah, it’s boring, but things like how they define “total and permanent disability” can make or break your claim. The fine print is key to finding the Best Life Insurance Australia 2025.

- Look at claims reputation. For me, the real test is how they treat you when things go wrong. TAL and AIA pay out billions, but you want to check if they’re quick and fair.

- Comparison tools are pretty handy, but don’t trust ’em blindly.Sites like Finder or Canstar are great for getting an overview, but remember some earn commissions from insurers.

What’s New in 2025?

- Genetic testing rules: The gov’s trying to stop insurers from judging people on their genes. Could be a big shift for anyone chasing the Best Life Insurance Australia 2025.

- AI in claims: Quicker claim approvals, though some folks worry it might not always feel fair.

- Wellness discounts: Hit the gym, eat well, and you could score cheaper premiums.

Common Mistakes Aussies Make

From chats with mates, these are the big ones:

- Getting too little cover. $200k sounds like a lot until you look at a $500k mortgage and school fees.

- Paying for more than they need.

- Forgetting to update when life changes—marriage, kids, new house.

- Skipping income protection, which, honestly, is often more important than death cover.

My Two Cents

Honestly speaking, if you asked me today what the Best Life Insurance Australia 2025 is, I’d say it depends. Personally, I’d lean towards a provider with a strong claims history, even if it costs more. Peace of mind’s worth a few extra bucks. If you’re young and love fitness, AIA Vitality could be right up your alley. If you want reliability, TAL or Zurich are hard to beat. And if you’re just watching the budget, MLC’s not a bad choice. It’s a matter of finding the Best Life Insurance Australia 2025 for your own situation.

One bit of advice? Don’t rush it. Read the details, compare carefully, and if you can, chat with an adviser. Your future self (and your family) will thank you.

FAQ

What’s the cheapest life cover you can grab in Australia in 2025?

Depends on your age and health. MLC and ClearView often come out cheaper, but shop around.

Is AIA Vitality worth the hassle?

If you’re already into fitness, yep, you can save money. If you’re not, it might feel like more effort than it’s worth.

How much cover do I really need?

Think debts, living costs for 5–10 years, and future expenses like school fees. That’s a good starting point.

Do insurers actually pay out

Yes—TAL, AIA, and Zurich pay billions each year. The key is knowing what’s included and excluded

Should I bother with an adviser?

If your situation’s tricky or you’re confused by the fine print, an adviser can save you headaches.

Final Thoughts

The life insurance game in Australia’s changing quickly. With tech, new rules, and rising demand, it’s never been more important to take a closer look at your cover. Whether you go with TAL, AIA, Zurich, or MLC, the key is making sure it actually fits your life.

When people look up Best Life Insurance Australia 2025, I don’t see it as just some Google thing. To me, it’s more like a reminder. Life insurance isn’t really about numbers, forms, or fancy words. It’s about the people we love. End of the day, no one cares about the paperwork. What matters is the feeling that your family will be safe if something happens. And that, in my view, is the real reason we even think about life insurance.

Disclaimer

This article is for general information only and not financial advice. Always chat with a licensed adviser before making decisions about life insurance.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook