SMSF Life Insurance 2025: Your Mate’s Guide to Protecting Your Family

G’day, everyone! Pull up a chair and let’s have a real yarn. We’re all busy with work, family, and trying to get ahead, but there’s one thing we often push to the side: what happens if the chips are down? If you’ve got an SMSF, this isn’t just a “what if”—it’s something you need to sort out. And in 2025, more Aussies are realising that being the boss of your own super means you’re also the boss of your own protection. I’m talking about SMSF Life Insurance. ato.gov.au

You went to the trouble of setting up an SMSF for a reason, right? You wanted control, smarter investments, and a better retirement. But here’s the thing: that control means you’ve also got to be the one to build the safety net. Unlike the big super funds that give you a basic, one-size-fits-all cover, an SMSF Life Insurance policy doesn’t come with the package. You have to put it in place yourself. Without it? Well, your family could be left in a real pickle.

This isn’t about frightening you. It’s about giving you the straight facts, mate-to-mate, so you can tick this off your list and get on with enjoying life, knowing you’ve got your family covered. Learn basic knowledge about Life Insurance

Table of Contents

Why SMSF Life Insurance Isn’t Just for the High-Rollers

You’ve built your SMSF to take charge, not to take risks with your family’s future. So, why would you leave your biggest asset—your ability to earn an income—unprotected?

That basic cover you might have had in an industry fund? It’s usually not enough to clear a big mortgage, let alone pay for the kids’ education and all the other bills. With an SMSF, there’s no cover at all unless you get it sorted. That’s a massive hole in your plan.

This is where SMSF Life Insurance becomes a lifesaver. It’s not just some boring policy; it’s a plan that says, “No matter what happens, our family will be okay.” Having the right Self-Managed Super Fund insurance is the smartest move you can make for your loved ones.

Let me tell you about my mate, Mark from Brisbane. He and his wife, Sarah, had an SMSF and a young family. They were focused on growing their investments, but their insurance was an afterthought. Last year, Mark had a nasty accident on his motorbike and couldn’t work for six months. Luckily, they’d taken my advice and set up income protection through their fund. Mark told me, “That monthly payment was an absolute godsend. It meant we didn’t have to touch our savings, and we could focus on my recovery without stressing about the bills.” That’s the real power of SMSF Life Insurance.

The Types of Cover You Can Get in Your SMSF (The Easy Breakdown)

Your SMSF life cover options give you the power to choose what’s right for you. Here’s a simple look at what’s available:

Death Cover

A lump sum is paid out to your family if you pass away. It’s meant to clear debts like the home loan and make sure your family has enough money to get by.

TPD Cover

This one’s a bit of a lifesaver. It’s a lump sum of cash that lands in your lap if you get so crook or have an accident that you can’t ever go back to work. Think of it as a safety net that lets you focus on your health and not the bills. It can help you pay for medical costs, make your house a bit easier to get around in, and just take the worry out of everyday expenses.

Income Protection

If you’re out of action for a while—say, a busted leg or a dodgy back—this cover gives you a monthly payment. It’s basically a stand-in for your wage while you’re on the mend. That way, you can put your feet up and focus on getting back to normal without stressing about how you’re going to pay for the groceries.

Critical Illness Cover

This one gives you a fat lump sum if you get hit with a serious illness, like a heart attack or a nasty bout of cancer. You can use the money for whatever you need—get the best doctors, pay for new treatments, or just take a break from work to recover properly. It’s all about getting back on your feet without having to worry about your finances.

The smartest people don’t just pick one; they layer their cover. Combining death, TPD, and income protection gives you a solid all-round defence. Plus, if you and your partner are in the same fund, you can insure both of you under one strategy.

SMSF vs. Personal Insurance: What’s the Go?

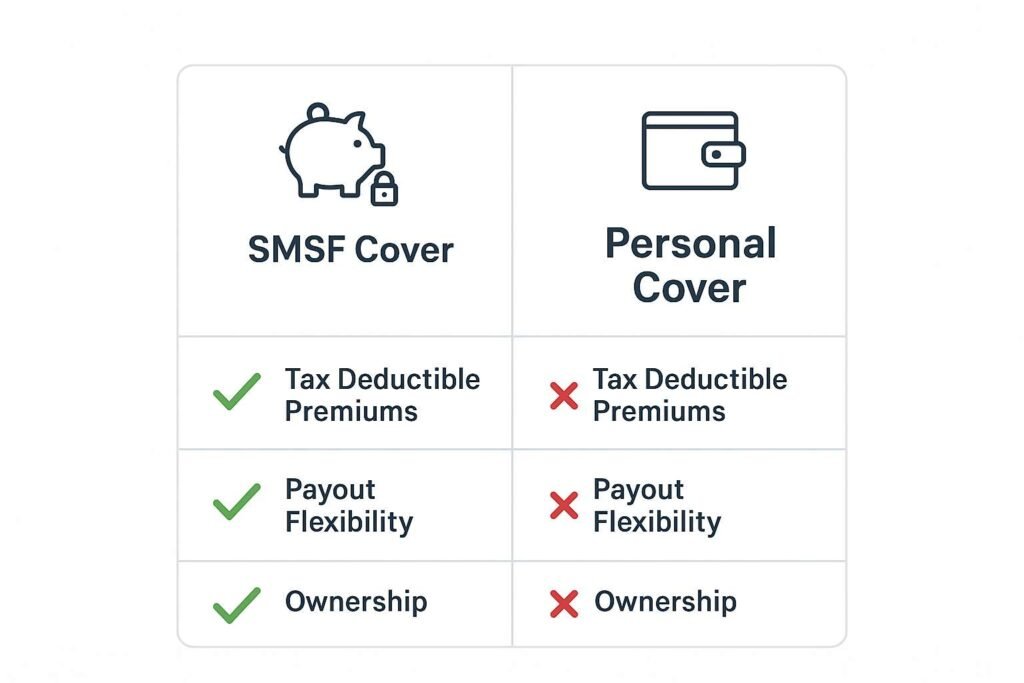

A lot of people ask me, “Should I just get personal insurance instead?” It’s a fair question. Let’s look at the main differences:

| Feature | SMSF Life Insurance | Personal Insurance |

| Who Owns It? | The SMSF | You personally |

| Who Pays? | The fund pays from its money | You pay from your take-home pay |

| Tax Benefits? | TPD & Income Protection premiums are usually tax-deductible to the fund | No tax deduction |

| Flexibility? | Can cover multiple members | Usually just one person |

| Payout? | Must follow super rules | You have full control over the payout |

The verdict? If you want to make the most of tax benefits and keep your investments safe, SMSF Life Insurance is often the better option. But if you need to be able to pay someone who isn’t your spouse or kids, personal cover might give you more flexibility. A lot of Aussies do a mix of both to get the best of both worlds.how ASIC and APRA are reshaping SMSF insurance”

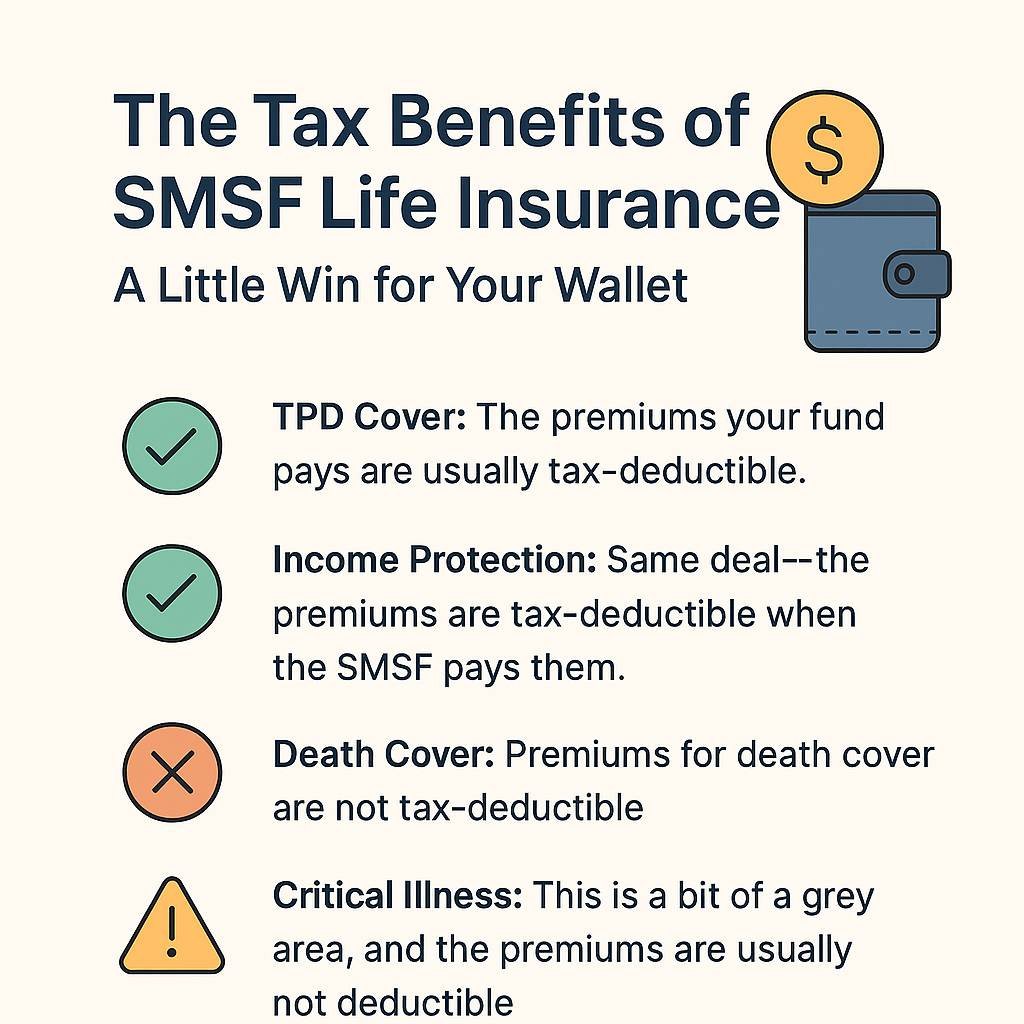

The Tax Benefits of SMSF Life Insurance: A Little Win for Your Wallet

This is where your SMSF really shines. The tax benefits of SMSF life insurance can save you a bundle over the years. Here’s how it works in 2025: ato.gov.au

- ✅ TPD Cover: The premiums your fund pays are usually tax-deductible.

- ✅ Income Protection: Same deal—the premiums are tax-deductible when the SMSF pays them.

- ❌ Death Cover: Premiums for death cover are not tax-deductible.

- ⚠️ Critical Illness: This is a bit of a grey area, and the premiums are usually not deductible.

A client of mine, a tradie named Pete from Melbourne, pays $2,500 a year for his TPD and income protection through his SMSF. Because of the fund’s low tax rate, he saves around $375 in tax every single year. Over 10 years, that’s almost $4,000 back in his pocket, just for having a smart plan. That’s the power of the tax benefits of SMSF life insurance.

Choosing Life Insurance for SMSF Members: Your Step-by-Step Plan

Don’t just guess what cover you need. Follow this simple plan to get it right:

- Work out your numbers: Grab a pen and paper. Write down your home loan, car loan, and how much your family spends in a year. This number is what you need to cover.

- Pick your cover: Match your needs to the types of cover we talked about. Need ongoing income? → Income Protection. Worried about a disability? → TPD.

- Get quotes: Your SMSF insurance premiums 2025 will depend on your age, health, and job. Shop around and compare a few different insurers.

- Name your beneficiaries: Make sure you fill this form out properly so the money goes exactly where you want it to go.

- Review it every year: Life changes. So should your insurance. Make it a habit to check your cover every year, just like you check your tax return.

Common Traps to Avoid with SMSF Life Insurance

Here are a few things to watch out for so you don’t get caught out:

- Not having enough cover: Don’t just get a cheap policy. Make sure it’s enough to actually cover your family’s needs.

- Ignoring the fine print: The devil is in the details. Some policies have strict rules about when they’ll pay out. Read the Product Disclosure Statement (PDS) carefully.

- Forgetting to review: Your life changes, and so do your insurance needs. Don’t set and forget your SMSF Life Insurance.

- Thinking all premiums are tax-deductible: Remember, only TPD and income protection usually qualify. Get advice to make sure you’re doing it right.

Smart Moves for SMSF Life Insurance in 2025

Want to be a bit of a legend with your SMSF? Try these tips:

- Layer your cover: Don’t rely on just one type of insurance. Combine them for a rock-solid plan.

- Cover both partners: A classic move for couples who are building wealth together.

- Link to your investments: If you own a property in your SMSF, a payout could be used to clear the loan, protecting that asset.

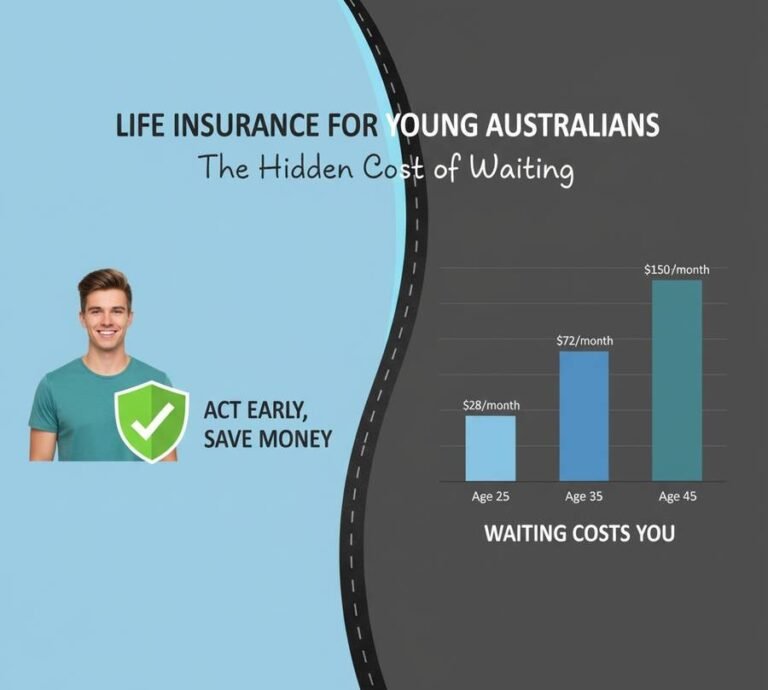

- Review your premiums: Now is the time to check the SMSF insurance premiums 2025 and lock in a good deal while you’re still young and healthy.

Real Stories: It’s Not Just Theory

These aren’t made-up examples. These are real Aussies I’ve worked with:

- Sophie from Adelaide: A young mum who was diagnosed with breast cancer. Her critical illness cover paid out, allowing her to take time off work for treatment without worrying about money.

- James from Perth: A small business owner who passed away suddenly. His death cover paid off the mortgage and cleared the business debt, leaving his family with a home and a tidy sum.

- Chloe from Sydney: A graphic designer who had a severe back injury. Her TPD cover gave her a lump sum that paid for medical treatment and home modifications, allowing her to live a comfortable life without the stress of not being able to work.

- Michael from the Gold Coast: When his business partner died unexpectedly, their business was in trouble. Their SMSF Life Insurance had a special buy/sell agreement, and the payout helped Michael buy his partner’s share and keep the business running smoothly.

This isn’t about fear. It’s about taking care of business so you can live a life without “what if?” hanging over your head. “impact of genetic discrimination ban on SMSF insurance”

FAQs: The Quick Q&A

Q: Can I move my old personal insurance into my SMSF?

You can, but it’s a bit complex. Chat with an expert to make sure you follow all the rules.

Q: Are all the premiums for SMSF life insurance tax-deductible?

A: No. Just TPD and income protection, generally.

Q: How often should I check my cover?

A: At least once a year. Or after any big life changes.

Q: Can I cover my partner in the same policy?

A: Yep! Choosing life insurance for SMSF members can easily include both of you.

Q: What if I don’t have cover?

A: Your family could face major financial stress if something happens to you.

Final Word: It’s About Love, Not Just Money

You built your SMSF because you’re a responsible person who cares about your future.

So, don’t leave your family’s security to chance. SMSF Life Insurance is about more than just numbers on a page; it’s about saying, “I’ve got you, no matter what.”

Disclaimer

This article is just for a bit of a read and is not personal financial advice. SMSF Life Insurance has complex rules about tax and eligibility. Before you make any decisions, you should always get advice from a licensed financial advisor or accountant. The rules change, and what works for one person might not work for another.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook