Best IDC Universal Life Insurance in Canada – Rates, Coverage & Benefits 2025

Yo, bhai, life’s a wild game, eh? One minute you’re grabbing a Timmy’s coffee, scarfing down a donut, and the next you’re thinking, “What happens to my family if I’m not here?” That’s where life insurance saves the day, and IDC Universal Life Insurance in Canada is a top player for 2025. It’s like a goalie that protects your family and lets you stash some cash for later. I went digging on three websites—InflationCalculator.ca, HelloSafe.ca, and LifeBuzz.ca—to get the full scoop. This blog’s got it all laid out in super simple words, like we’re chilling over a plate of poutine, so you can decide if IDC Universal Life Insurance in Canada is your kind of deal. Let’s hit the ice!

Table of Contents

What’s IDC Universal Life Insurance in Canada All About?

Picture a life insurance plan that’s with you for the long haul, not just a short skate. Plus, it lets you save money on the side. That’s IDC Universal Life Insurance in Canada in a nutshell. Term insurance is like renting an apartment—it’s only good for a bit. But this universal plan is like owning your dream cabin—it’s yours forever. It’s awesome for big stuff, like leaving money for your kids, keeping your business safe, or saving up for when you’re kicking back in retirement.

InflationCalculator.ca says IDC Universal Life Insurance in Canada lets you pick how much you pay each month and how much your family gets if you’re gone. The best part? It’s all online, eh! No boring meetings with suits, no stacks of papers. It’s as easy as checking your hockey scores or ordering wings for game night.

Why IDC Universal Life Insurance in Canada Is a Game-Changer

I checked out InflationCalculator.ca, HelloSafe.ca, and LifeBuzz.ca, and it’s no surprise why IDC Universal Life Insurance in Canada is getting all the cheers. It’s flexible, doesn’t cost a fortune, and fits our fast-paced Canadian lives. Here’s why it’s a total hat-trick:

You’re the Captain

With IDC Universal Life Insurance in Canada, you’re calling the shots. If cash is tight—like when you’re buying new skates or fixing your snowblower—you can pay less, as long as the savings part of your plan covers the insurance cost. Got some extra loonies from a work bonus? Pay more to beef up your savings. LifeBuzz.ca says it’s like picking your toppings at a chip truck—you decide what goes on your fries.

Save Money, No Taxes (Yet)

The savings part of IDC Universal Life Insurance in Canada, called the cash value, grows without you paying taxes on it right away. If you’ve already filled up your TFSA or RRSP, this is a smart way to keep saving. InflationCalculator.ca says it’s perfect for keeping your family safe while building some cash for the future. It’s like tossing toonies in a jar, but this jar makes your money grow bigger!

All Online, No Stress

Who’s got time to drive to an insurance office, eh? IDC Universal Life Insurance in Canada lets you do everything online—apply, check your plan, even file claims. InflationCalculator.ca says their website is as easy as checking if the Leafs won. Whether you’re in Vancouver, Toronto, or out in the Maritimes, you can handle it all from your phone while sipping a coffee.

Prices That Don’t Break the Bank

Universal life costs more than term because it’s for your whole life, but IDC Universal Life Insurance in Canada keeps it chill by skipping the fancy offices. LifeBuzz.ca shared some sample rates: a 40-year-old guy who doesn’t smoke might pay $108–$150 a month for $100,000 coverage, while a woman might pay $92–$133. Pretty sweet for coverage that never runs out, right?

Make It Your Own

You can add extras to IDC Universal Life Insurance in Canada, like coverage for getting super sick or having an accident. HelloSafe.ca says these add-ons let you customize your plan, whether you’re a new parent in Winnipeg or a business owner in Halifax. It’s like adding gravy and cheese curds to your fries—makes it just how you like it.

Rates for IDC Universal Life Insurance in Canada in 2025

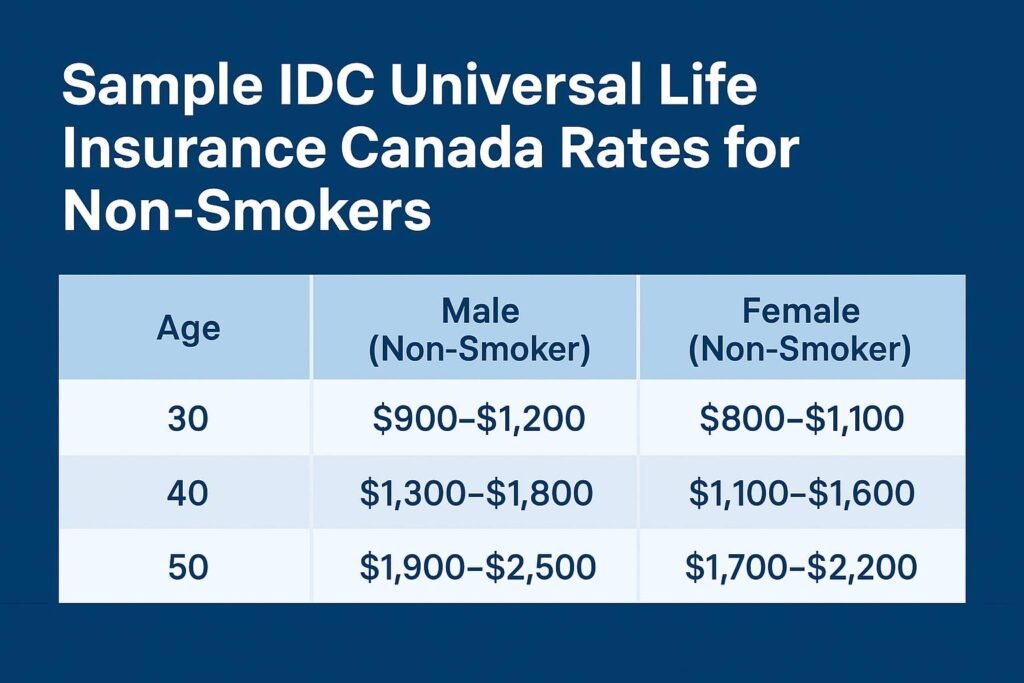

How much you pay depends on your age, if you’re a guy or girl, your health, and how much coverage you want. Based on LifeBuzz.ca and IDC’s vibe, here’s a table with sample yearly costs for a $100,000 policy for non-smokers:

| Age | Male (Non-Smoker) | Female (Non-Smoker) |

| 30 | $900–$1,200 | $800–$1,100 |

| 40 | $1,300–$1,800 | $1,100–$1,600 |

| 50 | $1,900–$2,500 | $1,700–$2,2 |

These numbers are just a rough guess, like figuring out how many toonies you’ve got in your pocket. Your real cost might be different, so hit up IDC Universal Life Insurance in Canada for a personal quote. Their online setup usually means cheaper prices than those big companies with shiny buildings.

Coverage and Benefits of IDC Universal Life Insurance in Canada

So, what do you get with IDC Universal Life Insurance in Canada? Here’s the full picture for 2025:

- Protection That Lasts: If you pass away, your family gets a tax-free chunk of money, no matter when it happens. Unlike term plans that expire, this one’s got you covered for life.

- Savings That Grow: Part of your payments goes into a savings account that grows without taxes (until you take it out). You can borrow or pull cash for big stuff, like a new snowmobile or your kid’s college, but check the tax rules first.

- Change It Up: Got a new kid? Bump up your coverage. Retired and chilling? Lower it. IDC Universal Life Insurance in Canada lets you tweak things as life changes.

- Awesome Support: It’s all online, but their team is quick to help out. InflationCalculator.ca says they’re super good at answering questions, so you’re never stuck.

- Extras You Pick: Add stuff like coverage for serious illnesses or accidents to make your plan perfect, whether you’re in Calgary or St. John’s.

Real-Life Example: How It Works

Let’s imagine you’re Priya, a 35-year-old mom living in Edmonton. She’s got her hands full with two kids and the big responsibility of a mortgage. Every day is a balancing act of family life and financial duties. You want your family to be okay if something happens to you, and you’d love to save some cash too. You grab a $200,000 policy from IDC Universal Life Insurance in Canada for about $1,500 a year. You love that you can pay less when money’s tight—like after buying winter gear for the kids—and the savings grow without taxes. You also add a critical illness option in case you get sick and can’t work. You set it all up online while sipping a coffee, no hassle. That’s the kind of easy, no-stress deal IDC Universal Life Insurance in Canada brings to the table.

Pros and Cons of IDC Universal Life Insurance in Canada

Here’s the good stuff and the not-so-great stuff, based on what I found:

What’s Great About It:

- It’s super flexible. Life changes, right? With this plan, you can adjust your payments or coverage whenever you need to.

- Your savings grow tax-free. The money you put in grows without being taxed until you actually take it out.

- Everything is online. It’s quick and easy, just like ordering dinner on an app. No endless phone calls.

- The prices are fair. They don’t have to pay for huge fancy offices, so they pass those savings on to you.

- The support team is top-notch. Even though it’s all digital, the people helping you are fantastic.

What to Keep in Mind:

- No in-person meetings. If you’re someone who likes to sit down face-to-face with an advisor, this won’t be a good fit.

- It can be a bit confusing. The details about savings and fees can get a little tricky to wrap your head around.

- You might need a medical checkup. Depending on your health, they might ask you to get a quick medical exam.

Is This Plan Right for You?

This plan is a fantastic option for a few different kinds of people:

- High-earners who’ve maxed out their other savings accounts like TFSAs or RRSPs and want another way to save money without the tax man taking a big cut.

- Business owners who need to protect their company or key employees.

- Families looking for coverage that lasts a lifetime and can grow and change right along with them.

- Smart planners who are comfortable with a plan that’s both insurance, part savings, and are okay with talking to an advisor online.

If you just need coverage for a little while—say, to cover your mortgage until it’s paid off—a term insurance plan might be a better choice. But for the long game, this kind of Universal Life Insurance is hard to beat.

How to Get Started

Ready to take a look? Just head over to their website and fill out a quick form. You can get a quote in just a few minutes. They’ll ask you some questions about your health, and for some people, it might lead to a quick checkup, like getting your blood pressure taken. Once you’re approved, you can handle everything online—making payments, adding extras, all of it. It’s surprisingly simple.

Quick Tips Before You Buy

- Compare prices. Don’t just go with the first quote you see. Check out what other companies are offering to make sure you’re getting the best deal.

- Talk to an expert. An insurance advisor can explain all the confusing parts and help you figure out if IDC Universal Life Insurance in Canada is the right plan for you.

- Think long-term. Make sure the payments fit into your budget now and for years to come.

- Look at the add-ons. See if extra coverage, like for critical illness, is something you might need.

- Ask lots of questions. This type of plan can be complex, so don’t be shy. Ask until you understand every last detail.

Common Questions, Answered

Q.1 What makes this plan different?

It’s all online, really flexible, and pretty affordable.

Q2. Can I pay less if I have a tight month?

Yes, as long as the money you’ve already saved can cover the cost of the insurance for that time.

Q3.Are my savings taxed?

The money grows tax-free until you take it out, and the money your family gets if something happens to you is usually tax-free, too.

Q4. How do I sign up?

You apply online, answer some health questions, and might need a quick medical check for IDC Universal Life Insurance in Canada

Q5. Can the plan stop?

Yes, if you don’t pay enough and the savings run out, the plan could end. So you need to keep an eye on it.

Q6. Is it good for young families

Absolutely! It’s perfect for getting lifelong coverage and building up some savings at the same time.

Q7. Can I borrow from my savings?

Yes, but it’s really important to talk to an advisor first to understand any tax issues that could come up with your IDC Universal Life Insurance in Canada policy.

My Final Take

After looking at all the details, I think IDC Universal Life Insurance in Canada is a great choice for 2025. It’s flexible, helps you save money tax-free, and is super easy to manage online—perfect for busy Canadians, no matter where you live. Just remember, because it’s all digital and the plan itself can be a bit complicated, don’t rush into it. Take your time, compare prices, chat with an advisor, and make sure it’s a perfect fit for your life. Do it right, and you’ll be set for the long haul.

Disclaimer

Just a heads-up, this is for information only, not professional financial advice. Before you buy anything, you should always talk to a licensed insurance advisor to make sure IDC Universal Life Insurance in Canada is the right choice for you and your family.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook

One Comment