AI Life Insurance Underwriting USA: How Artificial Intelligence is Transforming Coverage in 2025

Introduction

Hey everyone! You know how sometimes you have to do something that’s really, really important, but it’s also a giant headache? For a long time, getting life insurance was just like that. I remember watching my uncle go through it. He had to deal with a mountain of forms, schedule doctor visits, and then sit around waiting. It was super slow and a total drag. I always thought to myself, “There’s got to be a better solution than this.”

And guess what? There is! I’ve been doing some looking around, and I found out about this awesome new way of getting life insurance. It’s all because of something called artificial intelligence, or AI. We’re talking about AI life insurance underwriting USA, and it’s a total game-changer. This isn’t just a new, fancy word. It’s about making our lives so much easier when it comes to protecting the people we love.

In fact, Forbes recently explained how AI is transforming life insurance underwriting in the USA, showing how technology is helping reduce paperwork, cut wait times, and speed up approvals.

Table of Contents

The Old Way: A Big, Slow, Bumpy Road

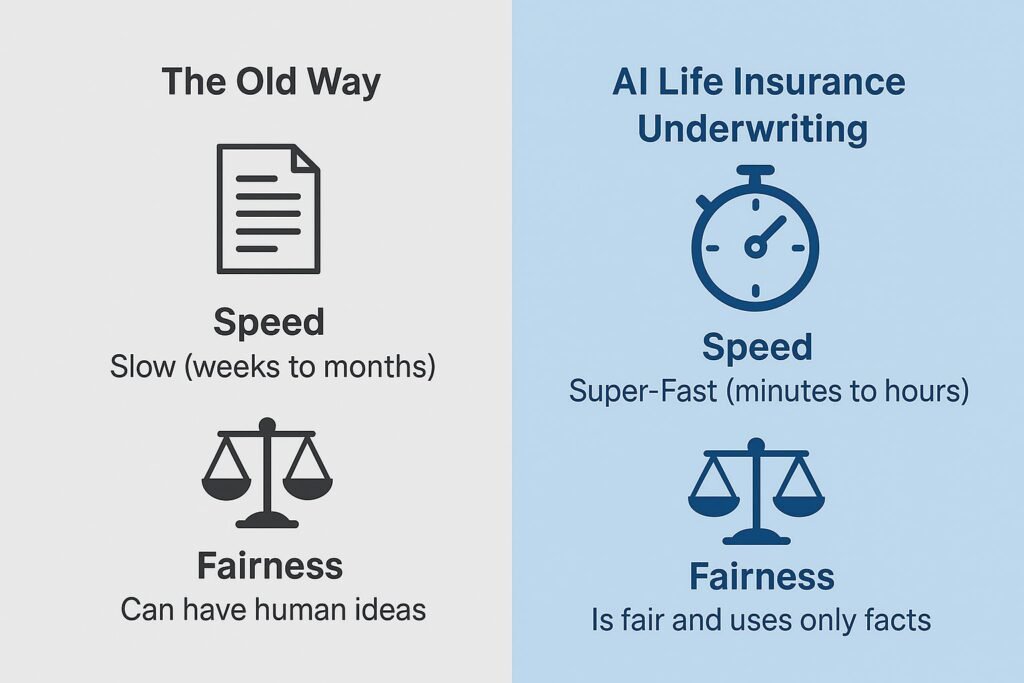

Let’s quickly talk about the way things used to be. The old way of getting life insurance was a long and bumpy road. The people who check your papers, they’re called underwriters. And they had to read every single thing by hand. I’m not kidding. They would look at all your doctor’s notes and papers, your family’s health history, and even your driving record. It was a huge job for them, and it took a very, very long time. My uncle said it took over a month just to get an answer!

And to be honest, it wasn’t always fair. A person might see one small health problem from a long time ago and think you are not healthy now. Even if you eat all your healthy food and play outside every day, that one old paper could make it harder for you to get life insurance. It felt like a guessing game, and you never knew what the answer would be.

Meet AI: The Super-Fast Helper

So, how is AI life insurance underwriting USA making things so much better?

The old way was a person buried under piles of paperwork. The new way? A super-smart computer can go through a ton of information all at once. Think of it like a lightning-fast reader that just doesn’t get tired. It can check out things like your medical notes, reading all the important stuff in just a few seconds. It’s a lot faster than a human looking at every page.

- Public records: It can look at things like your driving record very fast. It gets the facts it needs in a flash.

- Other cool info: With your grown-up’s permission, some companies can look at data from a fitness watch. This can show the AI how active you are. It’s a great way to show that you are a healthy person, which can help you get a better price.

Because of this, the AI life insurance underwriting USA process is a hundred times faster. What used to take weeks and weeks can now be done in minutes or a few hours. It’s like going from walking to school to flying in an airplane! It’s truly amazing how fast it is.

Why This is So Great for Everyone

There are two big reasons why using AI for life insurance is so awesome.

- First, there is speed. Imagine if you could get a new toy just by clicking a button. That’s kind of what this is like. You can fill out a simple online form and get an answer almost right away. This is a huge help for grown-ups who need to get life insurance very fast. It takes away all that waiting and worrying.

- Second, there is fairness. An AI system does not have feelings or ideas about people. It looks at all the numbers and facts, and it doesn’t get stuck on one little thing. It sees the whole picture. For example, maybe you have a family history of a health problem, but the AI sees that you are super active and healthy. The AI can see this and give you a better price. AI life insurance underwriting USA is making sure you get a price that is right for you, not just for a group of people.

- In fact, LIMRA research shows how AI is reshaping the life insurance underwriting process in the USA, helping insurers adopt fairer, faster, and more transparent practices across the industry.

The best part is that more people can get life insurance now. It makes sure that families are safe and taken care of, and it’s a lot less scary for everyone. This new way is helping so many people. It’s a real positive change in the world of grown-up things.

My Personal Adventure: Trying it Out Myself

I’m always a little bit cautious about new things, so I wanted to see if this AI life insurance underwriting USA stuff was real. I decided to try it out. I looked at how three different companies did their life insurance. I’ll call them Company A, Company B, and Company C.

Company A was an old company. I had to fill out a lot of papers, and then I had to wait. And wait. And wait. It took over a month for them to get back to me. It felt just like the old days. I was not happy about it at all.

Company B was a little better. They used some computers to help, but they still wanted me to go to the doctor for a checkup. It was faster than Company A, but it still took a long time. It was a little bit annoying.

But Company C was a total superhero! They used a powerful AI life insurance underwriting USA system. I went online, answered a few easy questions, and I got a price right away. The next day, I had a final offer, and I didn’t even have to go to the doctor or talk on the phone with anyone. It was so fast and so easy. I was super happy about it.

In my opinion, the future of insurance is with companies like C. They are not just using AI to be cool; they are using it to make life better for us, the customers. This new way is here to stay, and it’s a good thing.

Comparison Table

| What You Get | The Old Way | The New AI Way |

| Speed | Slow (weeks to months) | Super-Fast (minutes to hours) |

| Data Review | A person looks at papers | A computer looks at data instantly |

| Fairness | Can have human ideas | Is fair and uses only facts |

| Doctor Checkup | Often needed | Can often be skipped |

| Your Experience | Annoying and slow | Simple and happy |

Want to make the smartest choice between different insurance offers? Check out our comparison guide at Compare Life Insurance Quotes for an easy breakdown of the best options.

Your Questions, Answered (FAQs)

Q1: Is this AI stuff less safe?

A: No, it’s not. It’s actually the opposite! AI is made to be very fair. It uses facts and numbers to make choices, which helps to stop human mistakes. It is very, very safe.

Q2: Will I still have to go to the doctor for a checkup?

A: For a lot of life insurance plans, you will not have to! The AI life insurance underwriting USA process can give you a final price without you ever going to the doctor. But for a very big life insurance plan, a doctor’s checkup might still be needed.

Q3: Is my information safe with the AI?

A: Yes. Companies that use AI for this have very strong computer security to keep your information safe. They only use the information that you say is okay to use. They have to follow very strict rules to keep your information private.

Q4: How do I find a company that uses AI underwriting?

A: Look for companies that say things like “Get a price in minutes,” “Instant approval,” or “No doctor exam needed.” These are big clues that they are using the modern AI life insurance underwriting USA technology to help you.

Why This is Such a Big Deal

This change is not just a small thing for big companies; it is a big deal for everyone. The old way could be very stressful and confusing. But the new way, with AI life insurance underwriting USA, is all about making things simple. It means you can get the protection you need without a lot of worry. It helps to make sure that families are protected for a long, long time.

Imagine needing to get life insurance for someone you love. The old way, you would be worried sick, waiting for an answer. The new way, you can get a quick answer and feel good about it right away. This is why this change is so very important.

The rise of AI life insurance underwriting USA is a big step forward. It shows us how computers and technology can really help people in a good way. It’s making a big difference in how the world of insurance works.

Conclusion: A Better Way is Here

The move to AI life insurance underwriting USA is a big win for everyone. It means less waiting, a fairer price, and an experience that is a hundred times better. This isn’t just a fun new thing; it’s becoming the normal way of doing business. My own tests showed me just how much better it is.

If you are thinking about getting life insurance, you should look for a company that is using this new technology. It will save you so much time and make everything so much easier.

For single parents looking for budget-friendly ways to protect their families, explore our guide on Affordable Life Insurance for Single Moms in the USA — insurance solutions that are both caring and cost-effective.

Ready to see how easy it can be?

Click here to get a free, fast quote today! (CTA)

Disclaimer

This is just for your information. I am not a financial expert or an insurance agent. You should always talk to a professional before you make any big decisions, like buying an insurance plan. My thoughts here are based on my own research and what I found.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.