Best 5 Family Life Insurance Companies in the UK (2025) – A Good Old Gander at the Top Plans

Alright, let’s get down to it. In 2025, with everything going on—the cost of living, wobbly interest rates, and all that jazz—it’s more important than ever to have your family’s backs. Your home and your savings are one thing, but a decent life insurance policy is a proper lifeline. It’s a promise that if you’re not around, your loved ones won’t be in a pickle financially.

This guide will give you a proper rundown of the top 5 Family Life Insurance Companies in the UK for 2025. We’ll look at what they offer, what you’ll be paying, and all the little bits and bobs that come with a policy. Plus, I’ll tell you a real story to show you just how vital this all is.

Table of Contents

A Real-Life Story: The Patels Were Proper Chuffed

Meet the Patels, a lovely family from Manchester. Raj, 42, an architect, and Priya, 40, a teacher, had two kids, both at primary school. Their life was the usual chaotic mix of school runs, footie practice, and trying to keep on top of the mortgage.

A few years back, after a mate of theirs got seriously ill, Raj and Priya thought, “Right, we need to sort this out.” They had a chat with a financial advisor and got a Level Term Life Insurance policy with Legal & General, one of the big hitters among Family Life Insurance Companies in the UK. They got a cracking £400,000 of cover for 25 years, enough to clear the mortgage and make sure the kids’ education was all sorted. The premium was a very fair £35 a month. They also added Critical Illness Cover—and thank goodness they did.

Last year, everything went a bit pear-shaped. Raj was diagnosed with a life-threatening illness. It was a massive shock to everyone, but the financial worry wasn’t as bad because their Critical Illness policy paid out a tax-free lump sum of £100,000. That meant they could:

- Wipe out their credit card debt.

- Cover Raj’s medical costs.

- Priya was able to cut down her hours to look after Raj without them having to struggle for cash.

The Patels’ story is a brilliant reminder that life insurance isn’t just about a payout after you’re gone. It’s about being ready for anything, and that’s why finding a good one of the Family Life Insurance Companies in the UK is a top priority.

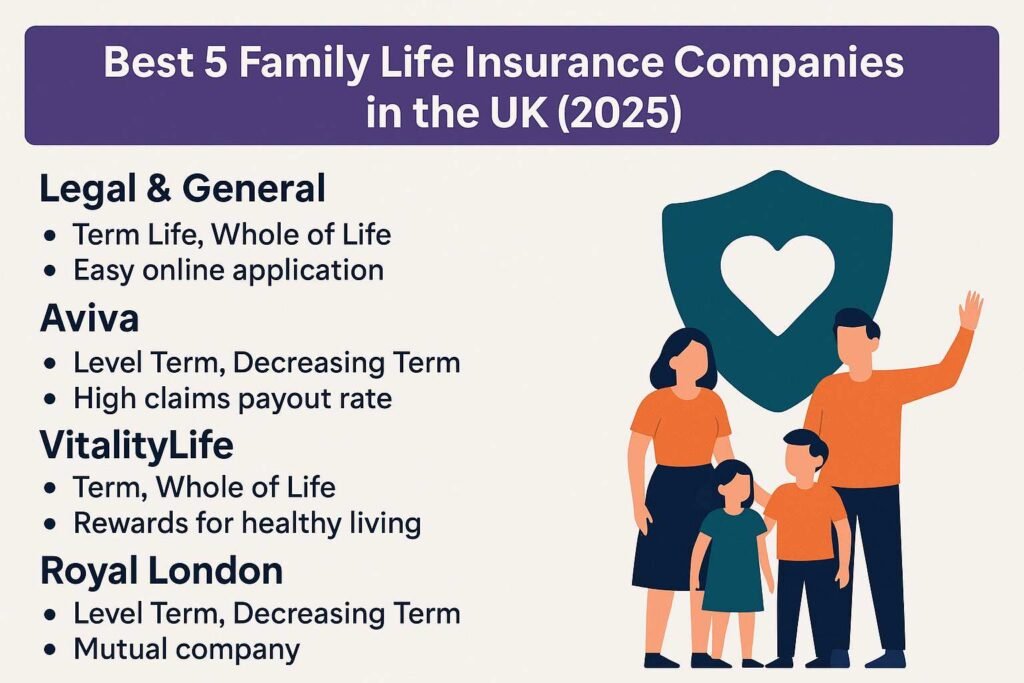

The Top 5 Family Life Insurance Companies in the UK (2025)

Alright, let’s have a look at the big players that helped the Patels and countless other families. Each of these Family Life Insurance Companies in the UK is a sound choice.

1. Legal & General

Why they’re on our list: They’re a bloody huge name in the UK, with millions of customers. Legal & General is a fantastic choice among Family Life Insurance Companies in the UK because their products are straightforward and they don’t mess you about.

- Cover they offer: Term Life, Whole of Life, Family Income Benefit.

- What you get:

- Applying is a piece of cake online.

- You can easily add Critical Illness Cover, which is proper handy.

- Best for: Families who want decent, affordable cover from a name they trust. They’re definitely one of the top Family Life Insurance Companies in the UK.

2. Aviva

Why they’re on our list: Aviva has been around for donkeys’ years—over 325 of them! They’re solid as a rock and have a seriously impressive claims payout history.

- Cover they offer: Level Term, Decreasing Term, Family Income Benefit.

- What you get:

- They pay out on over 98% of claims, which is very reassuring.

- You can add a “Waiver of Premium,” so if you get too ill to work, they’ll cover your premiums for you.

- Best for: Families who want a bit of flexibility and a company with a proven track record. A top-notch choice among Family Life Insurance Companies in the UK.

3. VitalityLife

Why they’re on our list: VitalityLife is a bit different, and in a good way. They reward you for being healthy, which is a clever bit of kit. It’s one of the most forward-thinking Family Life Insurance Companies in the UK.

- Cover they offer: Term, Whole of Life, Family Income Benefit.

- What you get:

- You get discounts on stuff like gym memberships and healthy food.

- Your premiums could even go down if you look after yourself.

- Best for: Families who are already health-conscious and want a policy that gives them a bit more back. A unique offering among the Family Life Insurance Companies in the UK.

4. Royal London

Why they’re on our list: Royal London is a standout because it’s a mutual company. That means it’s owned by its members, not some faceless shareholders. A real differentiator from other Family Life Insurance Companies in the UK.

- Cover they offer: Level Term, Decreasing Term, Family Income Benefit.

- What you get:

- A company that’s all about its members, not profits.

- Their free “Helping Hand” service offers proper support during tough times, not just a cheque.

- Best for: Families who like the idea of an ethical, community-focused company.

5. Scottish Widows

Why they’re on our list: They’ve been going for over 200 years. Scottish Widows is a symbol of reliability and long-term security, and they’ve got the backing of the mighty Lloyds Banking Group.

- Cover they offer: Term, Whole of Life, Family Income Benefit.

- What you get:

- The peace of mind that comes from a solid, financially stable company.

- They’re brilliant at helping with mortgage protection, which is a key feature of many of the best Family Life Insurance Companies in the UK.

- Best for: Families who want long-term security from a well-respected, traditional brand. A top-tier choice among Family Life Insurance Companies in the UK.

Family Life Insurance: A Quick Look at the Top Companies (2025)

| Company | Starting Price (Roughly) | Payout Record (2023) | What They’re Known For | Who They’re Best For… |

| Legal & General | A fiver a month | 97% | Dead simple policies. You can add a serious illness bit and they’ll even help you with your will. | Families who want cheap, no-fuss cover from a name they recognise. |

| Aviva | A fiver a month | 99.3% | Absolutely brilliant at paying out claims. They’ve got a great record. Plus, you can get free house purchase cover. | People who want total confidence that the money will get paid out, no messing about. |

| VitalityLife | A fiver a month | 99.7% | This is the one that rewards you for being healthy. You get discounts on the gym and all sorts. | Families who are into their fitness and want their insurance to give them a bit extra. |

| Royal London | Seven quid a month | 94.1% | They’re a mutual company, so they’re owned by us lot, the members. They’ve got a “Helping Hand” service for proper support. | People who like the idea of an ethical company that cares about its members, not just profits. |

| Scottish Widows | Seven quid a month | 99.4% | They’re backed by Lloyds Bank, so they’re solid as a rock. They even chuck in free critical illness cover for your kids. | Families who want rock-solid security from a huge, old-school brand. |

How to Pick the Right Plan from the Best Family Life Insurance Companies in the UK

Picking a policy can be a bit of a faff, but here’s how to make it easier:

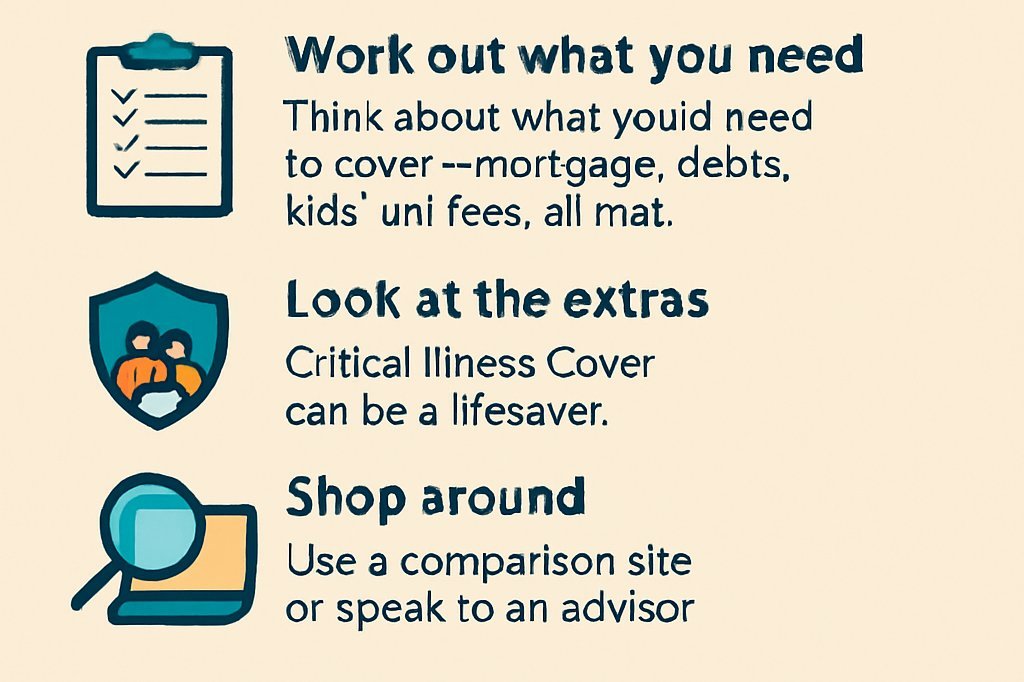

- Work out what you need: Don’t just guess. Think about what you’d need to cover—mortgage, debts, kids’ uni fees, all that.

- Look at the extras: The Patels’ story shows how an add-on like Critical Illness Cover can be a lifesaver.

- Shop around: Don’t just go with the first quote. Use a comparison site or have a chat with an advisor to see what’s what. That’s the best way to compare Family Life Insurance Companies in the UK.

A Few Quick Pointers:

- Get it while you’re young: The younger and healthier you are, the cheaper it is. It’s a no-brainer.

- Keep it healthy: Companies like VitalityLife reward you for a good lifestyle.

- Write it in trust: This is a bit of a clever one. It means the payout goes straight to your family and avoids that dreaded inheritance tax.

Common Mistakes to Avoid

- Not having enough cover: Don’t scrimp to save a few quid. Your family needs to be properly protected.

- Forgetting to update: If you have another kid or get a bigger mortgage, make sure your policy still covers you.

- Telling porkies: Be honest on your application. If you lie about your health, your family’s claim could be rejected, and that’s a nightmare.

FAQs

Q 1. What’s the cheapest family life insurance in the UK?

The cheapest policy changes for everyone. Legal & General and Royal London are often very competitive, but it’s always best to get a few quotes.

Q 2. Should I get a financial advisor?

They’re well worth it. They can give you tailored advice and help you navigate all the options from the different Family Life Insurance Companies in the UK.

Q 3. Is life insurance tax-free in the UK?

The payouts are usually free from income tax, but they can be subject to inheritance tax if you don’t write the policy in trust.

Disclaimer:

Look, this is all for a bit of a chinwag. Before you get a policy, you should have a chat with a qualified, FCA-regulated financial advisor who can give you proper advice for your specific circumstances.

Author Box

Written by DN Patel

Founder & Life Insurance Specialist

Helping families in USA, UK, Canada & Australia choose the right life cover.

Call To Action

“Ready to protect your family’s future? Compare the best life insurance plans today and make the right choice with confidence.”

📢 Stay connected for the latest insurance tips, updates, and guides!

👉 Follow us on Facebook